Finance User Manual ENG -> 2. Finance Configurations -> 2.6 Financial Journals.

2.6 FINANCIAL JOURNALS

UniField is an accrual accounting system using journals to record all accounting entries. Financial journals are the placeholders for double entries. Journals are not closed per period but remain open all the time. They are imported or created manually in every UniField instance. Financial journals are linked to the corresponding Analytic Journals: an Analytic Journal determines in which journal the costs and income are allocated.

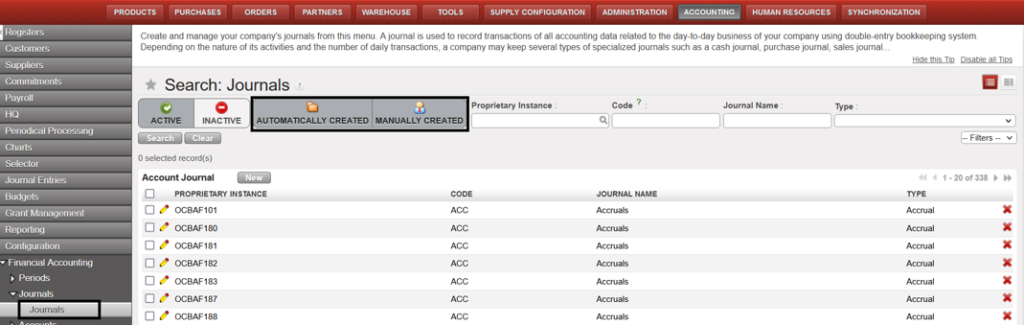

Financial journals can be found in Accounting/Configuration/Financial Accounting/Journals/Journals

There are different types of financial journals:

- ACC: Accrual journal, used to record accounting entries corresponding to accruals.

- FXA: FX adjustment journal, used to record automated accounting entries reflecting currency exchange rate loss or gain.

- HQ: Headquarter journal, used to record accounting entries initially booked in the HQ application (e.g. international procurement and expatriates’ salaries).

- HR: Human Resources journal, used to record accounting entries linked to national staff payroll.

- IKD: In-Kind Donation journal, used to record extra-accounting entries reflecting in-kind donations received in the field.

- INT: Inter-mission journal, used to record accounting entries linked to transactions between missions belonging to the same section.

- MIG: Migration journal used to migrate the initial balances to UniField when setting up a new mission.

- OD: Correction journal, used to record accounting entries linked to financial accounting correction (reversal and correction entries).

- ODX: Extra Accounting corrections journal, used to record corrections performed on extra accounting accounts (e.g. in-kind donations accounts, 81 and 91).

- ODHQ: Correction automatic HQ journal.

- ODM: Manual Correction journal.

- PUF: Purchase Refund journal, used to record accounting entries linked to supplier refunds (payables and expense accounts).

- PUR: Purchase journal, used to record accounting entries linked to financial transaction involving purchases operations (payables and expenses accounts).

- ISI: Intersection supplier invoice, used for intermission flows.

- REV: Revaluation journal, used to revaluate B/S accounts at the end of the period and/or fiscal year.

- SAL: Sale journal, used to record accounting entries linked to financial transaction involving sales operations (receivables and expense accounts) like stock transfers between 2 coordinations belonging to different OCs.

- SAR: Sale Refund journal, used to record accounting entries linked to customer refunds (receivables and expense accounts).

- STO: Stock journal, used to record accounting entries linked to stock transfers and variation.

- DEP: Depreciation journal.

- Liquidity journals: Used to record liquidity transactions (Cash, Cheque and Bank). Unlike other journals, liquidity journals are created locally in each instance.

In addition, two journals are automatically created upon first fiscal year closing (See LUFI-50401 Fiscal Year Closing):

- EOY: This journal is used only for automatic End of Year entries in Period 16 upon closing the fiscal year if the options of setting regular BS accounts to 0 and/or booking the P&L result have been selected.

- IB: This journal is used only for automatic Initial Balances entries in Period 0 upon closing the previous fiscal year.

To distinguish between journals that have been imported (automatic) or created manually, there are two buttons toggled on by default in the Journal Search view:

- AUTOMATICALLY CREATED: To view journals automatically created by import during instance creation.

- MANUALLY CREATED: To view journals manually created by users after an instance has been created.