Track Changes

|

File |

Version |

LU |

Date |

Modifications |

Comments |

| 2.11 Company set up | 39.0 | LUFI-21101 | 21.11.2025 | We have developed and implemented the requested enhancement in the “Companies” menu under the “Configuration” tab*.* A new mandatory dropdown field named “Extra Accounting Behavior” has been added. | |

5. Searching, Correcting and Closing | 39.0 | LUFI-50301 | 21.11.2025 | We have modified the error message when the cash register freezes. It is now larger | |

|

2.Finance Configurations |

38.0 |

|

17.09.2025 |

Partner’s form: to add in the track changes the deactivation and activation of partners | |

|

2.Finance Configurations |

38.0 |

|

17.09.2025 |

Partners/ suppliers setting: deactivation (phase-out status) | |

|

|

37.0 |

|

11.06.2025 |

Not to be able to select an inactive staff when booking an entry in the cash registers | |

|

|

37.0 |

LUFI-50104 General Ledger (G/L) Selector LUFI-50105 The Analytic Selector LUFI-50107 COMBINED JOURNALS |

11.06.2025 |

In the Selector/analytic selector/combine report: to increase the number of digits of the field sequence number to 365 digits | |

|

|

37.0 |

|

11.06.2025 |

Internal transfers: to add a new constraint to prevent to change the account code on a counterpart line | |

|

2. Finance Configurations |

36.0 |

2.8 Suppliers and Customers. |

12.03.2025 |

To be mandatory for partners to have at least one of the role customer/suppliers ticked at create/edit action | |

|

2. Finance Configurations |

36.0 |

|

12.03.2025 |

Inactivation of bank journal conditioned to the inactivation of the related cheques journal | |

|

2. Finance Configurations |

36.0 |

2.8 Suppliers and Customers. |

12.03.2025 |

Partners creation: we can modify a partners form and we can have 2 external partners with the same name and the same city within the same instance | |

|

5. Searching, Correcting and Closing |

35.0 |

LUFI-50104 The General Ledger (G/L) Selector |

11.Dec.2024 |

G/L selector PDF export: Improve the header by adding 2 fields: “currency table” and “output currency” | |

|

4. Imports |

34.0 |

LUFI-40105 H: How to Validate National Staff Payroll Entries. |

16.09.2024 |

PAYE SAGA: Import of payroll entries: to improve the error message when there are already draft payroll entries | |

|

03.Payment |

34.0 |

LUFI-30301 Register Entries Statuses |

16.09.2024 |

To be able to delete draft entries in mass in the liquidity registers | |

|

5. Searching, Correcting and Closing |

34.0 |

LUFI-50306 Fixed Assets |

16.09.2024 |

Fixed assets : mandatory to have analytical distribution AD before the status OPEN (and just after status Draft) | |

|

5. Searching, Correcting and Closing |

34.0 |

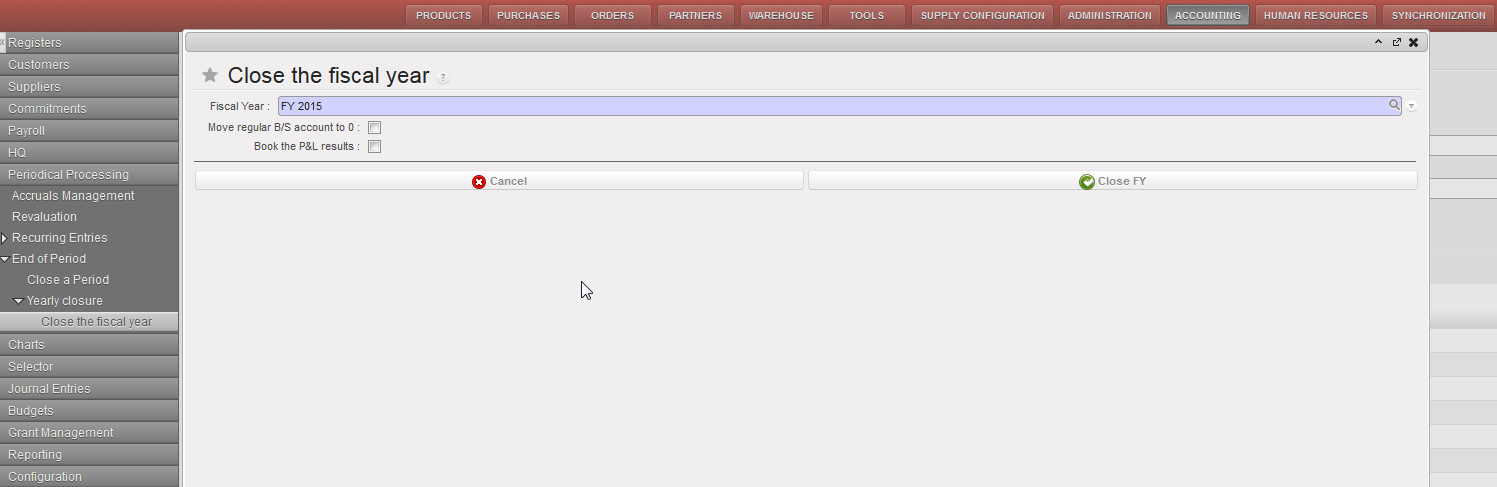

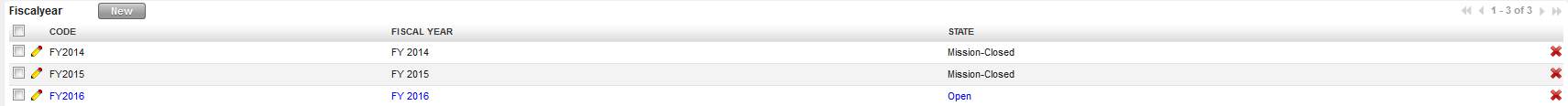

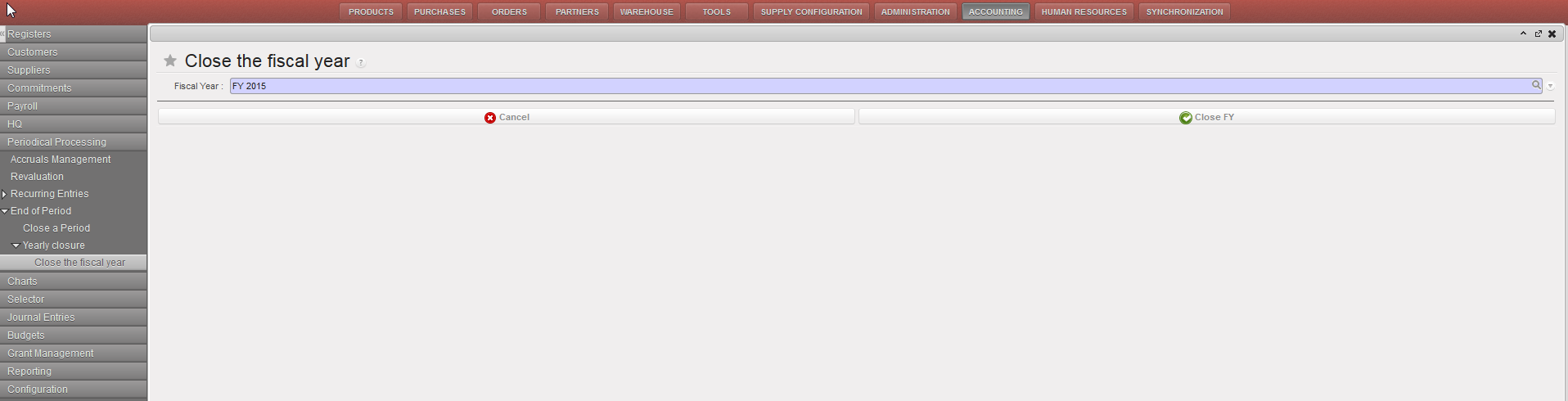

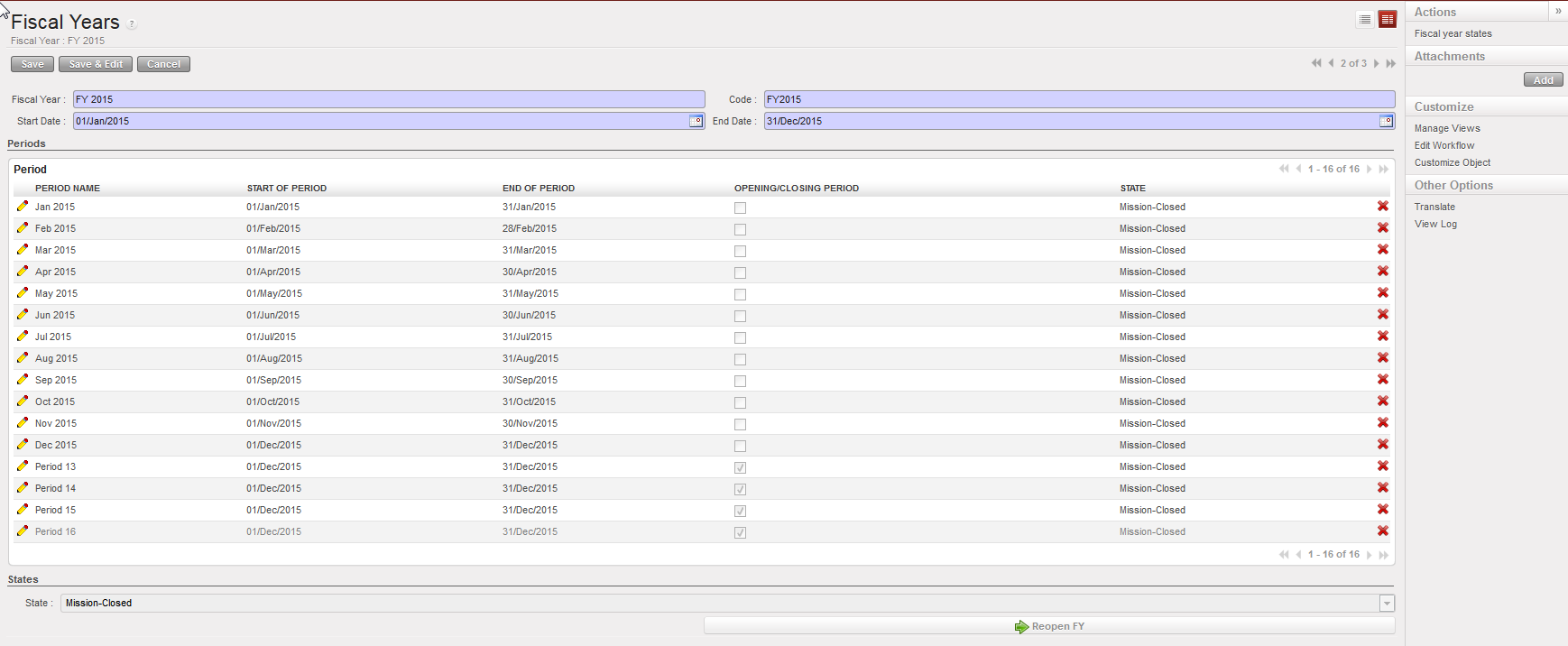

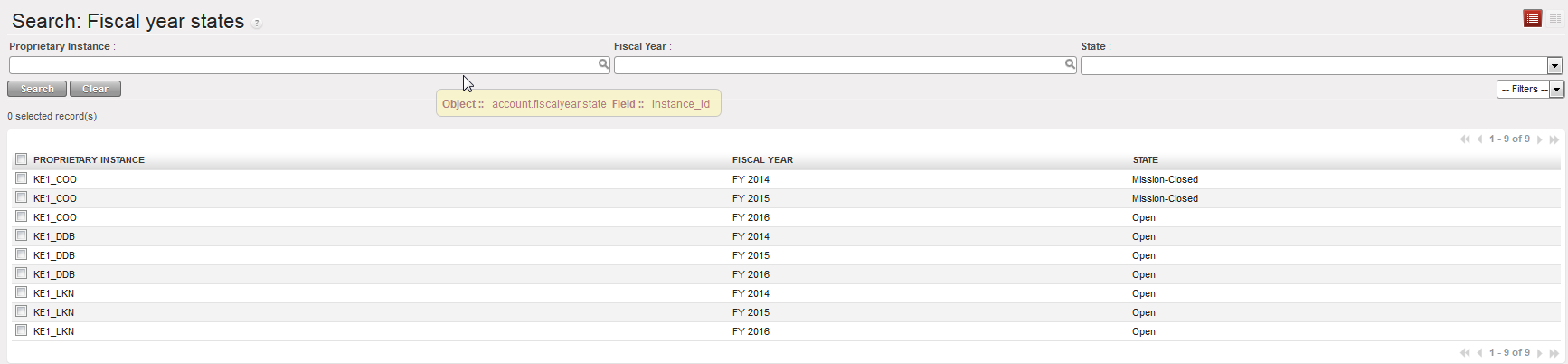

LUFI-50401 Fiscal Year Closing |

16.09.2024 |

FY closing check – check if all active project instances have reported Mission closed status for all periods of the FY | |

|

5. Searching, Correcting and Closing |

33.0 |

LUFI-50301 Month End Register Closing |

12.Jun.2024 |

Freezing register balance during the month: add additional check box with a warning message | |

|

03.Payment |

32.0 |

LUFI-30301 Register Entries Statuses |

7.May.2024 |

Draft entries must always show up on the top of the register | |

|

5. Searching, Correcting and Closing |

32.0 |

50306-fixed-assets |

7.May.2024 |

Fixed assets renaming: To correct the reconfig activation question “Does the system manage Fixed assets ? | |

|

2. Finance Configurations |

32.0 |

|

7.May.2024 |

To be able to change the status of a period from open to draft (when there is no JI) | |

|

2. Finance Configurations |

32.0 |

LUFI-20705 Register Deactivation |

7.May.2024 |

To be able to close the month only if the registers corresponding to all active journals are created | |

|

5. Searching, Correcting and Closing |

31.0 |

|

14.Dec.2023 |

Fixed Asset Management | |

|

2. Finance Configurations |

31.0 |

|

14.Dec.2023 |

To implement a filter in the journals list: journals manually created and journals automatically created (at instance creation) | |

|

03.Payment |

31.0 |

|

14.Dec.2023 |

Importing Multiple Analytical Distribution Lines in Unifield on draft invoices (SI) in line with US-11369 | |

|

03.Payment |

30.0 |

Under LUFI-30501 Auto Rebilling (inter-mission / inter-sectional) |

30.Aug.2023 |

For IVO and for IVI: to put in the list all accounts with type regular, expenses, payables and receivables (as in the SI) | |

|

2. Finance Configurations |

30.0 |

LUFI-20703 Monthly Register Creation> |

30.Aug.2023 |

Bank and Cash registers created in a special period: to prevent! | |

|

5. Searching, Correcting and Closing |

30.0 |

LUFI-50101 Searching Filters |

30.Aug.2023 |

Search : Supplier and customers screens: to remove the field “Journal” and to replace it with “booking currency” field filter | |

|

5. Searching, Correcting and Closing |

30.0 |

1.LUFI-50103 Journal Search |

30.Aug.2023 |

OCBHQ to have in the Combined report and JI and AJI exports the accounts mapped : “HQ system accounts” at project level | |

|

2. Finance Configurations |

30.0 |

LUFI-20502 Cost Centers and Proprietary Instances |

30.Aug.2023 |

Proprietary instance, filter active CC on the list + red color lines with inactive cost centers | |

|

5. Searching, Correcting and Closing |

30.0 |

LUFI-50101 Searching Filters |

30.Aug.2023 |

To add a line with the “Total” when selecting invoice object/CV from list (same as in the Journal Entries) | |

|

03.Payment |

30.0 |

|

30.Aug.2023 |

Improvement Internal transfer: auto booking of counterpart (in the same instance) | |

|

03.Payment |

29.0 |

LUFI-30409 Journal Entries |

13.Jun.2023 |

Manual journal entry: available journals: to remove the not used journal with code REV | |

|

2. Finance Configurations |

29.0 |

LUFI-20502 Cost Centers and Proprietary Instances |

13.Jun.2023 |

To prevent FO / PO creation if “Cost center picked for PO/FO reference” is empty | |

|

03.Payment |

29.0 |

|

13.Jun.2023 |

IVI / IVO / STV / ISI: to add the Counterpart Invoice Number search field | |

|

5. Searching, Correcting and Closing |

29.0 |

LUFI-50101 Searching Filters |

13.Jun.2023 |

Final status of in kind donation: from OPEN status to new status DONE/TERMINE (it is not a renaming) | |

|

2. Finance Configurations |

29.0 |

LUFI-20505 Analytic Account Inactivation |

13.Jun.2023 |

OCB: Sub-cost center validity date greater than parent cost center validity date, no import in CODA: to add an error message | |

|

5. Searching, Correcting and Closing |

29.0 |

LUFI-50109 Synchronisation of Queries |

13.Jun.2023 |

Selector saved queries/templates: to be able to delete them at once (to do with the user right ticket US-11328) | |

|

2.8 Suppliers and Customers. |

29.0 |

LUFI-20801 Partner Creation |

13.Jun.2023 |

Partners form: purchase default currency and field order default currency | |

|

2. Finance Configurations |

28.0 |

2.8 Suppliers and Customers. |

15.Mar.2023 |

Improvement of the Supplier list (Search: Suppliers): to add 3 additional filters | |

|

5. Searching, Correcting and Closing |

28.0 |

1. LUFI-50104 General Ledger (G/L) Selector |

15.Mar.2023 |

Selector (GL and combined): to add a new checkbox “Exclude inactive journals” with also the filter journal inactive date. | |

|

5. Searching, Correcting and Closing |

20.0 |

LUFI-50302 Month End Period Closing |

15-December-2022 |

To add a filter button named “ACTIVE INSTANCES” in the “Search: Period States” interface | |

|

03.Payment |

27.0 |

|

15-December-2022 |

Extend to AD the Export/Import invoice lines | |

|

5. Searching, Correcting and Closing |

27.0 |

LUFI-50103 Journal Search |

15-December-2022 |

The filtering for the periods 13, 14, 15 and 16 (extra accounting) is not correct in AJI on ENGI (international commitments). | |

|

03.Payment |

27.0 |

LUFI-30202 Commitment Vouchers: Step Two in the Purchase Process |

15-December-2022 |

Commitment Voucher CV: to set up “export CV lines “and “import CV lines” like for the supplier invoices | |

|

5. Searching, Correcting and Closing |

27.0 |

LUFI-50101 Searching Filters |

15-December-2022 |

Donation’s improvements miscellaneous: filters, journals, fields | |

|

5. Searching, Correcting and Closing |

27.0 |

LUFI-50301 Month End Register Closing |

15-December-2022 |

Full report: add the correction lines when using Wizard of correction on return of advance expenses. | |

|

5. Searching, Correcting and Closing |

27.0 |

LUFI-50104 General Ledger (G/L) Selector. |

15-December-2022 |

Add in Interface the total of Output Amount/Output Credit and Debit when Output Currency is selected in Selector. | |

|

03.Payment |

27.0 |

LUFI-30501 Auto Rebilling (inter-mission / inter-sectional) |

15-December-2022 |

Intermission / intersection flow: Counterpart invoice status filter on IVO/IVI/STV/ISI. | |

|

2. Finance Configurations |

26.0 |

LUFI-20603 Monthly Register Creation |

14.Sep.2022 |

Get an additional column with the register codes in the list of the Register creation wizard | |

|

03.Payment |

26.0 |

LUFI-30306 Recurring Entries |

14.Sep.2022 |

OCB proposal: quick update in Recurring Entries module for management of Fixed Assets | |

|

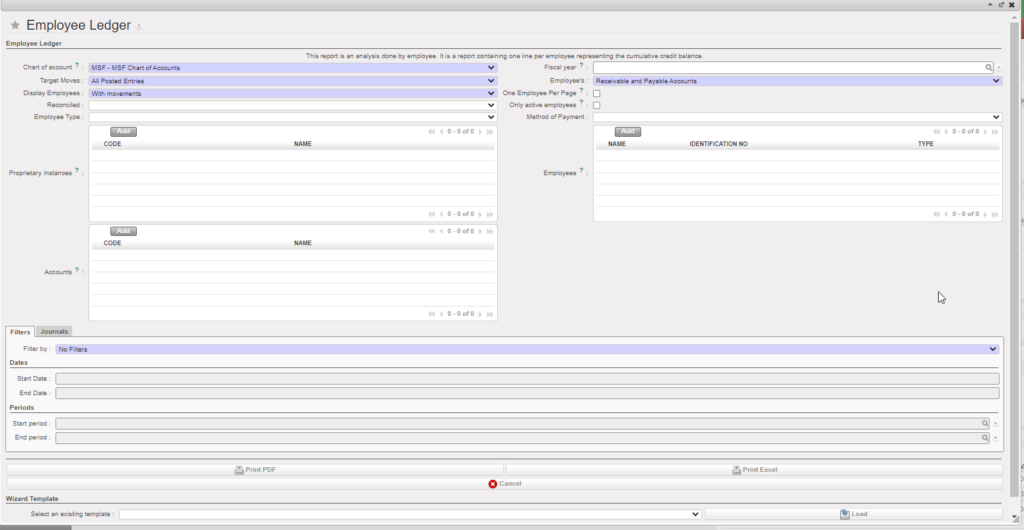

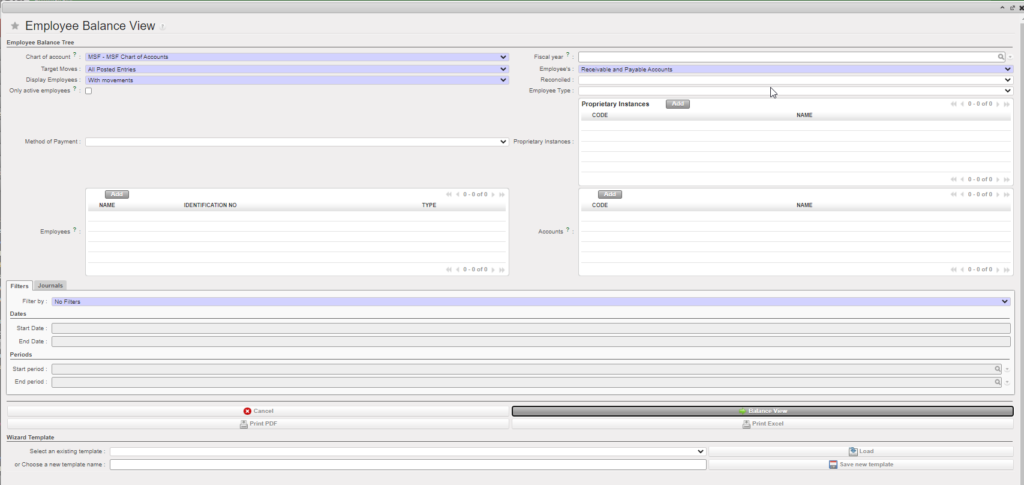

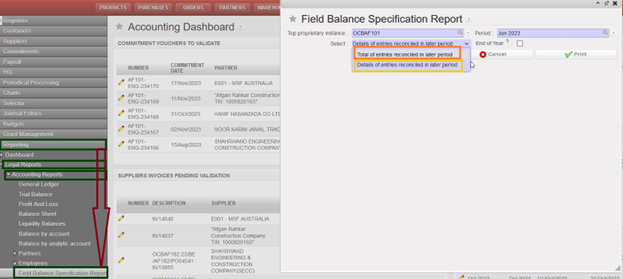

4. Imports |

26.0 |

4.2 Human Resource Management. |

14.Sep.2022 |

OCP Employee Ledger and Balance | |

|

5. Searching, Correcting and Closing |

25.0 |

LUFI-50303 Accruals Management |

15.Jun.2022 |

Accruals Management improvements release | |

|

03.Payment |

25.0 |

1.LUFI-30101 Purchase Order: Step One in the Purchase Process |

15.Jun.2022 |

VAT corner for the PO – like VAT corner for SI | |

|

5. Searching, Correcting and Closing |

25.0 |

LUFI-50103 Journal Search |

15.Jun.2022 |

Button filters on AJI: Engagements and ENGI journals | |

|

03.Payment |

25.0 |

LUFI-30304 Operational Advance Management |

15.Jun.2022 |

To allow to settle one advance in cash or bank register, even it has been originally booked in a cheque register. | |

|

5. Searching, Correcting and Closing |

25.0 |

LUFI-50303 Accruals Management |

15.Jun.2022 |

In the analytic journal items please add the journal ACC (accruals) in the “Journal type” filter TO DO WITH US-5722 | |

|

2. Finance Configurations |

25.0 |

2.8 Suppliers and Customers. |

15.Jun.2022 |

Do not allow to activate the intermission partner when an internal partner already exists with the same name | |

|

2. Finance Configurations |

25.0 |

2.4 Financial Accounts. |

15.Jun.2022 |

Set the first day of the current month at [active from field] when creating a new analytic account or a new GL/account | |

|

5. Searching, Correcting and Closing |

25.0 |

LUFI-50301 Month End Register Closing |

15.Jun.2022 |

Changes in the “Open Invoices” Report (suppliers right action menu) – to add draft invoices and other | |

|

03.Payment |

24.1 |

LUFI-30210 INACTIVATION LIQUIDITY JOURNALS AND THEIR CORRESPONDING REGISTERS |

27.April.2022 |

Possibility to inactivate GL journals | |

|

2. Finance Configurations |

24.0 |

2.8 Suppliers and Customers. |

16.March.2022 |

Intersection: To be able to identify where the partner has been originally created “instance creator” | |

|

03.Payment |

24.0 |

3.5 AUTO REBILLING (INTER-MISSION / INTER-SECTIONAL) |

16.March.2022 |

Intersection: To add the legal entity names in the STV PDF print out form | |

|

03.Payment |

24.0 |

3.5 AUTO REBILLING (INTER-MISSION / INTER-SECTIONAL) |

16.March.2022 |

Add a filter button named “OPEN FY” on STV/IVO/ISI/IVI | |

|

03.Payment |

24.0 |

3.5 AUTO REBILLING (INTER-MISSION / INTER-SECTIONAL) |

16.March.2022 |

manual STV/IVO synch check box and (US-9331) Synch check box of manual STV/IVO when created from duplicate | |

|

03.Payment |

24.0 |

3.5 AUTO REBILLING (INTER-MISSION / INTER-SECTIONAL) |

16.March.2022 |

Intermission/Intersection: synch rule when the account code on STV/IVO is not available/active at client level |

Also apply in >Accounting Features>20. Intermission and Intersection flows |

|

03.Payment |

24.0 |

LUFI-30104 Supplier Invoices: Step Four in the Purchase Process |

16.March.2022 |

To remove the “merge lines by account” functionality from invoice objects where it is available (SI and ISI) |

Also applied in the following chapters: |

|

03.Payment |

23.0 |

LUFI-30401 Auto Rebilling (inter-mission / inter-sectional) |

08.Dec.2021 |

STV’s invoice Excel Export – Equivalent of IVO’s Invoice Excel Export (intermission/intersection) | |

|

2. Finance Configurations |

23.0 |

2.6 Financial Journals |

08.Dec.2021 |

Intersection: create a specific journal and new name for SI from intersection flow. | |

|

4.Imports |

23.0 |

LUFI-40201 C-F: Commitment Vouchers |

08.Dec.2021 |

Customer Commitment Vouchers from Field Order – Intermission/intersection | |

|

03.Payment |

22.0 |

LUFI-30102 Commitment Vouchers: Step Two in the Purchase Process |

15.Sep.21 |

Request to have Commitment vouchers linked to the PO with Inter-section / intermission partner types | |

|

03.Payment |

22.0 |

LUFI-30102 Commitment Vouchers: Step Two in the Purchase Process |

15.Sep.21 |

The AD of the CV and SI lines will be the one of the PO | |

|

03.Payment |

21.0 |

LUFI-30101 Purchase Order: Step One in the Purchase Process) |

16.Jun.2021 |

Improvement In Kind Donation functionality | |

|

4.Imports |

21.0 |

LUFI-40202 F: How to Validate HQ Entries |

16.Jun.2021 |

Track Changes in HQ Entries | |

|

5. Searching, Correcting and Closing |

21.0 |

LUFI-50206 OD Journals |

16.Jun.2021 |

CODE FIX: Don’t generate REV and COR when correction on FP on HQ entries using the correction wizard | |

|

2. Finance Configurations |

21.0 |

MULTI-CURRENCY MANAGEMENT |

16.Jun.2021 |

Track changes on currencies and currency tables | |

|

2. Finance Configurations |

21.0 |

LUFI-20401 Destinations |

16.Jun.2021 |

Deactivation date of Cost Center/Destination combination in UF | |

|

03.Payment |

20.0 |

LUFI-30401 Auto Rebilling (inter-mission / inter-sectional) |

5.May.2021 |

Intermission/intersection: new STV/IVO Follow-up per client Finance reportt | |

|

03.Payment |

20.0 |

LUFI-30401 Auto Rebilling (inter-mission / inter-sectional) |

5.May.2021 |

Intermission improvement: Add a payment tab on IVO and STV similar to the SI | |

|

03.Payment |

20.0 |

LUFI-30104 Supplier Invoices: Step Four in the Purchase Process |

5.May.2021 |

Improvement in the split fonction for all type of invoices: delete from the split selection several invoice lines at once | |

|

03.Payment |

20.0 |

LUFI-30104 Supplier Invoices: Step Four in the Purchase Process |

5.May.2021 |

“Split invoice” function – show the left of the invoice after click on [process] in place of the removed lines |

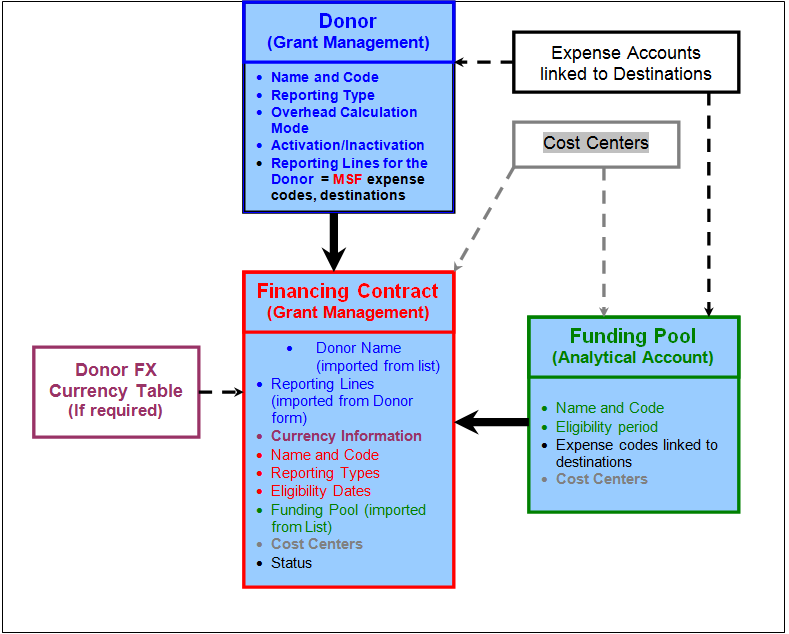

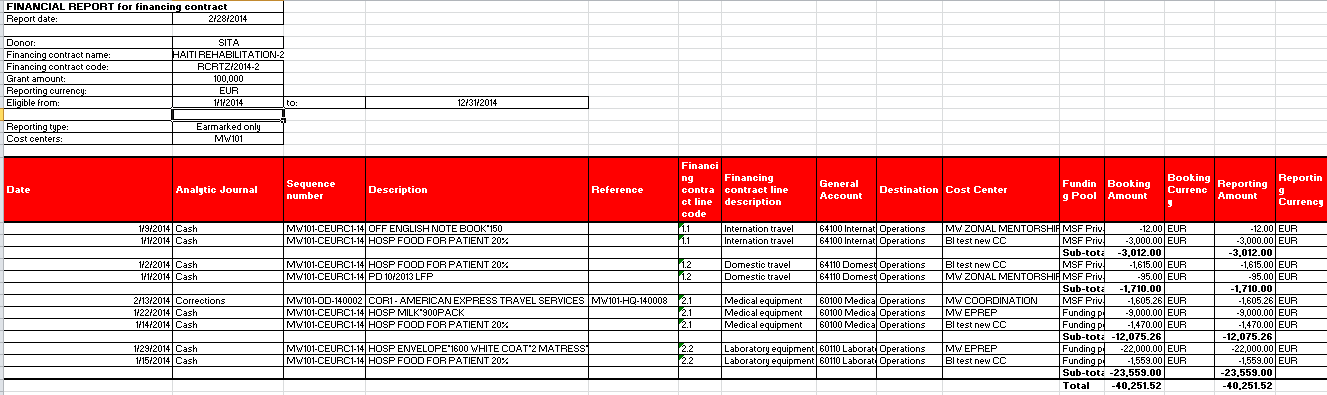

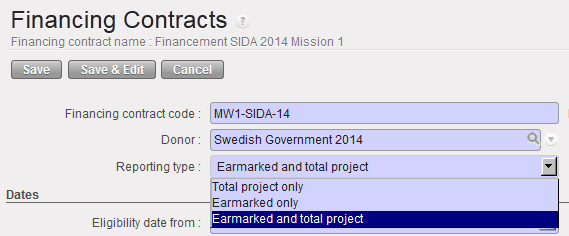

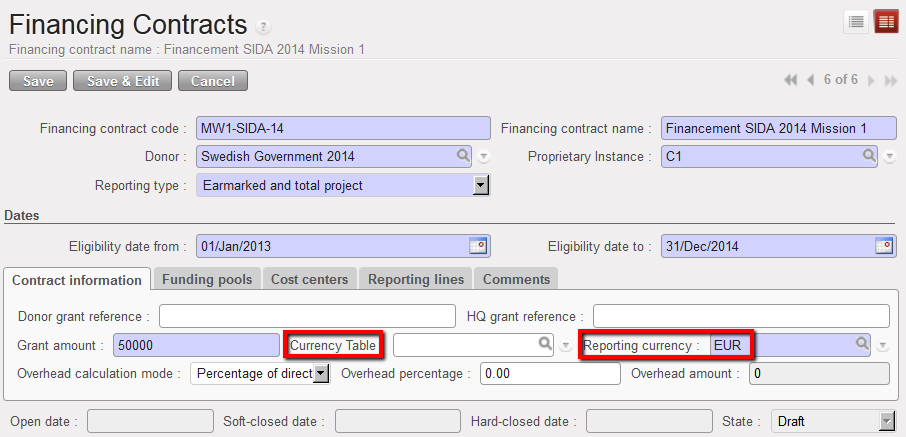

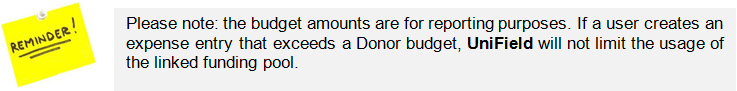

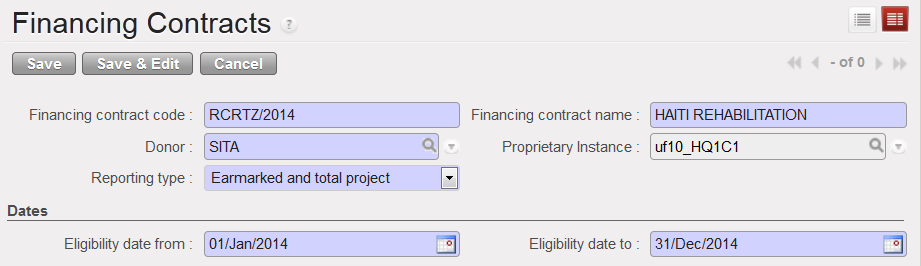

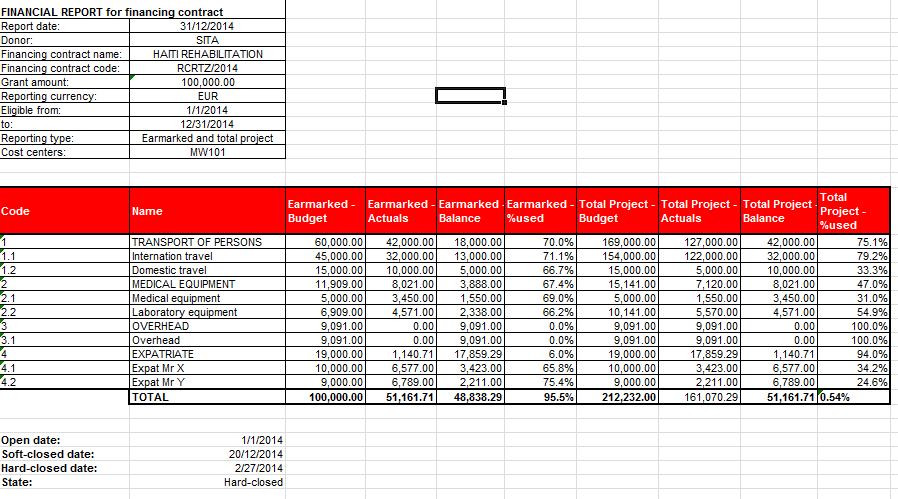

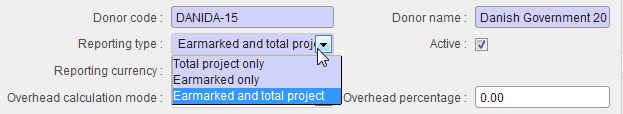

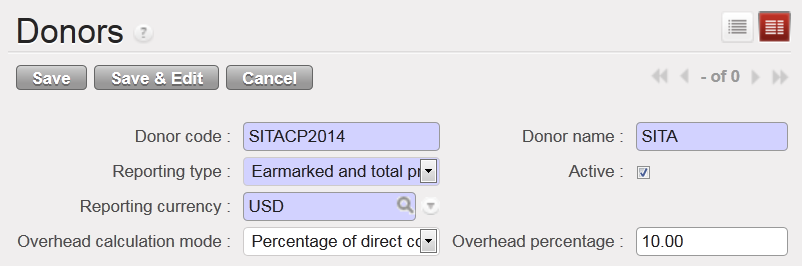

Reporting types of a financing contract

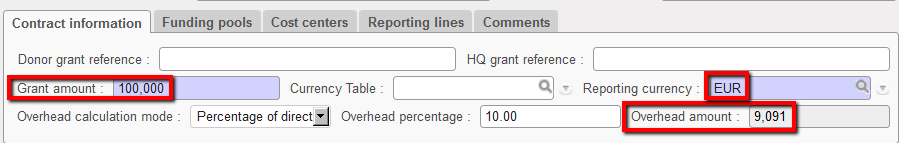

Reporting types of a financing contract Reporting currency

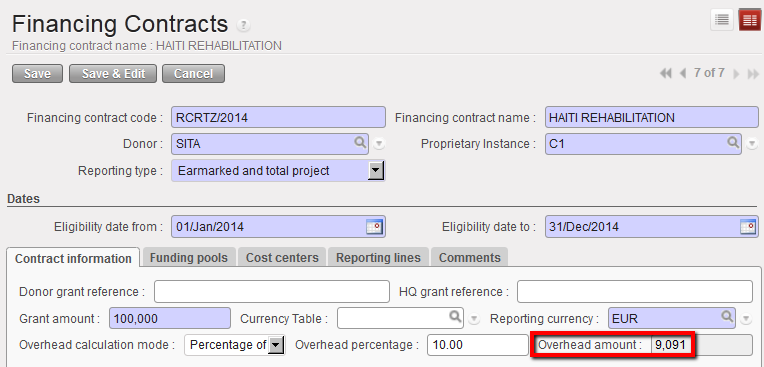

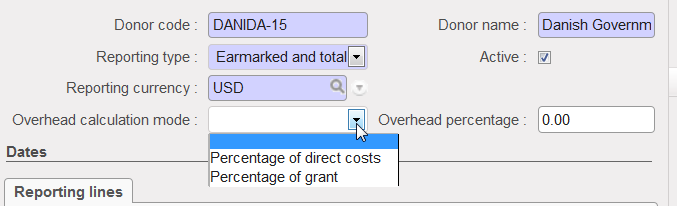

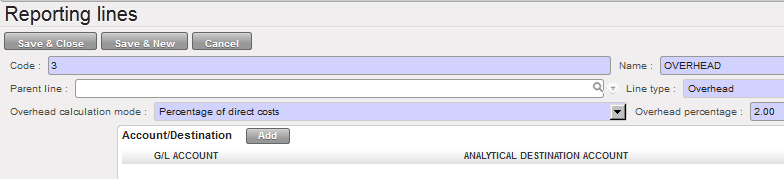

Reporting currency Overhead Donor contribution calculated

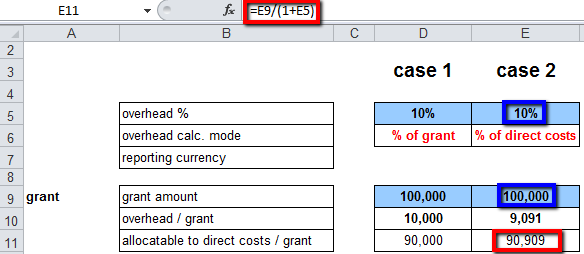

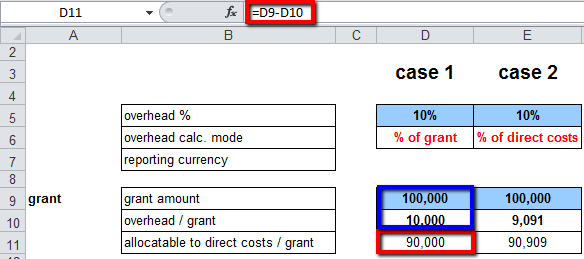

Overhead Donor contribution calculated Direct cost and Overhead calculation explanation when overhead calculation is based on direct costs

Direct cost and Overhead calculation explanation when overhead calculation is based on direct costs Direct cost and Overhead calcualtion explanation when overhead calculation is based on total grant

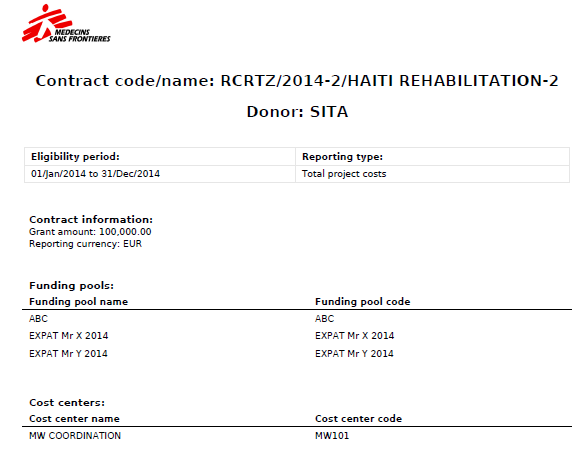

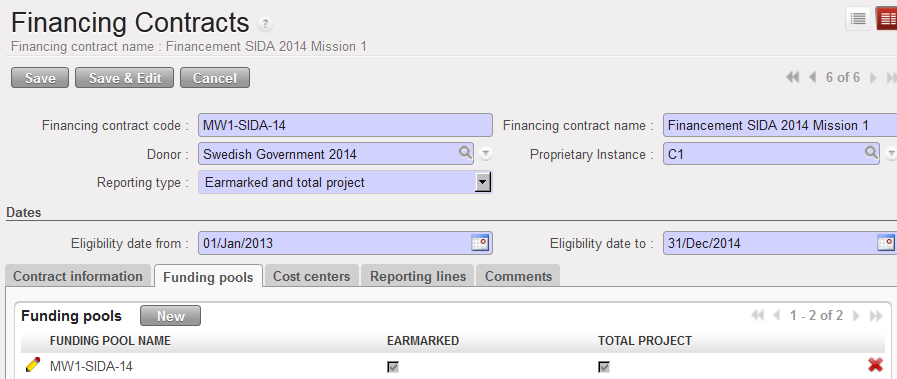

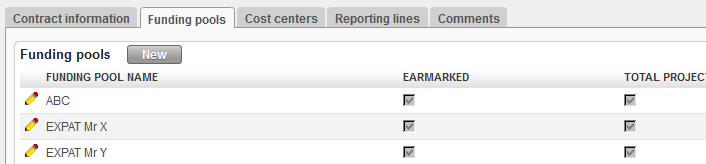

Direct cost and Overhead calcualtion explanation when overhead calculation is based on total grant Funding pools tab displaying FP linked to a financing contract

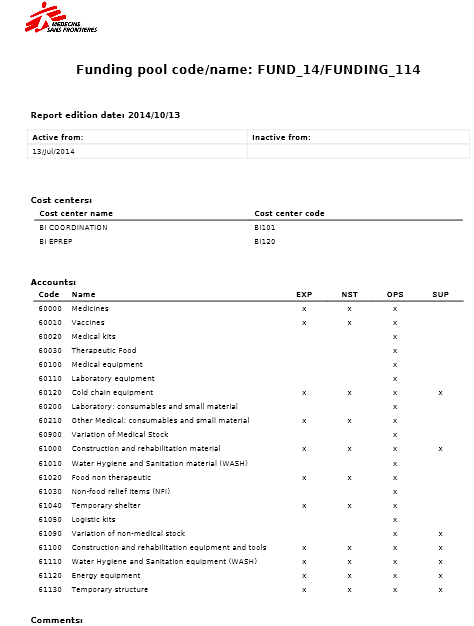

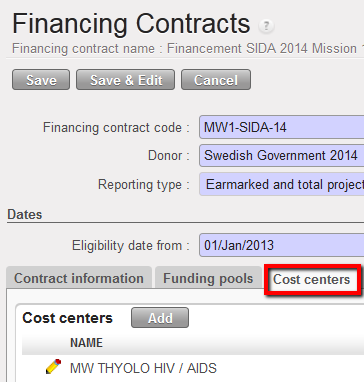

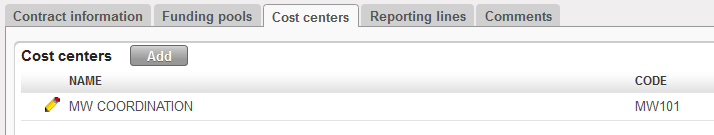

Funding pools tab displaying FP linked to a financing contract Cost centers associated to a financing contract

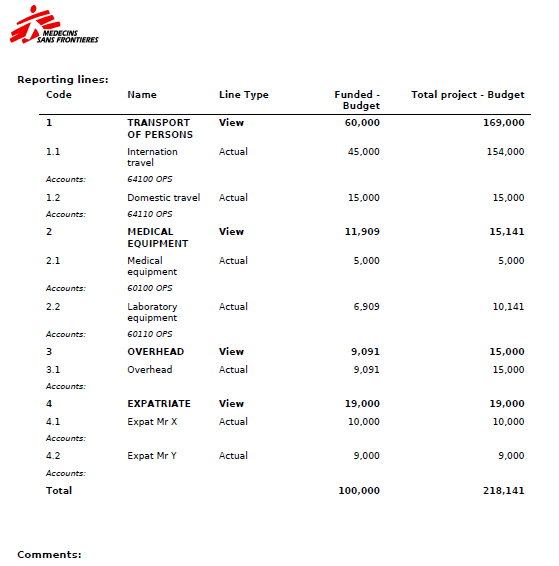

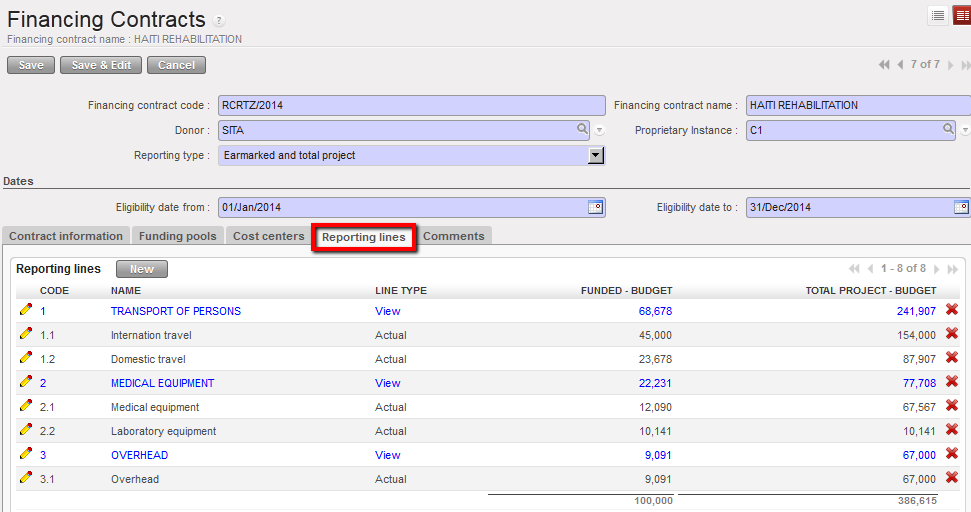

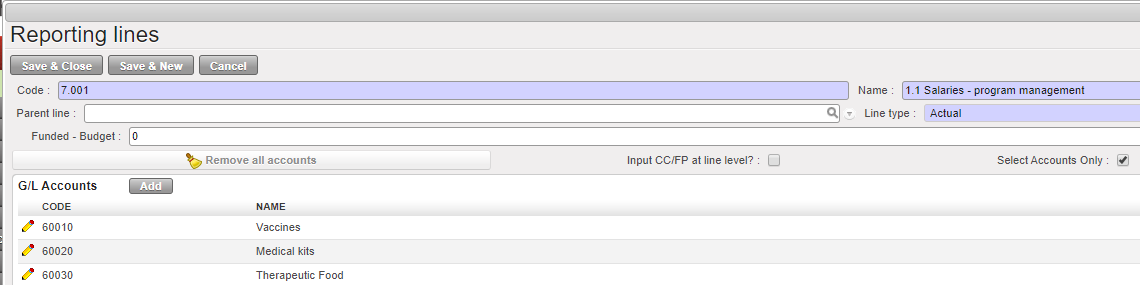

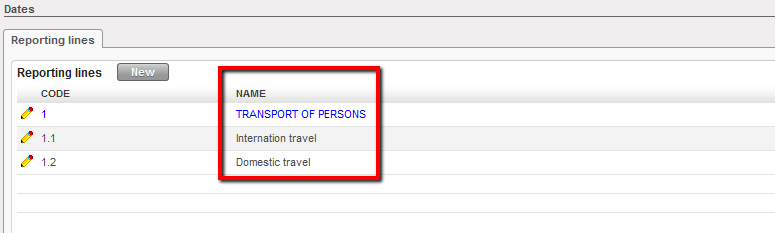

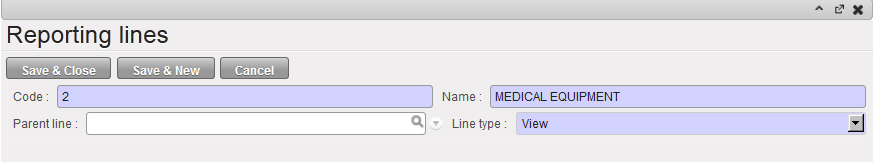

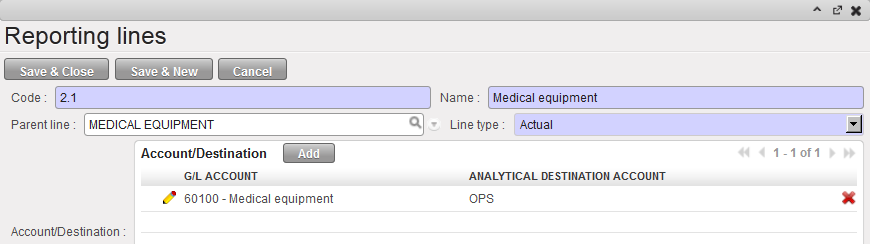

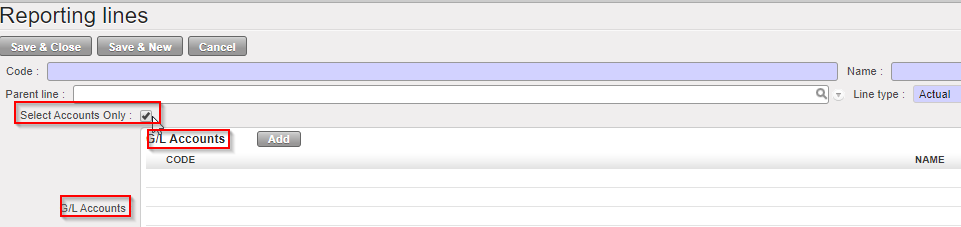

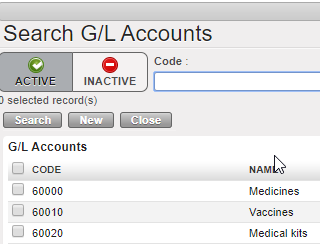

Cost centers associated to a financing contract Reporting lines

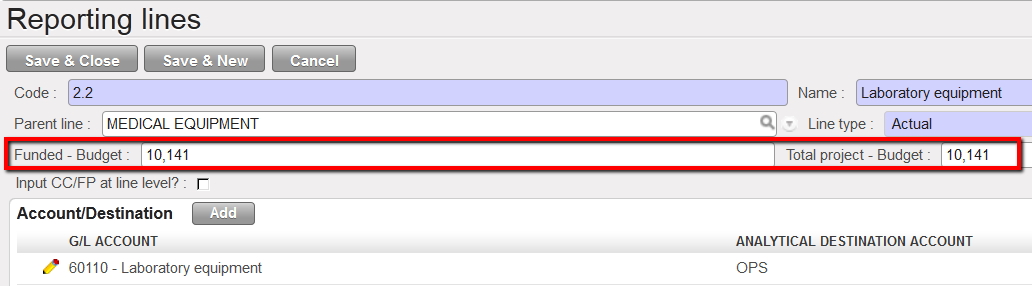

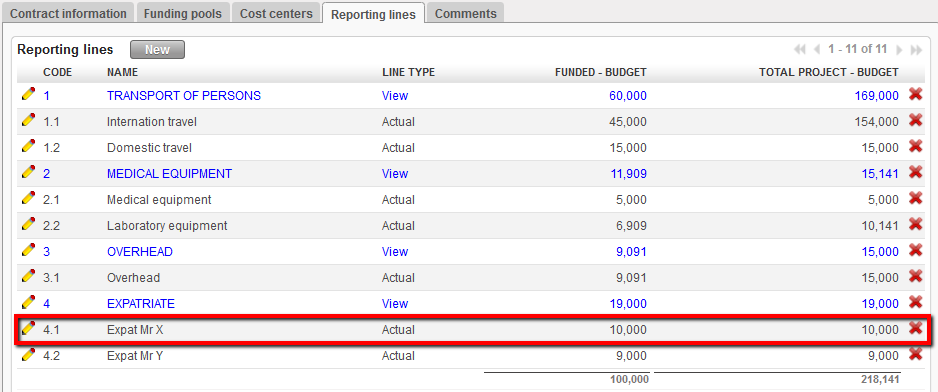

Reporting lines Reporting line and associated budget (earmarked and total)

Reporting line and associated budget (earmarked and total)

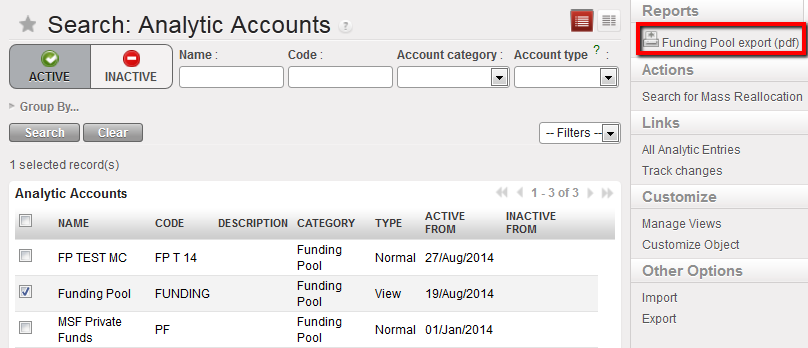

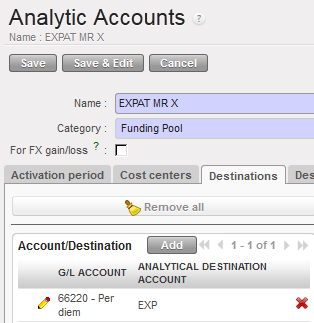

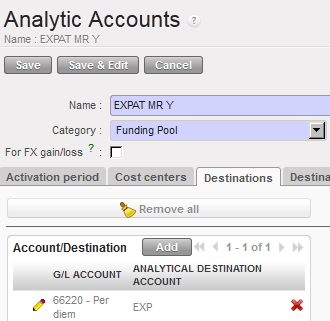

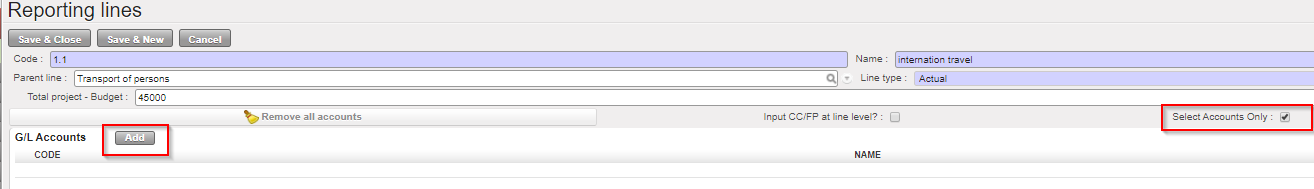

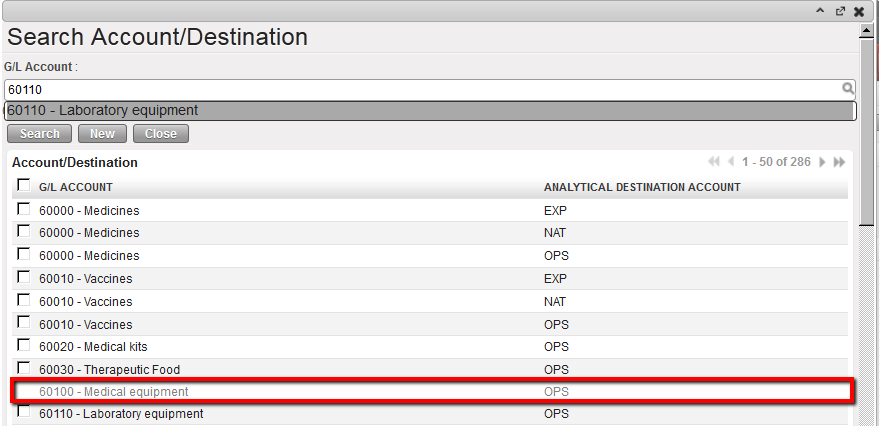

Funding Pools to use when setting reporting line

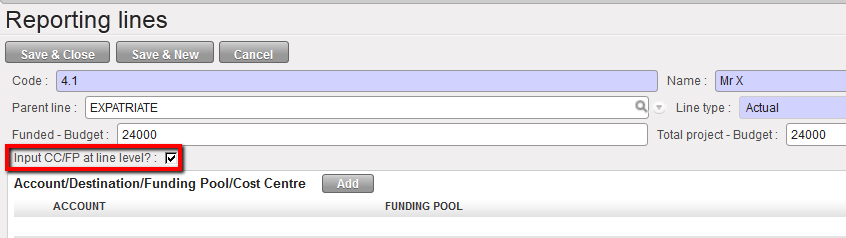

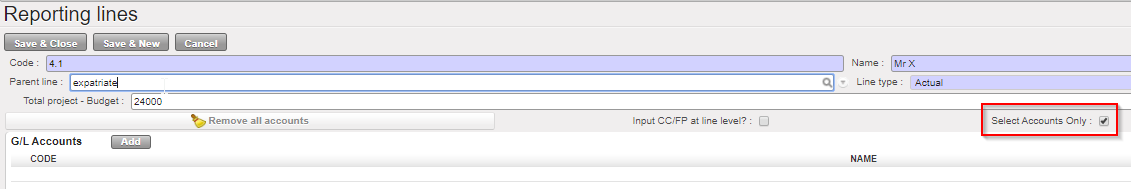

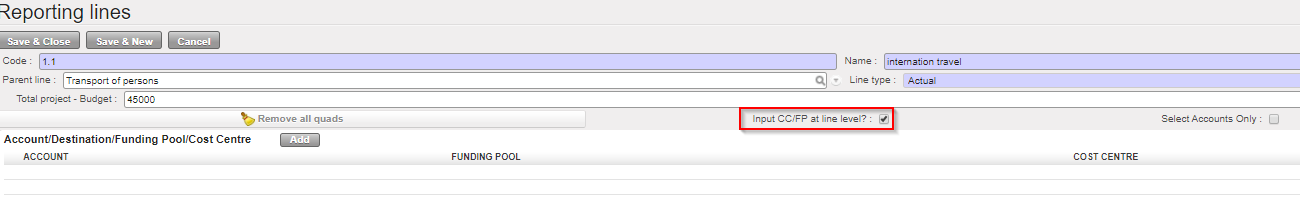

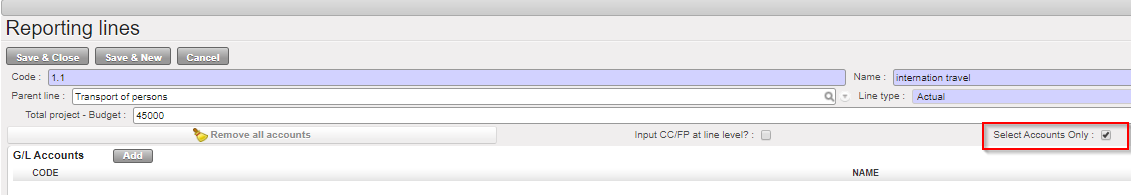

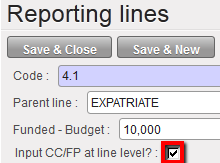

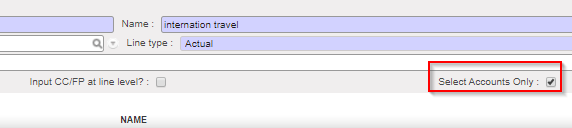

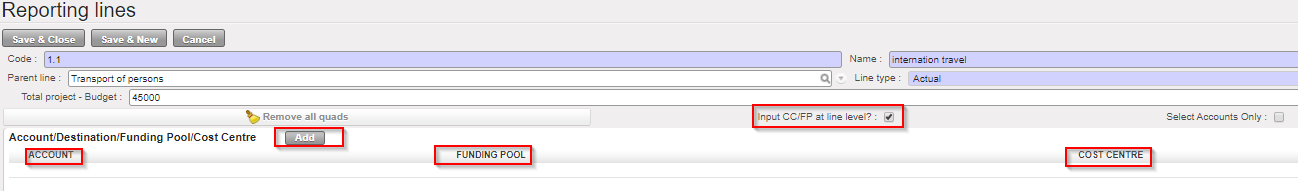

Funding Pools to use when setting reporting line Ticking the checkbox Input CC/FP at line level

Ticking the checkbox Input CC/FP at line level

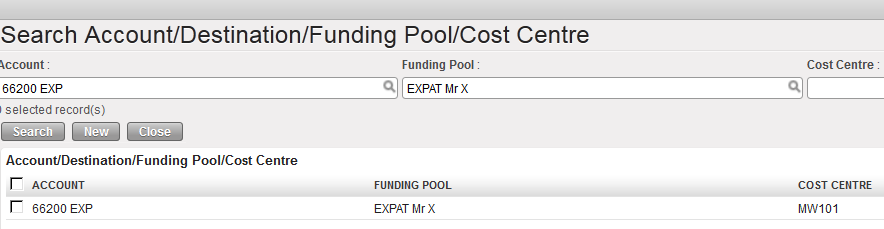

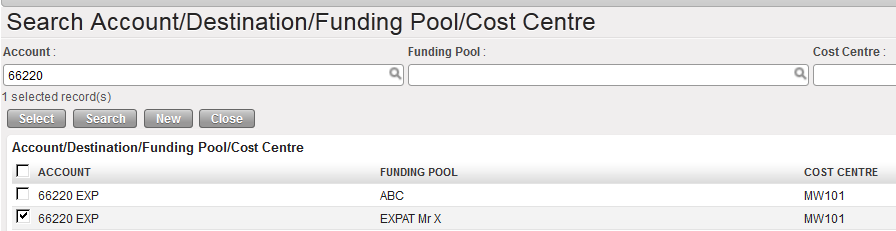

Linking the reporting line Mr X to the funding pool EXPAT Mr X in the Search Account/Destination/Funding Pool/Cost Center

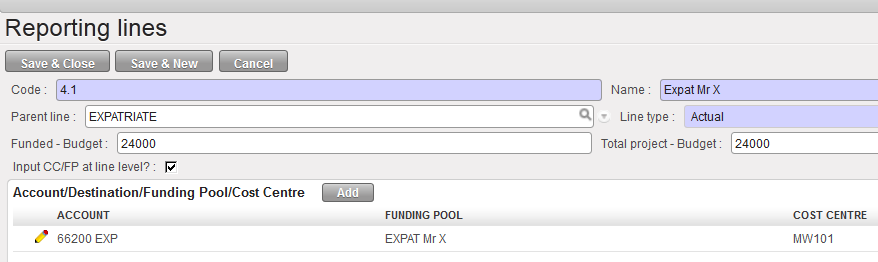

Linking the reporting line Mr X to the funding pool EXPAT Mr X in the Search Account/Destination/Funding Pool/Cost Center Reporting line associated to the funding pool EXPAT Mr X

Reporting line associated to the funding pool EXPAT Mr X

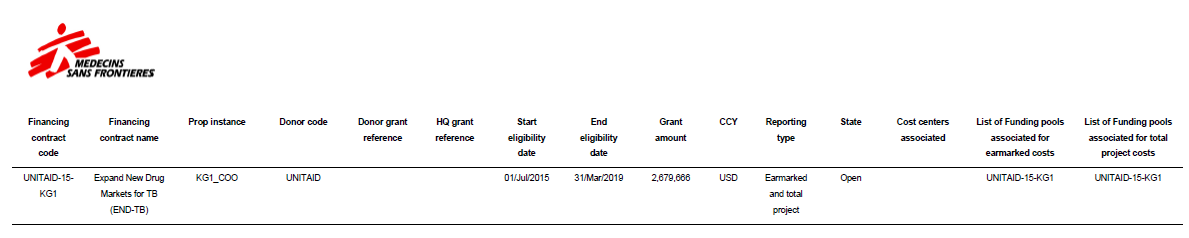

Financing contract creation

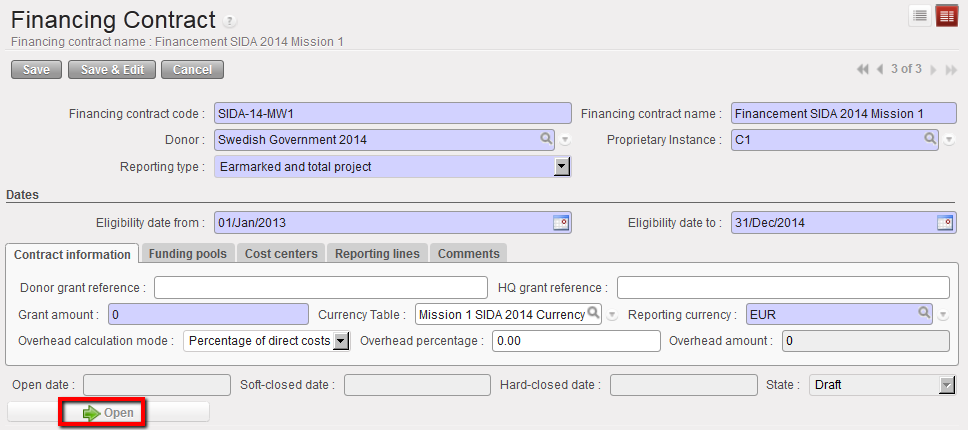

Financing contract creation Contract information tab

Contract information tab Funding Pools tab and pools added

Funding Pools tab and pools added Cost centers tab and adding data

Cost centers tab and adding data Budgeted amount for the reporting line {Personnel}

Budgeted amount for the reporting line {Personnel}

Ticking the checkbox to input CC/FP at line level

Ticking the checkbox to input CC/FP at line level

Linking cost centers and funding pools at line level

Linking cost centers and funding pools at line level

Choosing a quadruplet to link it to a reporting line

Choosing a quadruplet to link it to a reporting line

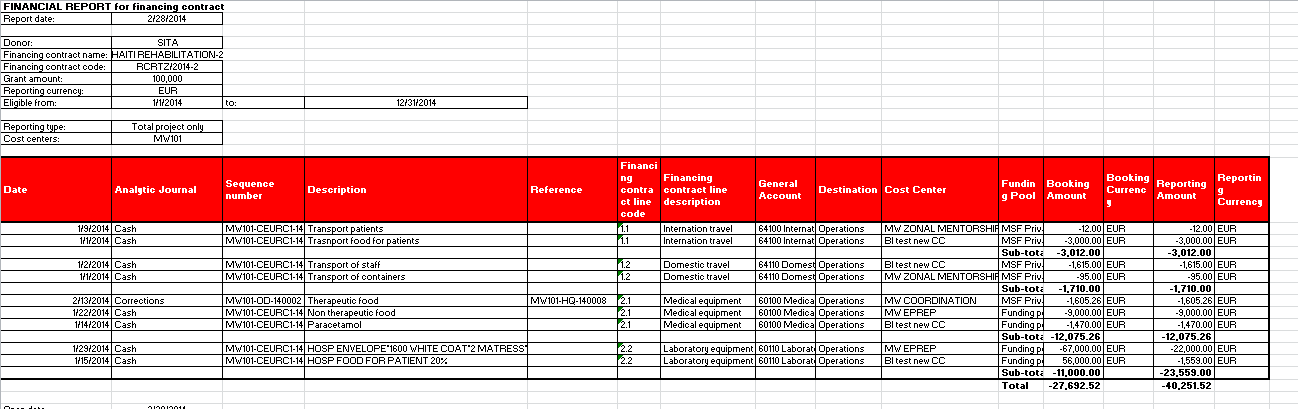

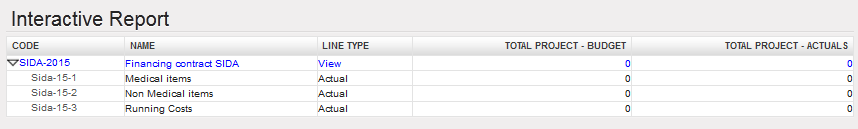

Interactive report showing expenses incurred in 2014 and splitting EXPATRIATE cost in two reporting lines

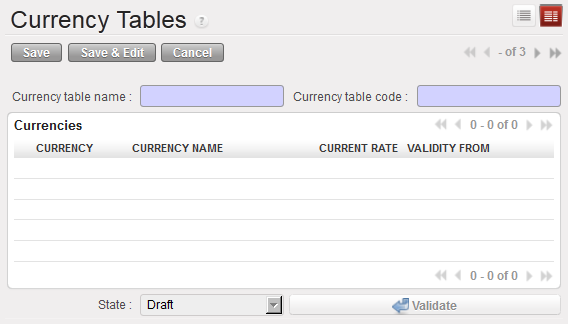

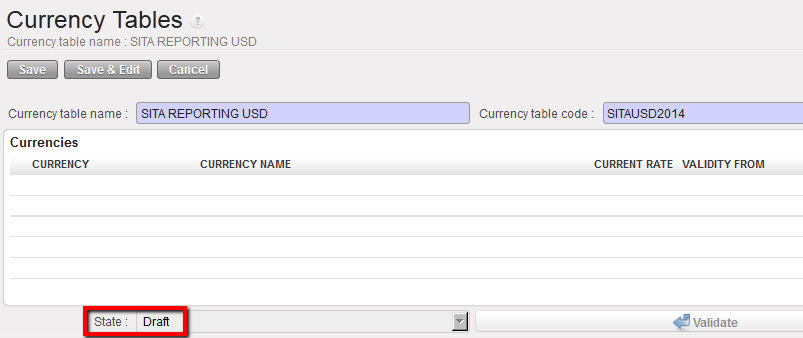

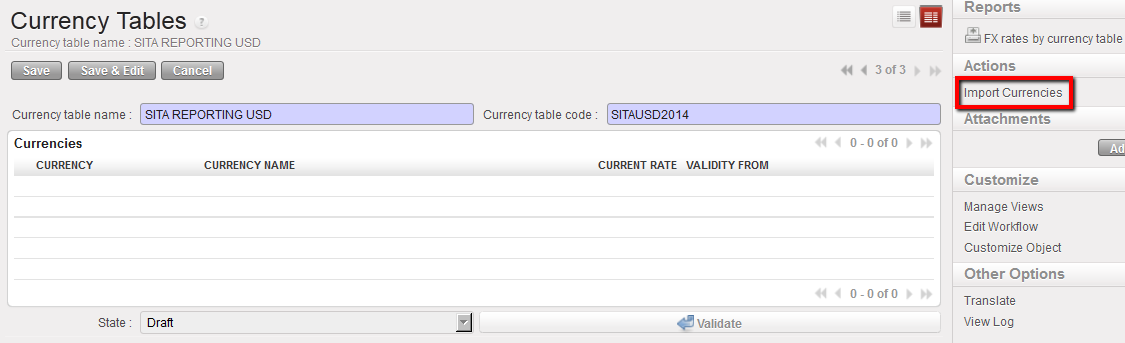

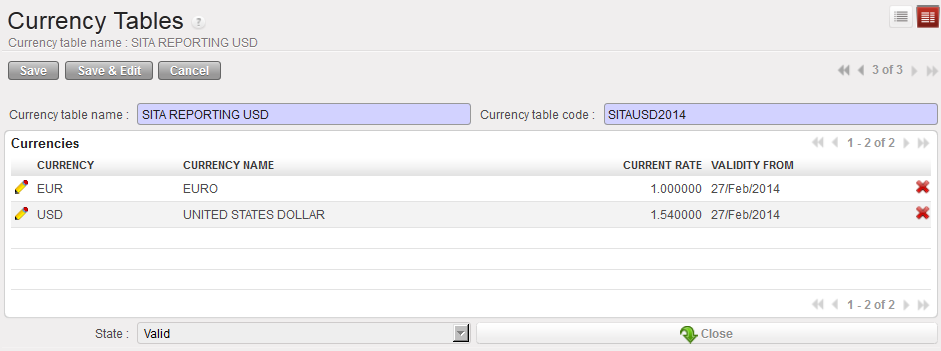

Interactive report showing expenses incurred in 2014 and splitting EXPATRIATE cost in two reporting lines Currency table form

Currency table form  Currency table in Draft state

Currency table in Draft state Import currency action

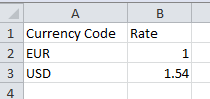

Import currency action Example of currency rate import file

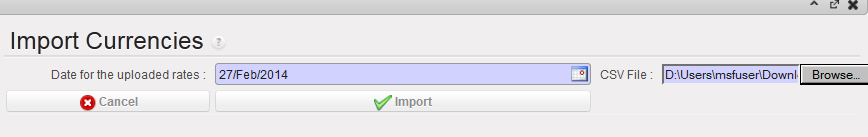

Example of currency rate import file Import Currencies window

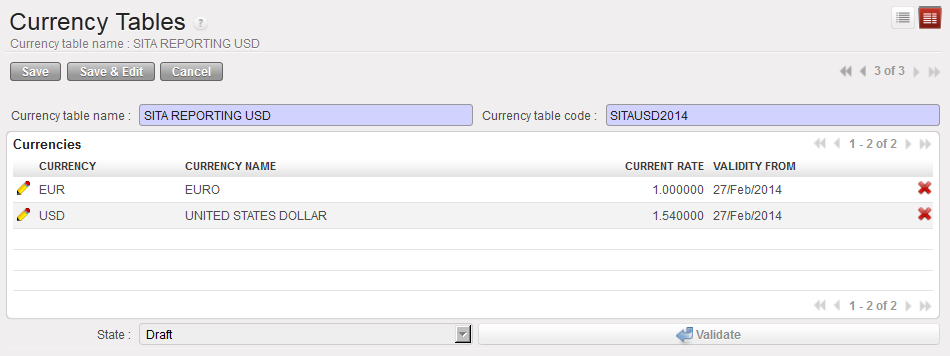

Import Currencies window The currency table rate is imported in the section {Currencies}

The currency table rate is imported in the section {Currencies} Valid currency table

Valid currency table

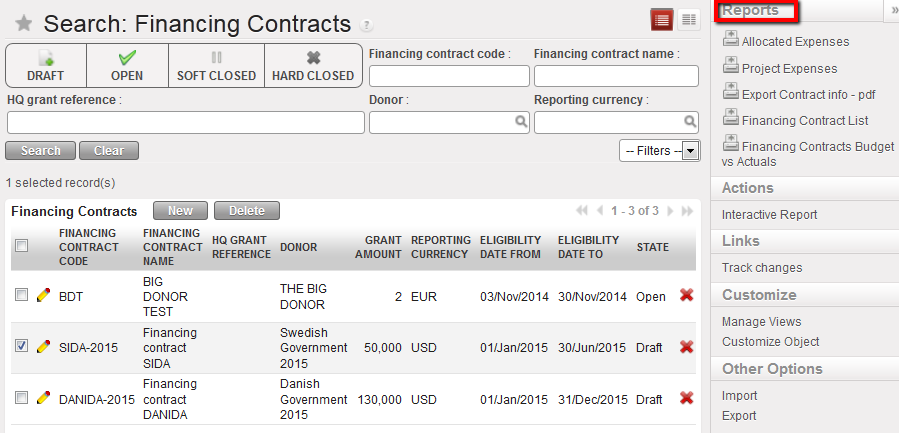

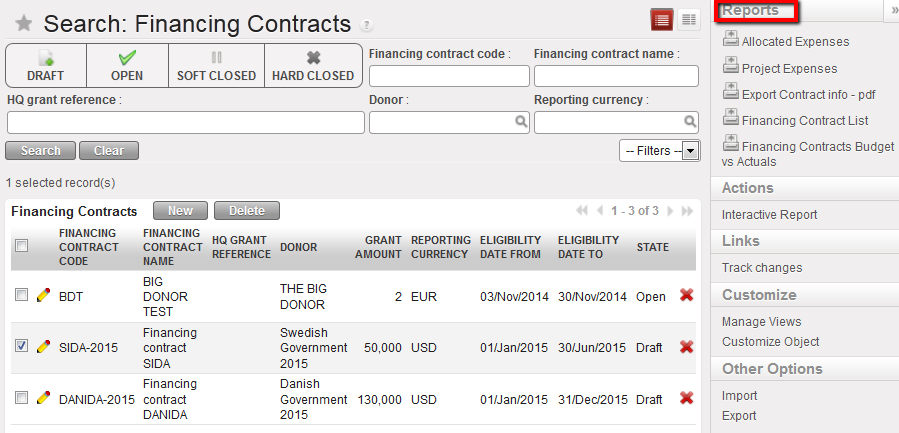

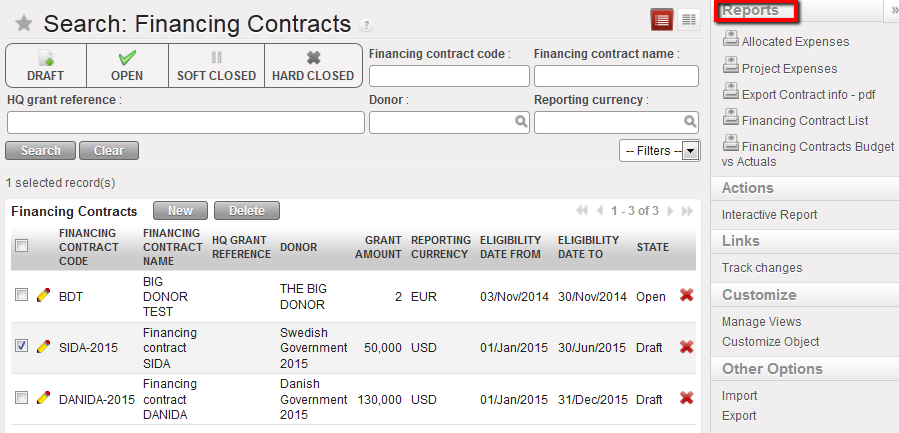

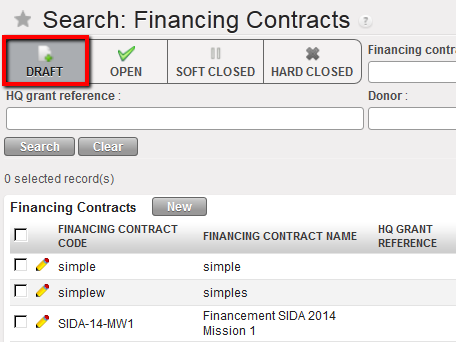

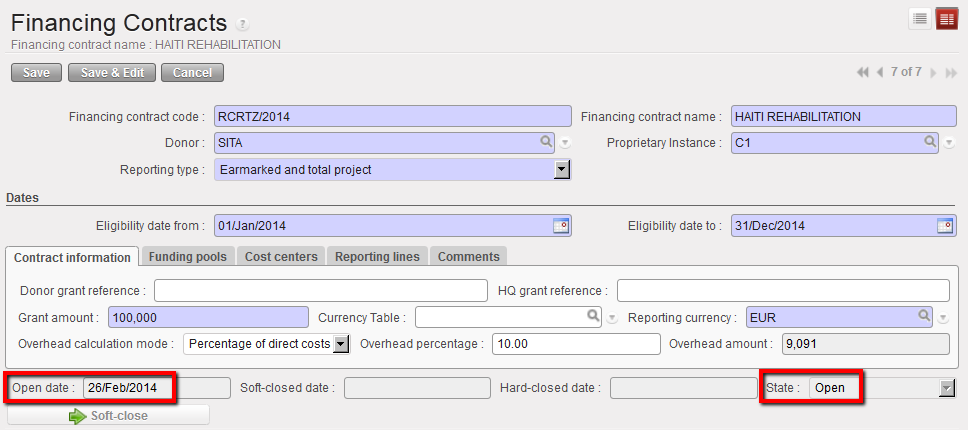

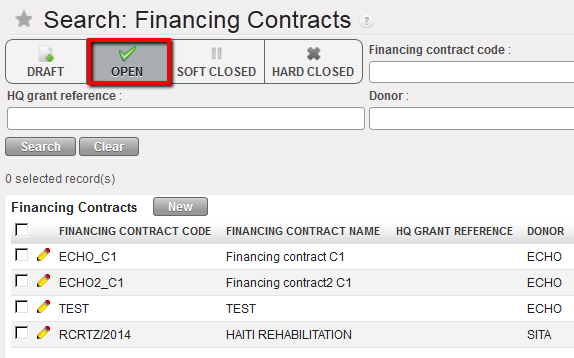

List of Draft contracts

List of Draft contracts Opening a financing contract for Draft state contract

Opening a financing contract for Draft state contract Contract in Open state from 26/Feb/2014

Contract in Open state from 26/Feb/2014

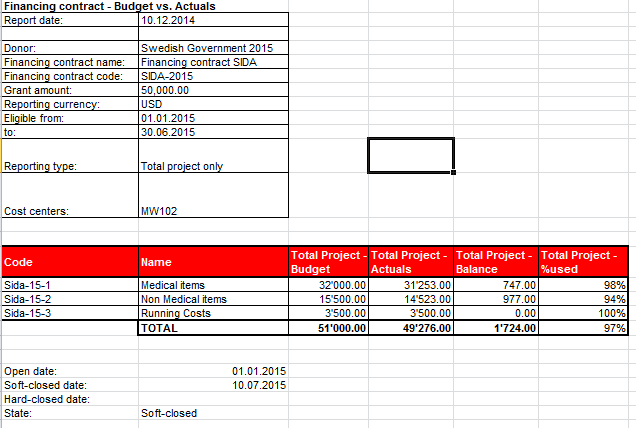

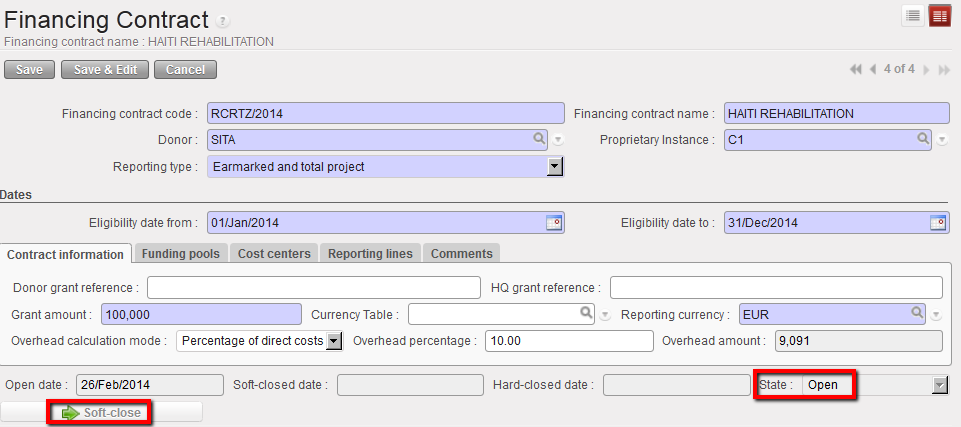

Soft Close Screen for Open state contract

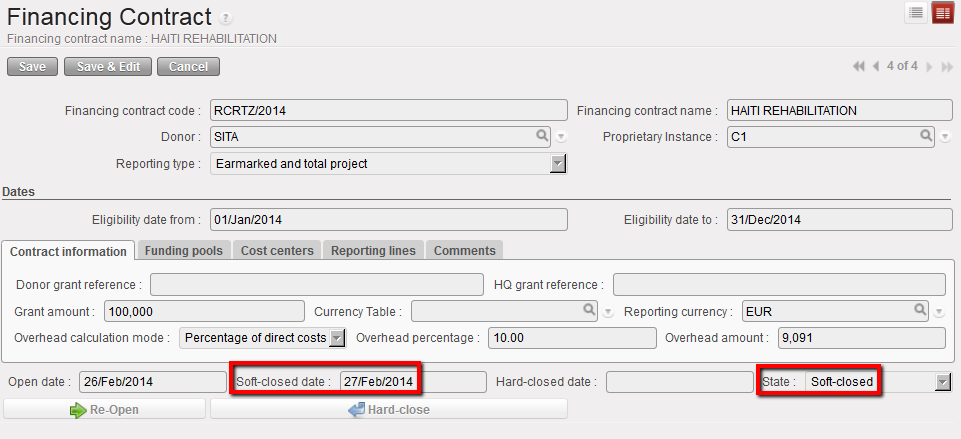

Soft Close Screen for Open state contract Contract in Soft-closed state from 27/Feb/2014

Contract in Soft-closed state from 27/Feb/2014

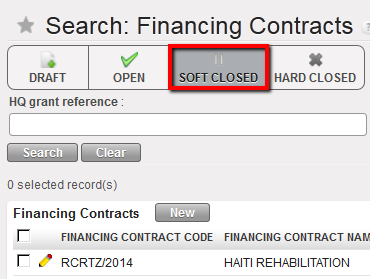

List of Soft-Closed contracts

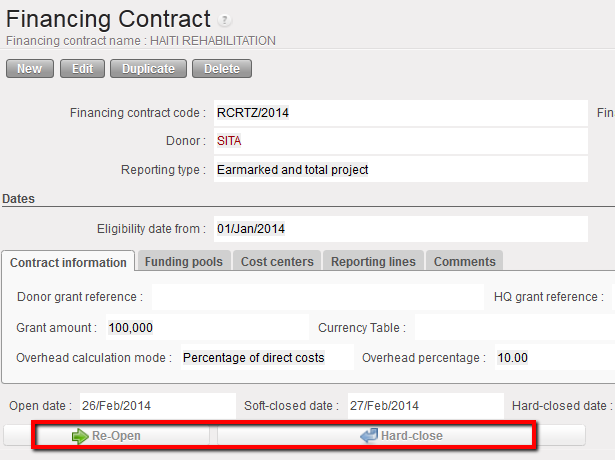

List of Soft-Closed contracts Reopen or Hard-Close Screen

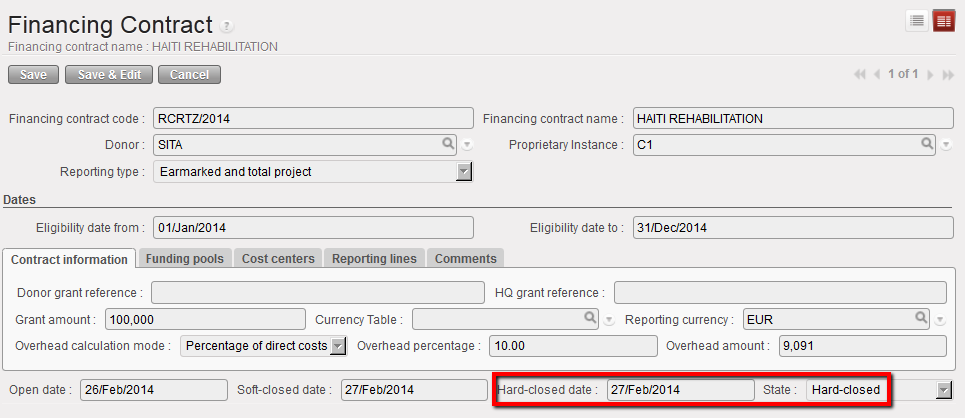

Reopen or Hard-Close Screen Contract in Hard-closed state from 27/Feb/2014

Contract in Hard-closed state from 27/Feb/2014

Drop down menu to choose Donor Reporting Type

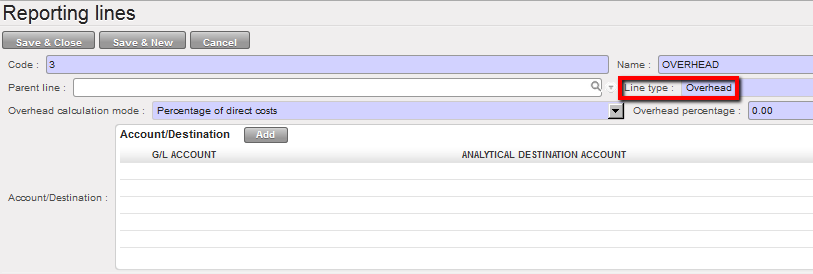

Drop down menu to choose Donor Reporting Type Overhead calculation mode

Overhead calculation mode Example of View and Actual reporting lines

Example of View and Actual reporting lines 1. In the {Reporting Lines} field, click on {New}

1. In the {Reporting Lines} field, click on {New}

Reporting lines configuration

Reporting lines configuration System shows account/destination unavailable (in grey) when mapping the reporting lines

System shows account/destination unavailable (in grey) when mapping the reporting lines

Select the Line Type

Select the Line Type Overhead calculation mode setting

Overhead calculation mode setting