Finance User Manual ENG -> 2. Finance Configurations -> 2.10 VAT and Taxes -> LUFI-21001 VAT Configuration

LUFI-21001 VAT Configuration

LU Introduction

Before setting the taxes in the instance, you must activate the taxes functionality. To activate it, you will follow the below steps.

How to Activate the Taxes Functionality

Go to: Administration/Configuration/Reconfigure

- Search for the step “Manage the VAT” by pressing the button

Manage the VAT step

Manage the VAT step

2. On the “Manage the VAT” window, check the box “Manage the VAT locally”

3. Press  when the task is completed

when the task is completed

If the Step “Manage the VAT” is left blank, the Taxes section is removed from the Configuration sub-module.

The Fiscal Position field in the Accounting tab of a supplier form is hidden

The Account Tax section in the Accounting tab of a product form is taken away

The Taxes section is also removed from any payment documents (supplier invoices, refund invoices, direct invoices)

Now let’s see how Taxes are set in UniField.

Assuming VAT applied on sales is out of UniField scope, 3 cases were identified for purchase:

VAT not recoverable. Purchases are accounted for at price including VAT. No VAT management in this case.

VAT exemption. Purchases are accounted for at price excluding VAT. No VAT management in this case.

VAT recoverable. Purchases are accounted for at price including VAT but VAT is isolated on separate Receivable Accounts for later settlement through a proper VAT declaration. The VAT recoverable is booked on the debit side as any other receivable account as it is expected to be claimed back from the government.

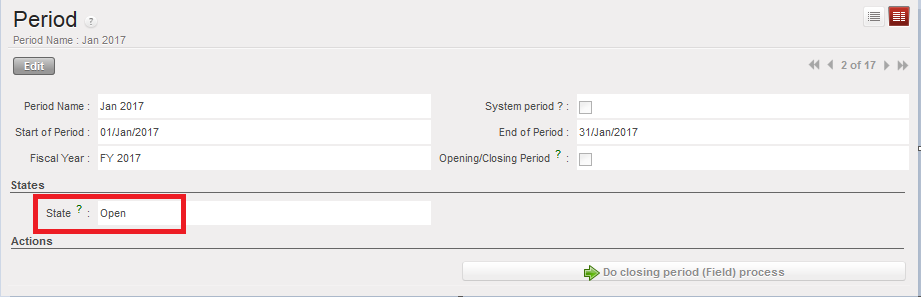

VAT Recoverable booked on the debit side

VAT Recoverable booked on the debit side

The different tax percentages applicable in a country are created through the taxes sub-modules.

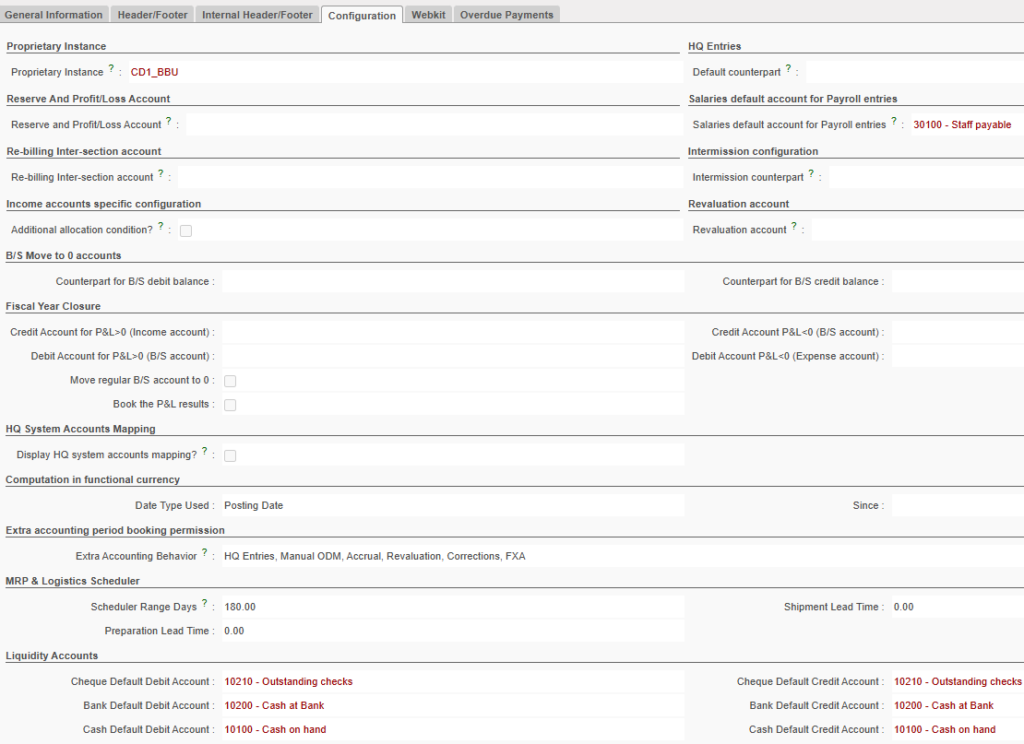

- If it is done at HQ level, it is synchronized downwards to the mission (coordination and projects). In this case HQ can create a standard form, synchronize it and it is up to the mission to change the percentage according to the local applicable rate.

- If mission creates VAT, it will not synchronize to HQ.

VAT set at project instance remains in the instance, thus it is not synchronized up to Coordination.

Please check your OC’s procedure.

The lists of taxes are available in the Search taxes view under the configuration sub-module as displayed below:

List of taxes in the taxes sub-module

List of taxes in the taxes sub-module

The tax form view is the object used to define the percentage, calculation, application and accounting code of a tax.

Taxes form view

Taxes form view

Once a VAT code is set, you can :

- Associate a VAT to a product in the product form (See LUFI-20902 VAT and Product Linkage)

- Associate a VAT directly to a whole invoice before validation (See chapter 03 – Payments)

How to Set Up a VAT

Go to: Accounting/Configurations/Financial Accounting/Taxes/Taxes

- In the Search Taxes view, select

- Complete the {Tax Name} and {Tax Code} fields.

- In the {Tax Application} field, select the value {Purchase}. {Sale} and {All} are not used. The {Active} box is automatically checked.

- Leave the box {Tax included in Price} blank if price is to be excluded form price.

Taxes form view header

- In the {Tax Definition} tab, select the tax type {Percentage}. The tax type defines the computation method for the tax amount. The values {Fixed amount, None, Python code and Balance} are not used.

- Enter an amount as a value between 0 and 1. For instance, for a tax of 20%, enter 0.20. You need to enter a positive value so that this tax (recoverable) is booked on the debit side as any other receivable accounts.

- In the Accounting Information section, enter a receivable account for both the Invoice Tax Account and Refund Tax Account.

Tax Definition: computation method and accounting codes setting

Tax Definition: computation method and accounting codes setting

4. The remaining sections on the form as well as the Special Computation tab do not have to be completed.

Special Computation and Tax Declaration Invoices are left as such

Special Computation and Tax Declaration Invoices are left as such

5. Save the form.

6. In the Taxes Search view list, the tax is displayed. You can always edit  or delete it

or delete it

Search Taxes view

- You will have these filters in the search view: [active] [inactive] [Tax included in price] [Tax not included in price].

- For the status [active] or [inactive] filters, the default display will be [active].

- For the types [Tax included in price] or [Tax not included in price] the display will be both.

Note: If no third party is added to the tax configuration, tax lines will take the supplier invoice third party.

Note: If no third party is added to the tax configuration, tax lines will take the supplier invoice third party.

Withholding tax booked on the credit side as any other payables account

Withholding tax booked on the credit side as any other payables account Setting a withholding tax with negative amount

Setting a withholding tax with negative amount Withholding tax applied to a supplier invoice

Withholding tax applied to a supplier invoice VAT 0% used to set a partner’s fiscal position not handling VAT

VAT 0% used to set a partner’s fiscal position not handling VAT Fiscal Positions form view

Fiscal Positions form view

Fiscal position setting in a supplier form

Fiscal position setting in a supplier form Supplier invoice and applied fiscal position

Supplier invoice and applied fiscal position Purchase Taxes on the product form

Purchase Taxes on the product form Products list in the Search Products list view.

Products list in the Search Products list view. Add button located in the Purchase Taxes section in the Accounting tab of a product form

Add button located in the Purchase Taxes section in the Accounting tab of a product form Search Account Tax window and selection of a tax to link to a product

Search Account Tax window and selection of a tax to link to a product Tax set in the Purchase Taxes section in the Accounting tab of a product form

Tax set in the Purchase Taxes section in the Accounting tab of a product form Manage the VAT step

Manage the VAT step

VAT Recoverable booked on the debit side

VAT Recoverable booked on the debit side List of taxes in the taxes sub-module

List of taxes in the taxes sub-module Taxes form view

Taxes form view

Tax Definition: computation method and accounting codes setting

Tax Definition: computation method and accounting codes setting Special Computation and Tax Declaration Invoices are left as such

Special Computation and Tax Declaration Invoices are left as such