Finance User Manual ENG -> 2. Finance Configurations -> 2.8 Suppliers and Customers -> LUFI-20801 Partner Creation

LUFI-20801 Partner Creation

LU Introduction

In the below example we will create a partner form type external to book the social security liabilities.

How to Create a Supplier

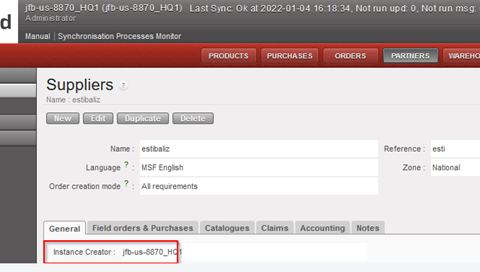

Go to: Accounting/Suppliers/Suppliers

A list of suppliers appears

- Click on {New} to create a new supplier form.

A supplier form appears (the supplier’s box is automatically checked)

2. Enter the supplier name in the {Name} field. In this case it will be {Social security}.

-

- If it concerns a business company, spell the name exactly as it is on the company’s invoice/letterhead.

3. Enter the reference in the {Reference} field, e.g {SSEC}.

-

- It could be the type of services provided if it is a business company.

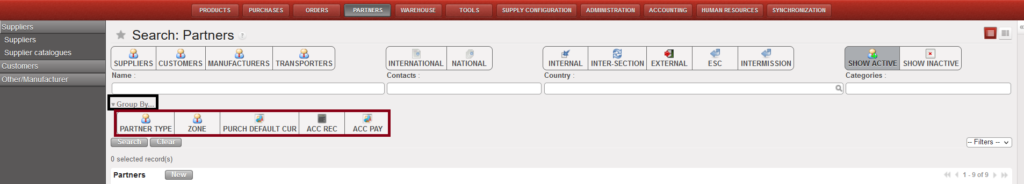

4. Set {Partner type} field to {External} as we are creating a partner which is not linked to MSF

5. Set the {Language} of communication. All documents related to this partner will be printed in this language. If not, it will default to English

6. Set {Zone} field to {National}.

-

- {National} is used for all-in country partners. If {International} check with LogCo.

7. In the field {Order creation mode} {All requirements} is set by default.

8. The {Active} box is checked by default.

9. In the General tab, in the {contact name} section, enter the name of your contact in {Contact Name}.

-

- If it is a business company, spell exactly as it is on the company’s invoice/letterhead

10. Choose the right title using the combo box {Title}, enter manually a function.

11. Check the box active if you want to display the contact details in the partners Search view

12. In the {Postal address} section, fill in the different information fields.

-

- If it is a business company, spell exactly as it is on the company’s invoice.

13. In the {Communication} section, fill in the different information fields.

-

- If it is a business company, spell exactly as it appears on the company’s invoice.

14. In the tab {Field Orders & Purchases}, select the {Default Purchase Currency}. The {Default field order currency} should be identical. The selected currency will be the default currency you use to pay this supplier.

- The standard in the partner is that both Purchase Default Currency & Field Order Default Currency must be unique with the currency code, so once Purchase Default Currency has a value, the field automatically updates the Field Order Default Currency with the same currency code.

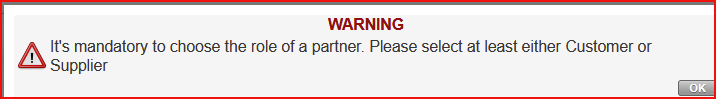

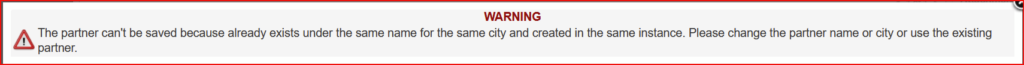

- It’s not possible to edit Field Order Default Currency otherwise a popup with a warning message will appear as below:

15. In the {Supplier lead time} keep {0} days.

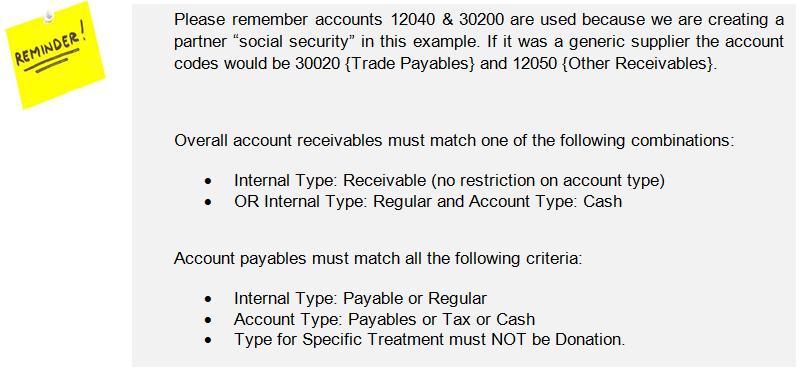

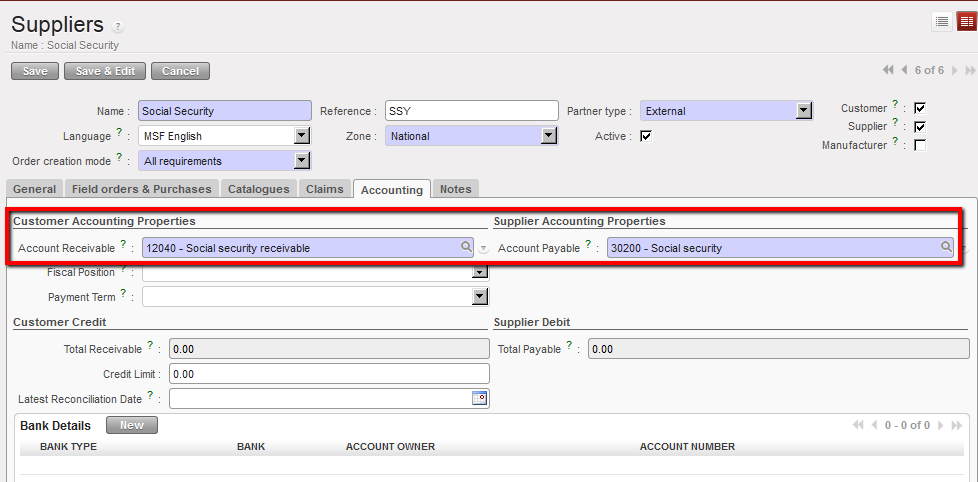

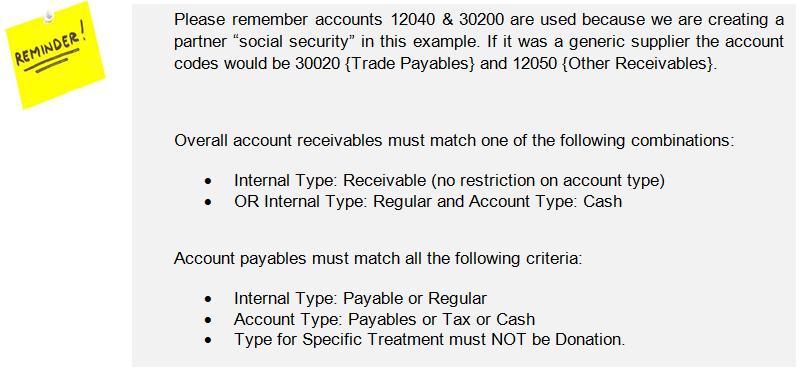

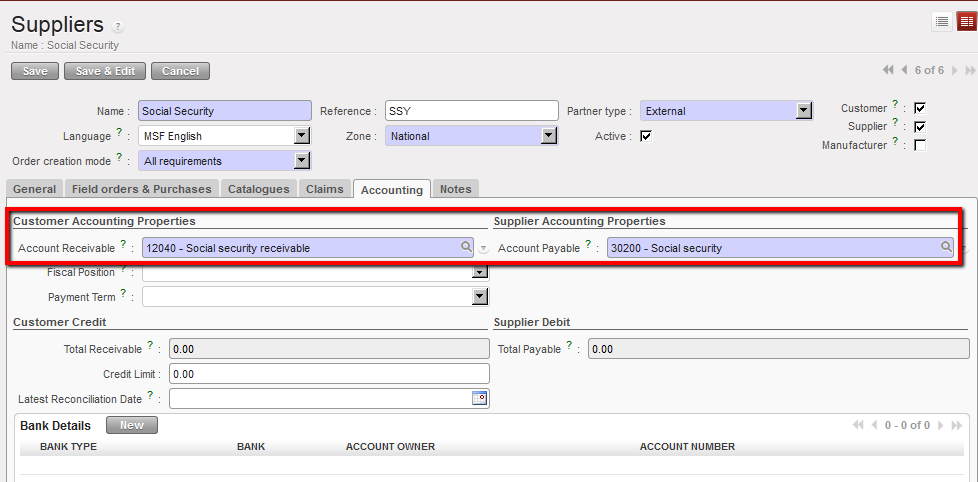

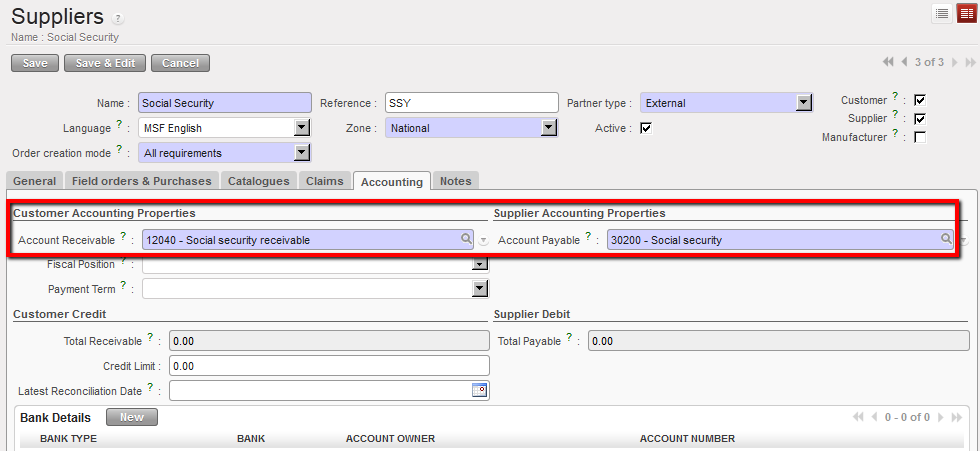

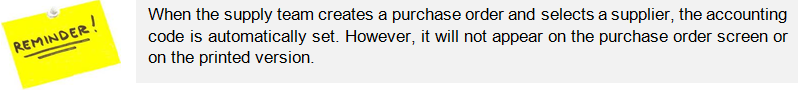

16. In the Accounting tab, enter the Account Receivable 12040 {Social security receivable} and Account Payable 30200 {Social security).

17. You do not need to complete any other tabs/fields. Save the form.

The social security supplier form is created

Social Security form and accounting tab

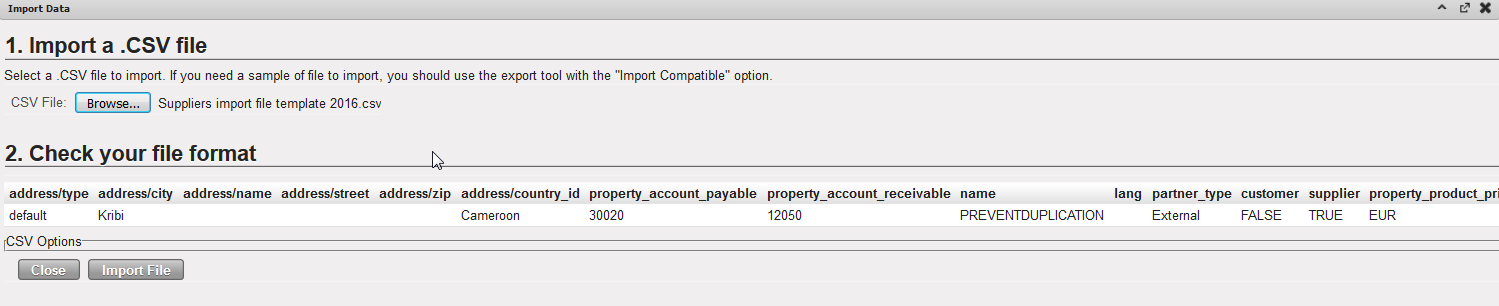

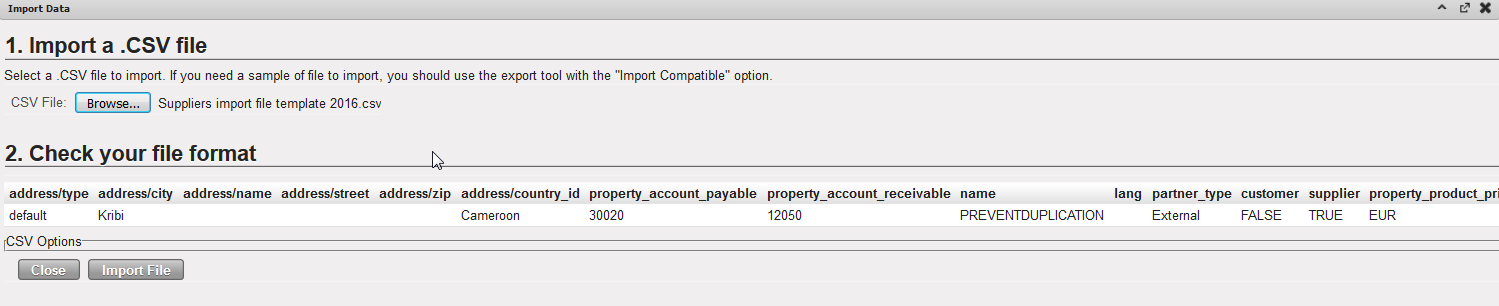

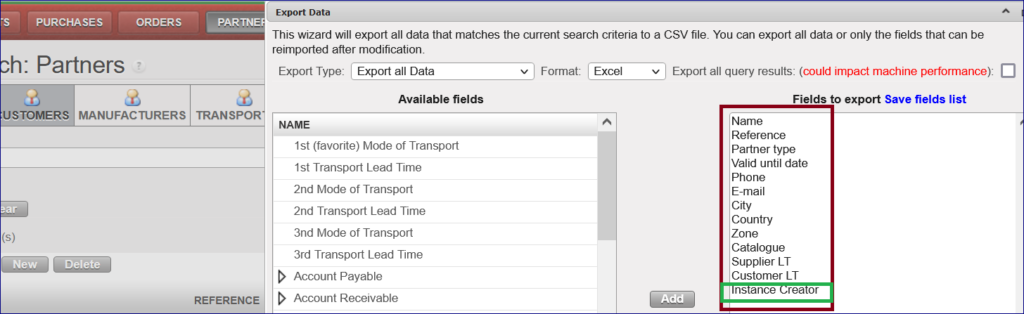

A faster way to create a partner form is to use the “Import” function at the top pane in the “Actions” menu. You will need a template of type csv to process the import. Remember that restrictions on account codes will apply too.

Supplier Import View

Supplier Import View

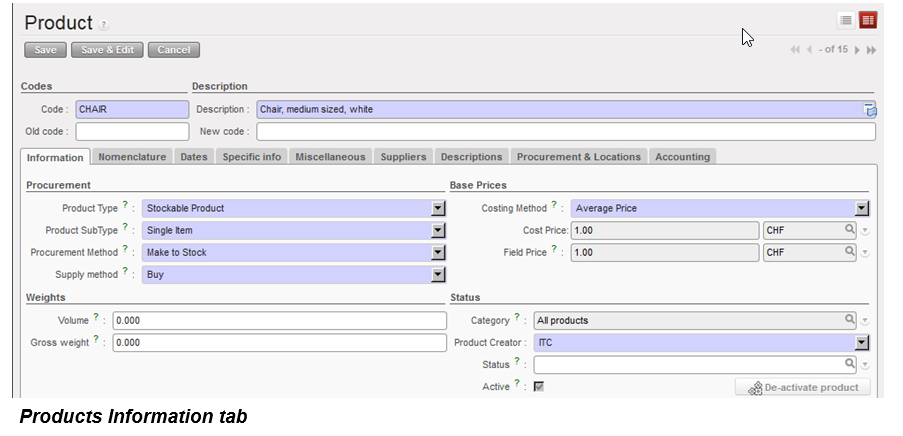

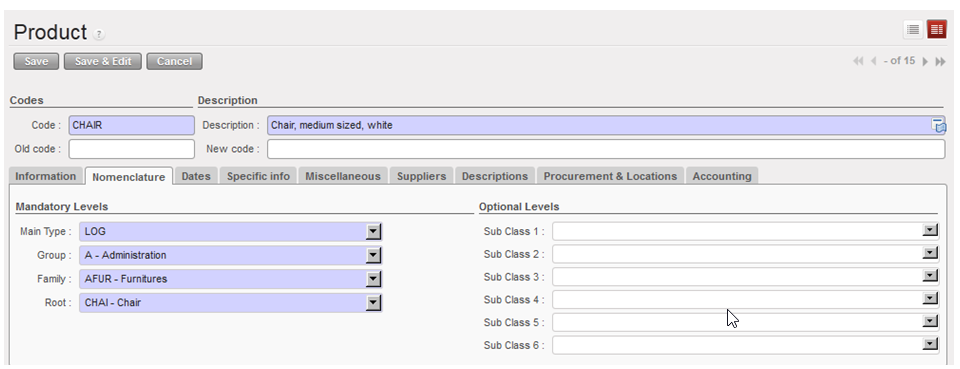

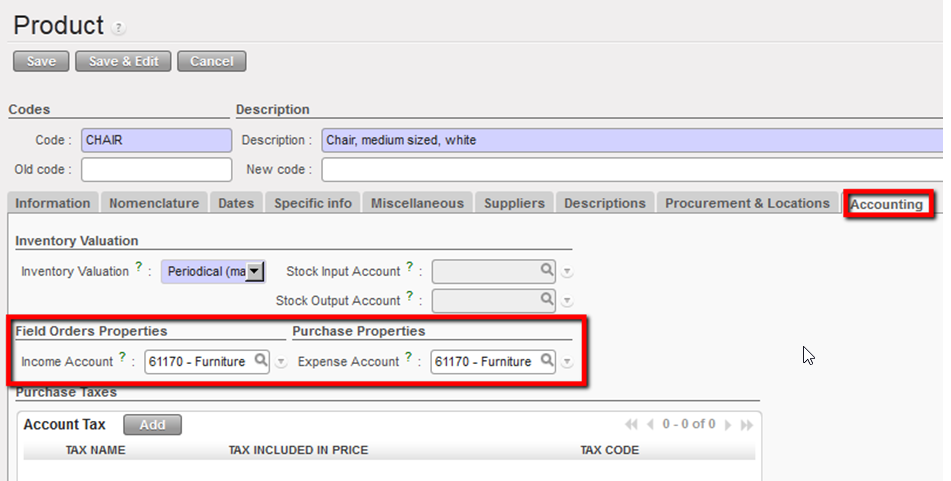

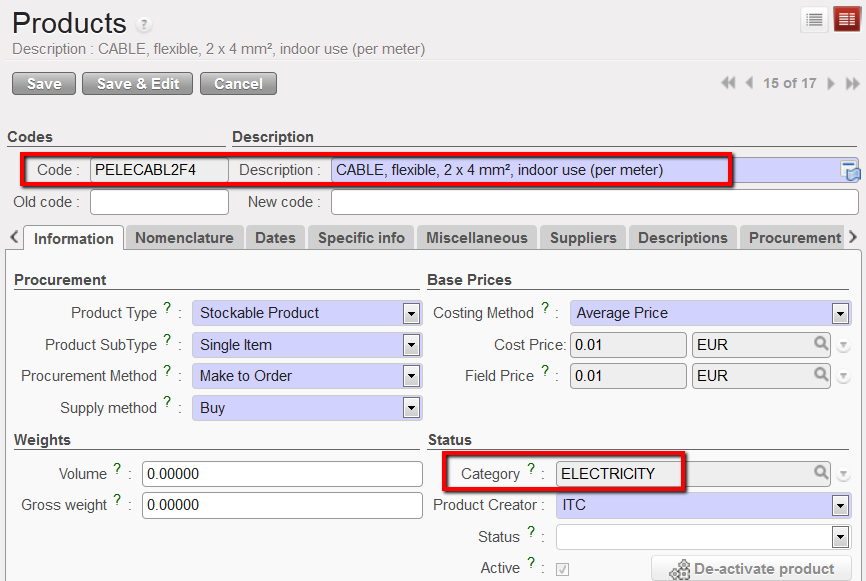

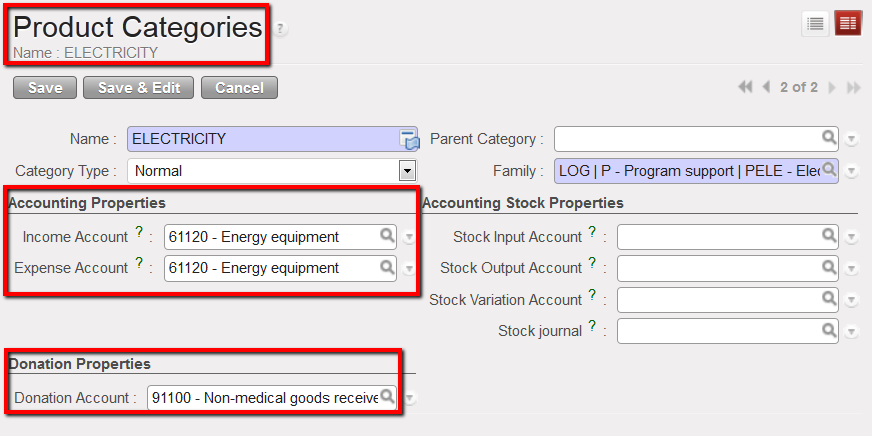

Product category displayed on the information tab of a product form view

Product category displayed on the information tab of a product form view

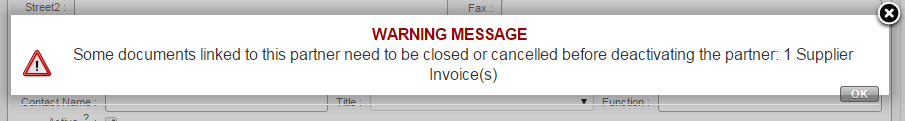

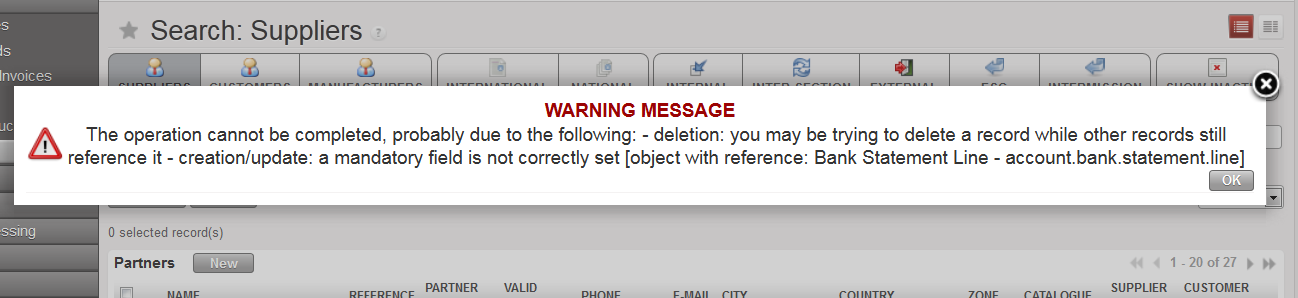

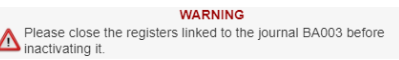

In this example, you cannot delete this partner because there is a transaction booked against it in a bank register.

In this example, you cannot delete this partner because there is a transaction booked against it in a bank register.

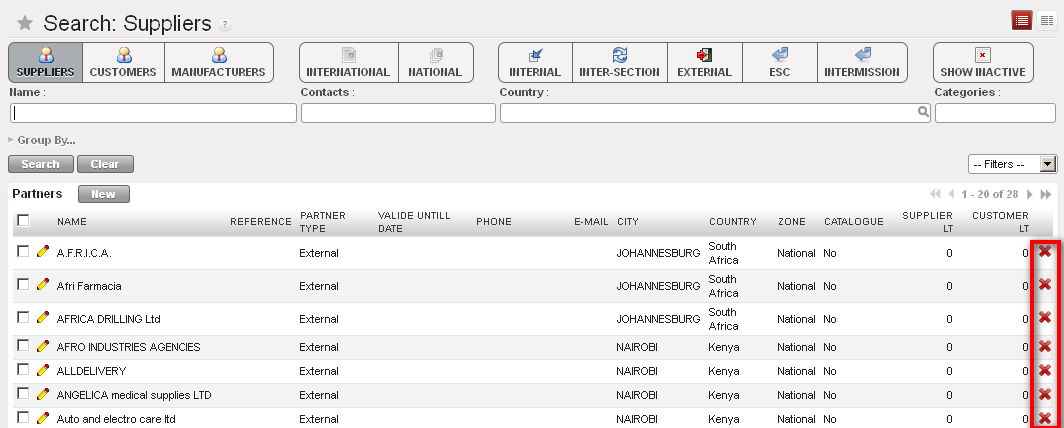

Supplier Import View

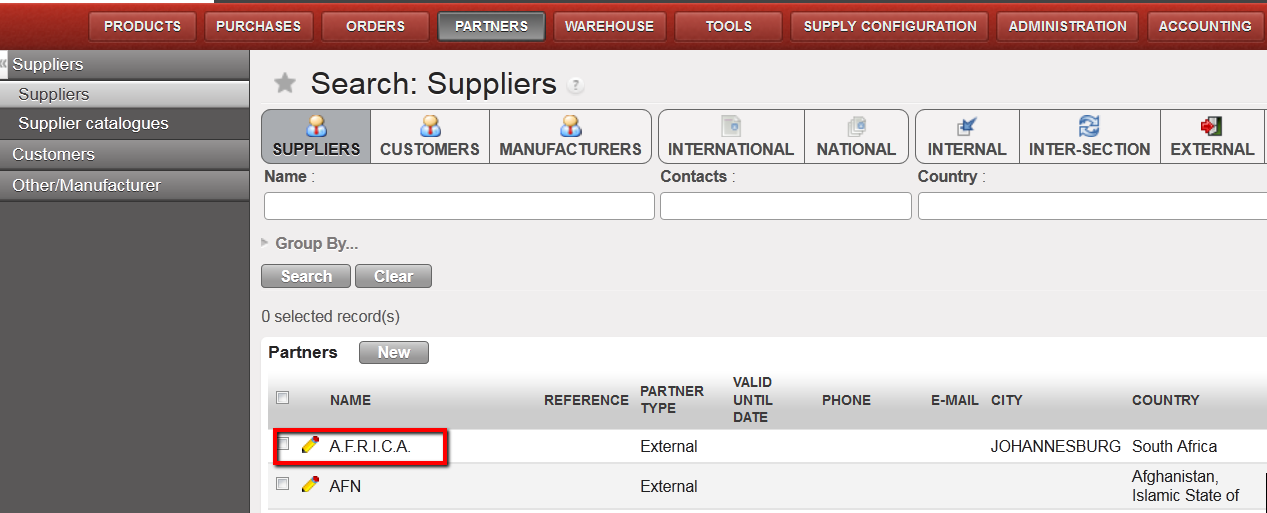

Supplier Import View Supplier A.F.R.I.C.A. visible in the PARTNERS business application

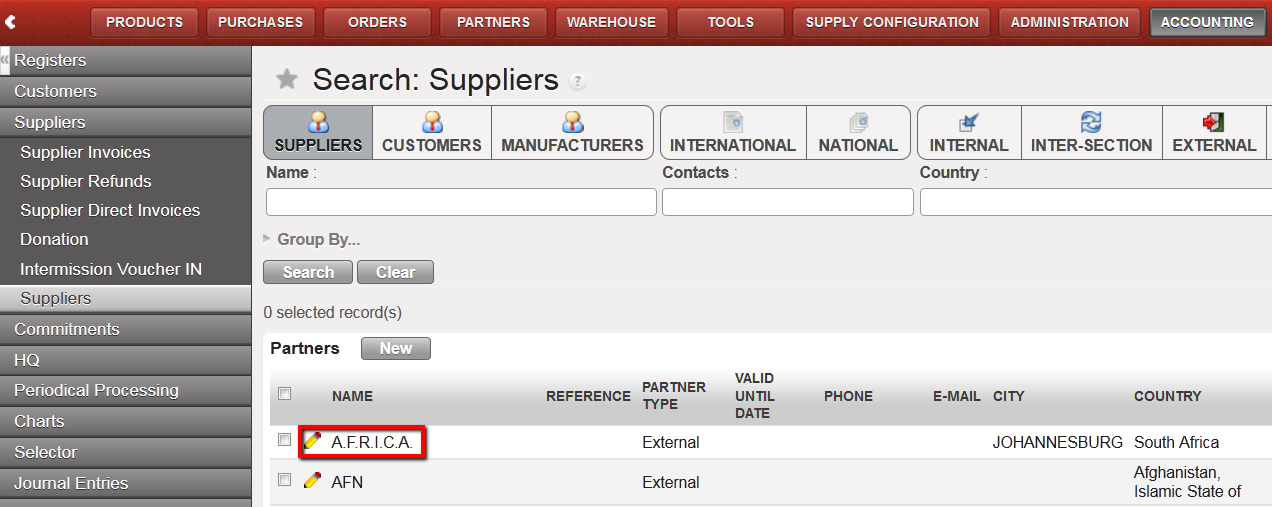

Supplier A.F.R.I.C.A. visible in the PARTNERS business application Supplier A.F.R.I.C.A. visible in the ACCOUNTING business application

Supplier A.F.R.I.C.A. visible in the ACCOUNTING business application

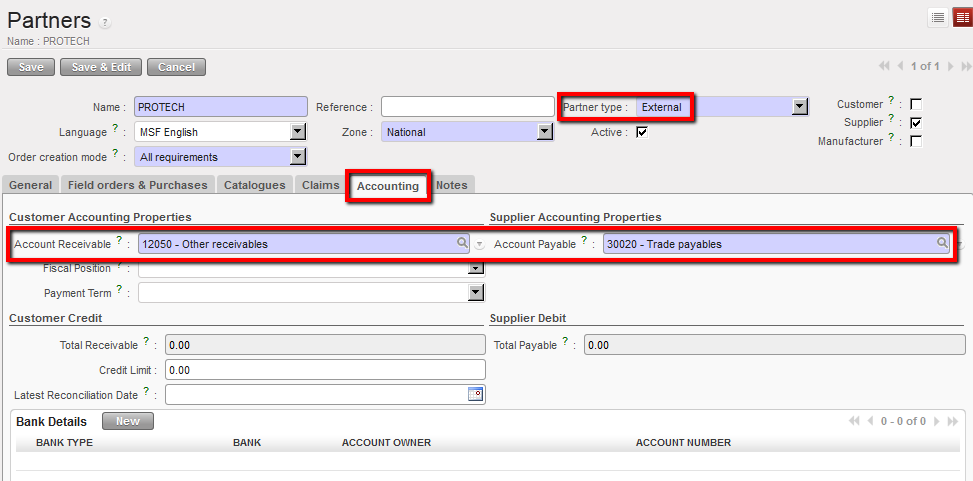

A supplier {External} of goods and services and associated accounting codes

A supplier {External} of goods and services and associated accounting codes  Social security partner (external supplier) and associated accounting codes

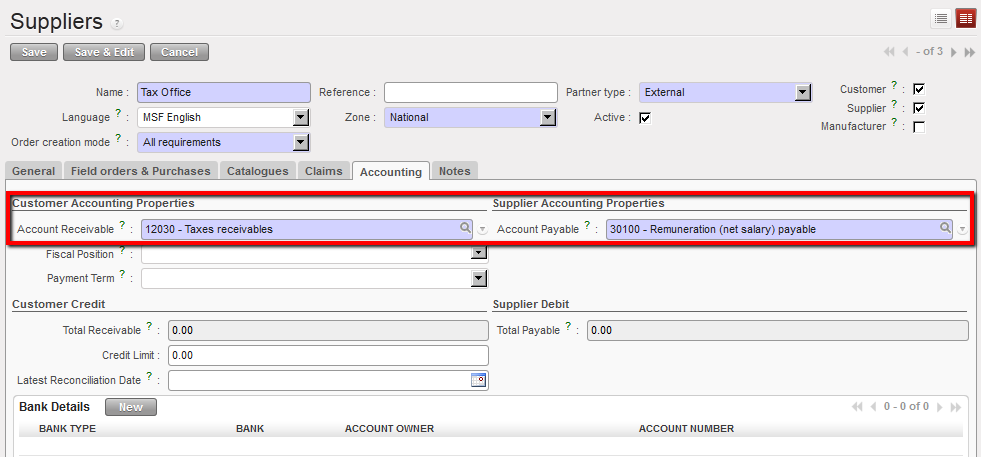

Social security partner (external supplier) and associated accounting codes Tax office partner (external supplier) and associated accounting codes

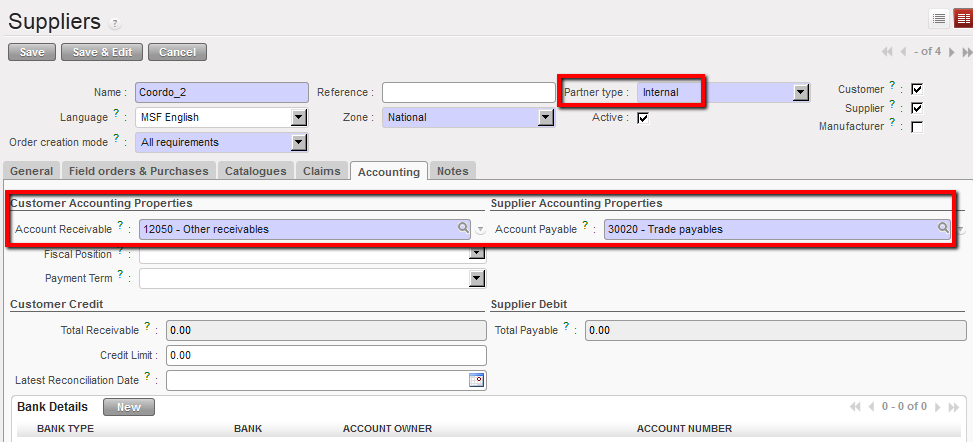

Tax office partner (external supplier) and associated accounting codes Coordo_2 is both a supplier and customer type of internal partner

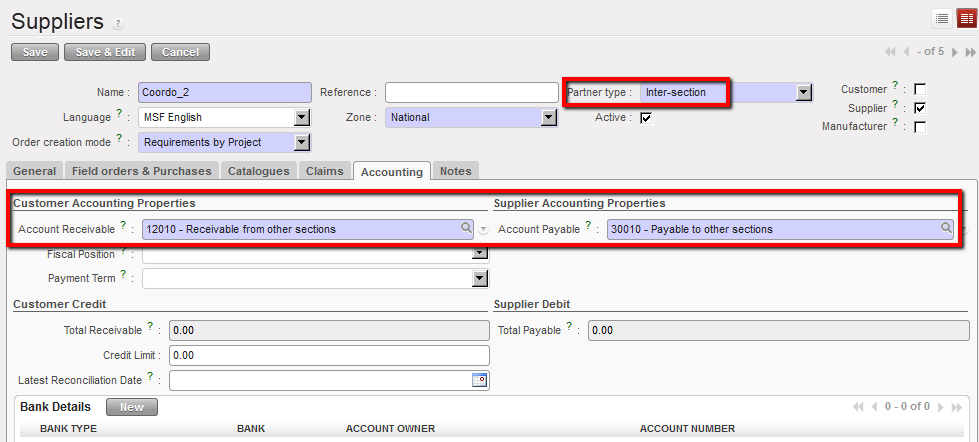

Coordo_2 is both a supplier and customer type of internal partner  Coordination-002 is a supplier type of inter-section partner

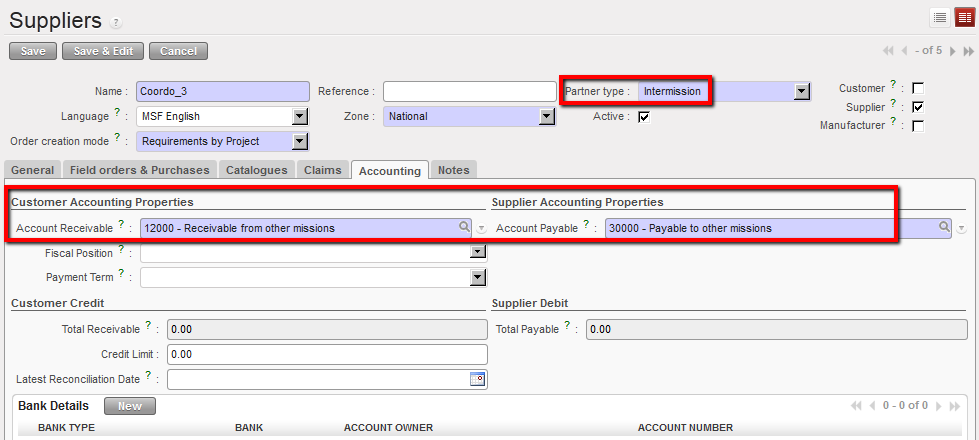

Coordination-002 is a supplier type of inter-section partner

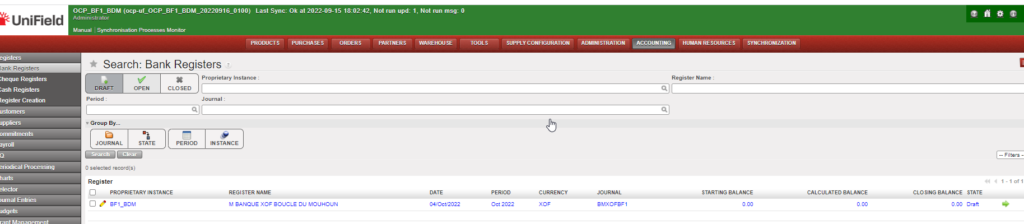

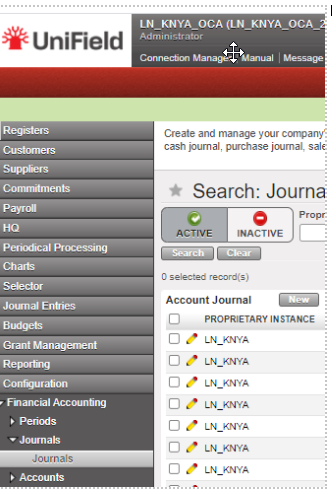

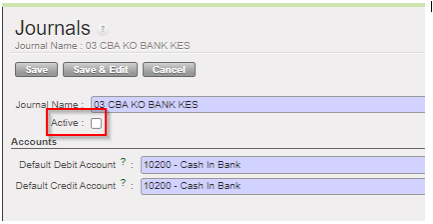

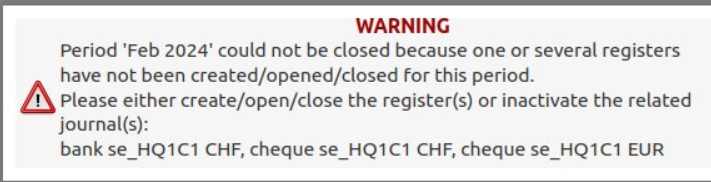

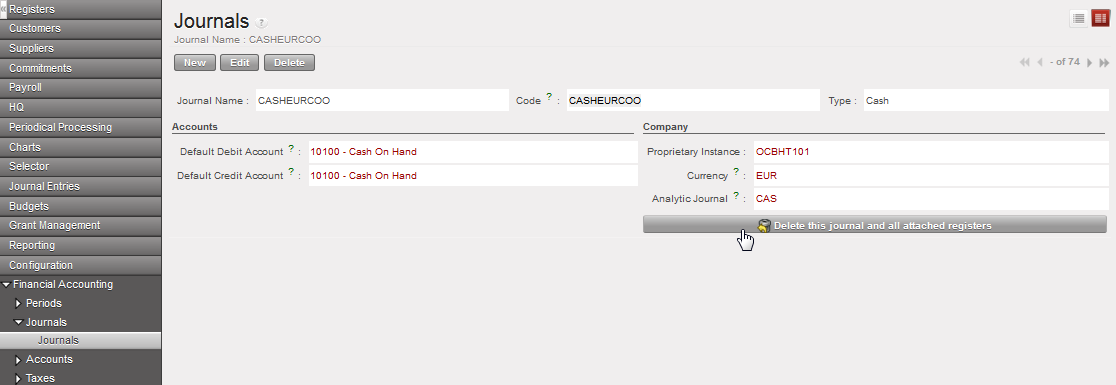

. You want to create all cash, cheque and bank registers that have active cashboxes and bank accounts.

. You want to create all cash, cheque and bank registers that have active cashboxes and bank accounts.