Finance User Manual ENG -> 3. Payments -> 3.3 Finance Payments and Registers -> LUFI-30305 Direct Entries Booking

LUFI-30305 Direct Entries Booking

LU Introduction

Direct Entries allow the finance team to book an entry directly in the register. The appropriate financial account is selected by the user. Direct entries are useful when Finance is paying for goods or services not purchased by Logistics. The double booking entries are automatically created in the liquidity journals as soon as the entry is temp or hard posted.

How to Book Direct Entries in a Register

Same procedure applies to booking entries in cash, bank or cheque registers.

Go to: Accounting/Registers

- Select the register where you want to record your expense. We will use a cash register for this example but the cheque and bank register will be laid out the same way.

- Click on the edit pencil

to open the register form.

to open the register form. - In the cash transactions box click on {New} to create a new statement line.

Cash Register Statement Line Creation

Cash Register Statement Line Creation

4. The fields in blue are mandatory, in white optional and in grey view only. Complete them as follow:

| Title of field | Entry protocol: register entry |

|---|---|

| DOCUMENT DATE | Blue field. Click on the calendar icon to select a date or manual entry as dd/mm/yyyy. The {Document Date} can be before or within the period. Remember that UniField picks the {posting date} rather than {the document date} to define the conversion rate to functional currency. |

| POSTING DATE | Blue field. Click on the calendar icon to select a date or manual entry as dd/mm/yyyy. Defaults to today’s date. The {Posting Date} must be within the Period and > or = to the {Document Date} |

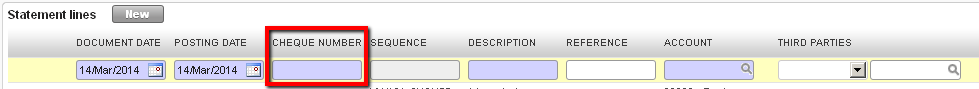

| CHEQUE NUMBER | Only for cheque registers: Blue field. A unique cheque number is mandatory |

| SEQUENCE | Grey field. Automatic input. Register code and incremental number. There is no sequence number for draft entries. |

| DESCRIPTION | Blue field. Similar to the description of your current system (max 64 characters length) |

| REFERENCE | White field. If the field {Reference} of an invoice is filled, it is automatically reported in the {Reference} field of a register line when importing an invoice. |

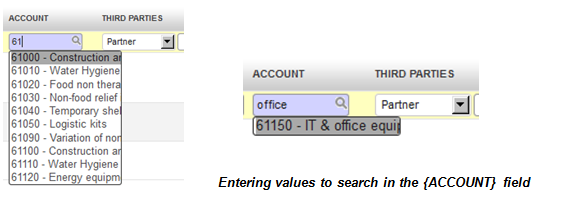

| ACCOUNT | Blue field. You can enter the account code if you know it or type the code name and a list of codes will appear. See figure below. |

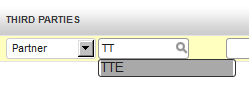

| THIRD PARTIES | White field. Drop down values Partner, Journal, and Employee. Once selected, you search for the supplier/journal/employee name in the next field. Remember if you need to create an entry on an inactive employee, you will need to uncheck the {Active} filter in the {Search Employee} view. |

| AMOUNT IN | White field. Amount of cash received in booking currency |

| AMOUNT OUT | White field. Amount of cash paid out in booking currency |

| AMOUNT RECONCILED | Automatic input. The check indicates that the record has been reconciled e.g. for internal transfers and operating advances |

| OPE ADV-LINK TO PO | Link an operating advance register line to a PO not of type Purchase List (i.e. regular or DPO). |

| STATUS | Grey field. Automatic input. Can be Draft, Temp or Hard |

Remember to check the date and period! For instance if you create and open a register in March and then enter transactions of February, remember to change the posting date which defaults to today’s date.

If you make a payment through the cheque register, the cheque number will need to be entered. It is a mandatory field.

Cheque number input, mandatory field

Cheque number input, mandatory field

When selecting {Account}, just by entering a few digits of the code or a key word in the account description, UniField will display the options that match your search as shown below. If you move your mouse over a selection, the entire description displays.

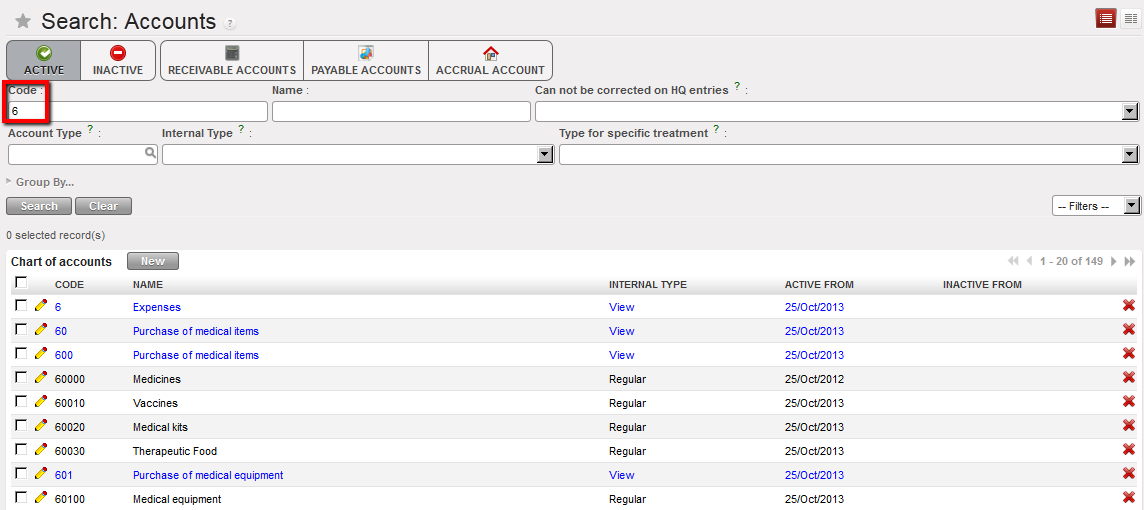

Or you can click on the magnifying glass ![]() to open up the {Search Chart of Accounts} wizard. The accounts will appear in numerical order. To select only expense accounts type 6 into the filter as showed below.

to open up the {Search Chart of Accounts} wizard. The accounts will appear in numerical order. To select only expense accounts type 6 into the filter as showed below. {Search Chart of Accounts} wizard

{Search Chart of Accounts} wizard

When selecting {Third Party}, you can enter part of the name. UniField will display the search that matches as shown below. If you move your mouse over a selection, the entire description displays. The third party field is optional for some entries and required for others.

Entering values to search in the {THIRD PARTY} name field

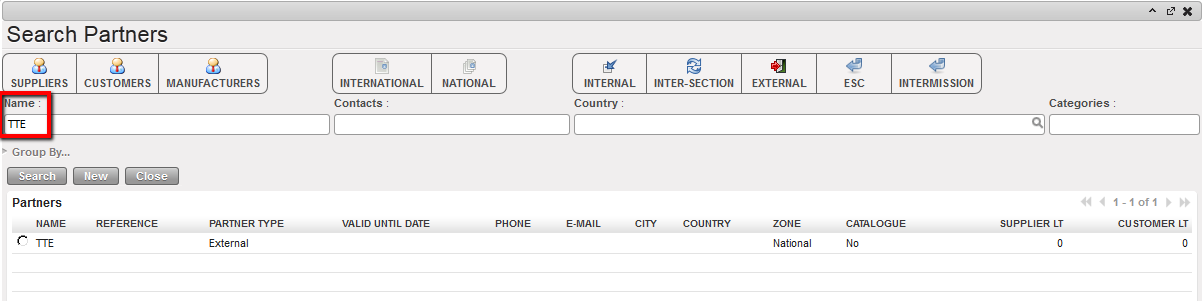

{Search Partners} wizard

{Search Partners} wizard

5. Save by clicking on the floppy disc ![]() or pressing the enter button.

or pressing the enter button.

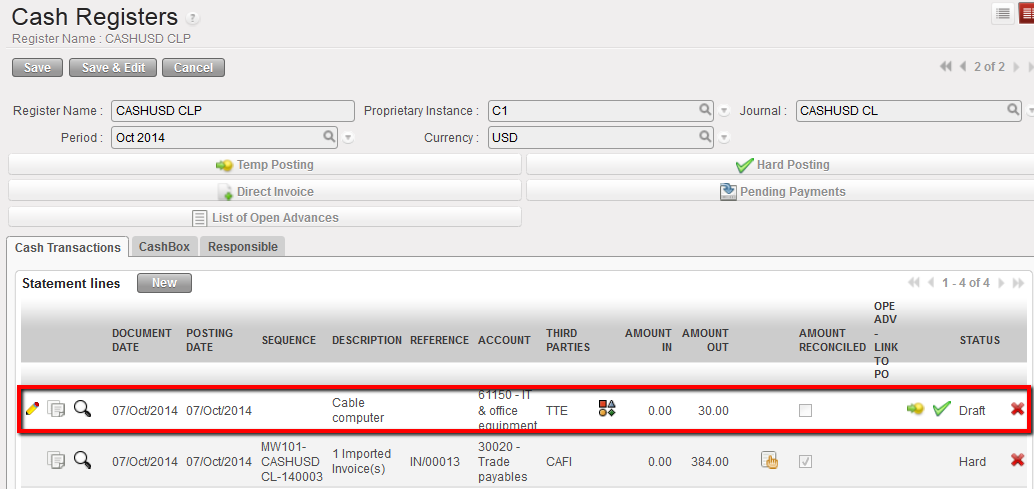

The entry appears in {Draft} status. If you selected an expense account, the ![]() button will appear and the entry will be in red. A red entry is an indication that the analytic distribution has not been assigned or has not been assigned properly.

button will appear and the entry will be in red. A red entry is an indication that the analytic distribution has not been assigned or has not been assigned properly.

6. Click on the ![]() button to open the {Analytic distribution} wizard.

button to open the {Analytic distribution} wizard.

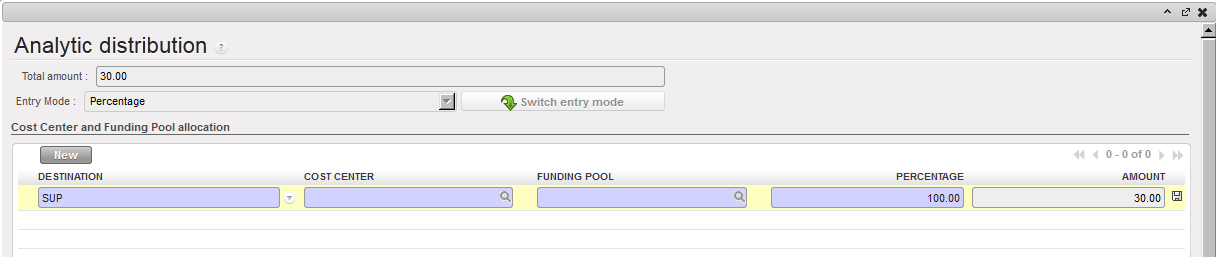

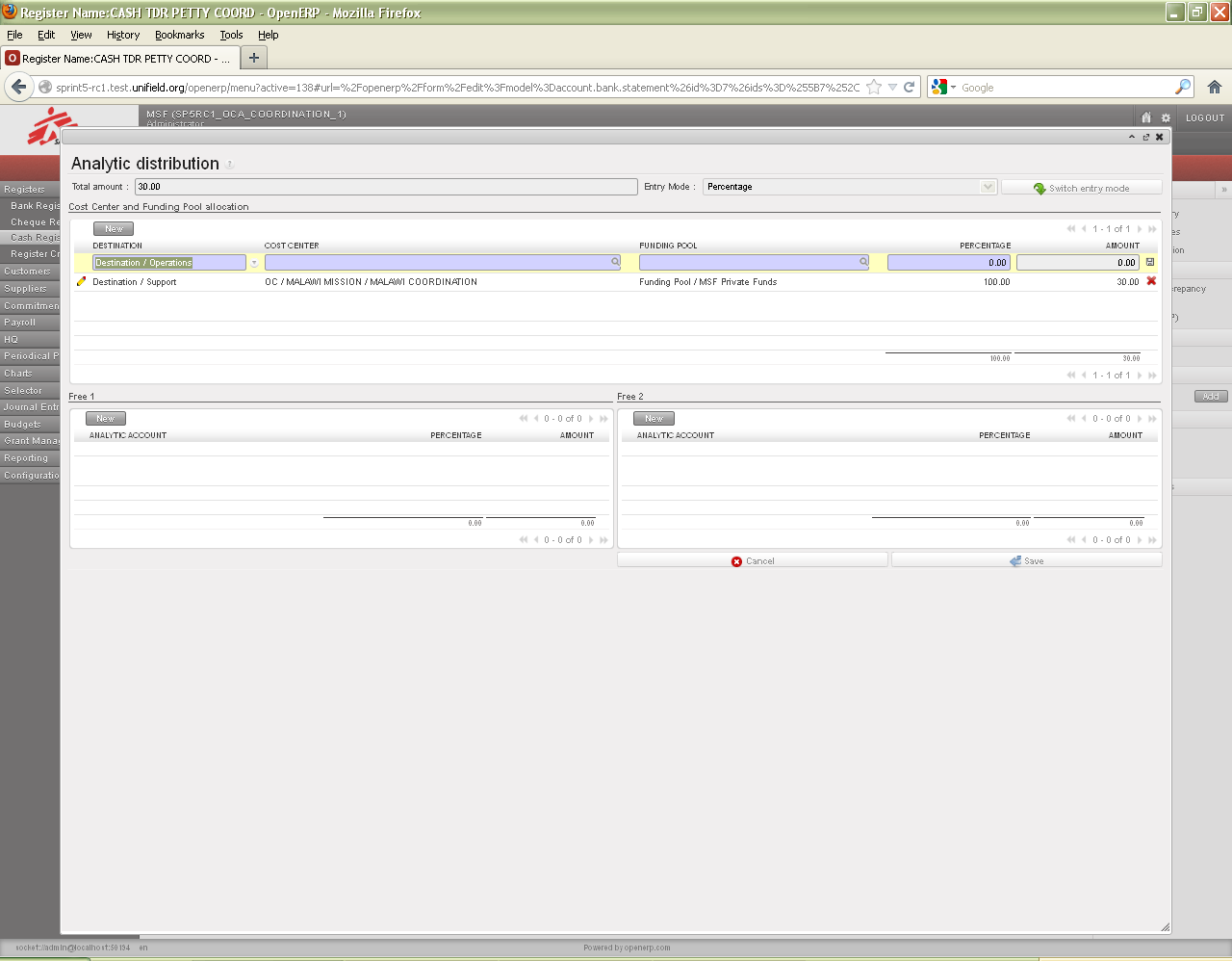

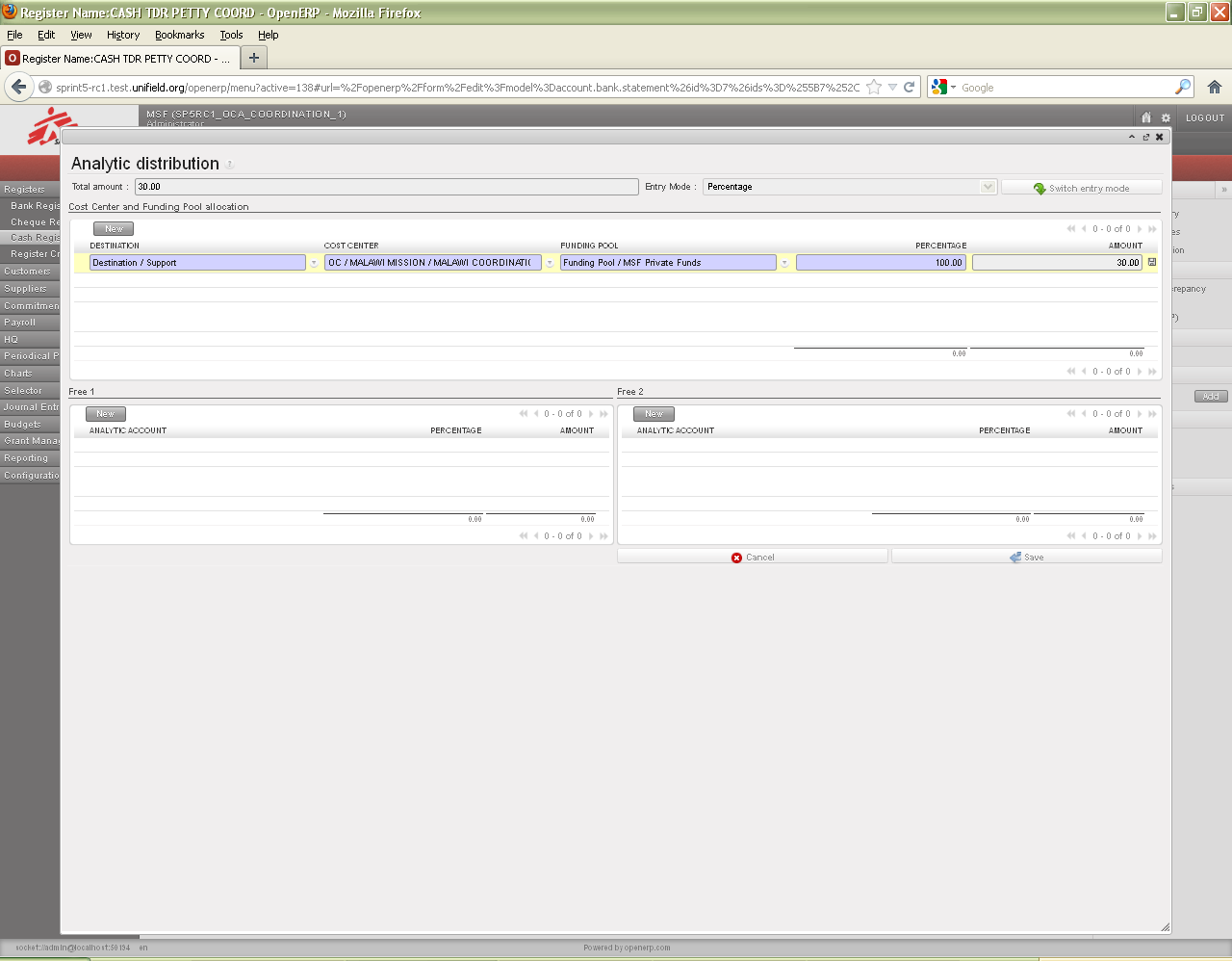

7. In the wizard, select {New} to create a new allocation. The destination is set by default.

{Analytic distribution} wizard

{Analytic distribution} wizard

8. Select a {Destination}, {Cost Center} and {Funding Pool}. If you know the code, enter it. Otherwise, click on the magnifying glass ![]() to retrieve it.

to retrieve it.

9. Click on the floppy disk ![]() to save the allocation line.

to save the allocation line.

10. Click at the bottom right of the window to save the analytic distribution and close the window.

The allocation is done; the entry appears now in black. The register line is {Draft}.

| Title of field | Entry protocol: analytic distribution wizard |

|---|---|

| Total amount | The total amount of the expense to be allocated |

| Entry Mode | If the expense needs to be distributed across multiple destinations, cost centers or funding pools, the user can split by Percentage or Amount |

|

Clicking switches between entry mode Percentage or Amount |

| DESTINATION | The destination will be a default option based on the account code in the register entry but it can be changed.

|

| COST CENTER | Cost center tree |

| FUNDING POOL | Donor tree. If there are no donors in the project, expenses are allocated to “PF” (MSF Private Funds) |

| PERCENTAGE/ AMOUNT | If the expense is distributed across multiple destinations, cost centers or funding pools, this indicates the allocation amounts |

| FREE1 | Potential additional analytic dimension |

| FREE2 | Potential additional analytic dimension |

Direct entry created in Draft in a cash register. No acccounting moves.

Direct entry created in Draft in a cash register. No acccounting moves.

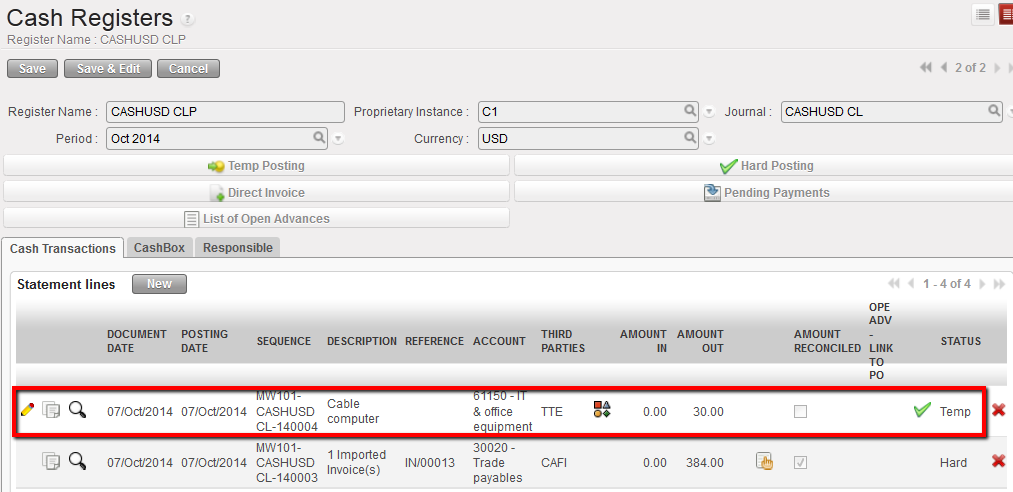

To go further, temp-posting a direct entry would create in the liquidity journal the below entries:

Expense to Cash

Temp Direct entry in the cash register

Temp Direct entry in the cash register

Expense to cash in the Liquidity journal

Expense to cash in the Liquidity journal

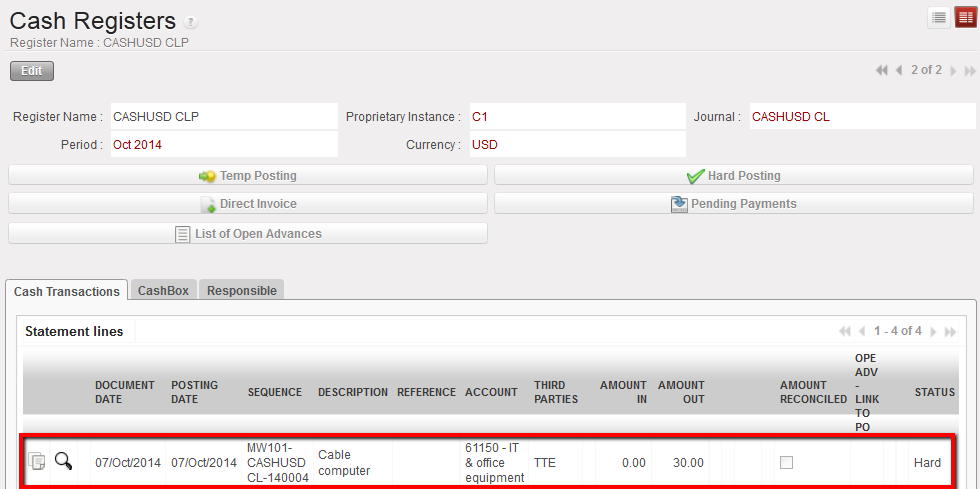

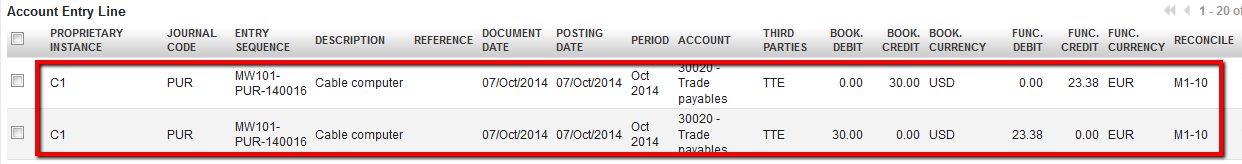

Hard-posting a direct entry would create in the purchase journal the below entries:

Payable to Payable

Hard direct entry in the cash register

Hard direct entry in the cash register

Corresponding journal entries booked in the purchase journal

Corresponding journal entries booked in the purchase journal

Internal transfer within the same instance

Overview:

A- Internal Transfer Definition

B- Old Behaviour For Internal Transfer Between Unifield Instances

C- New Behaviour For Internal Transfer Within One Unifield Instance

1- Automatic Counterpart Booking

2- Automatic Reconciliation

3- When Automatic Reconciliation Does Not Work

D- Consequences Of The Changes

4- Before Booking An Internal Transfer

5- Modification After Temp Posting Initial Entry

6- Manual Reconciliation

7- How To Book An Entry Without Counterpart

Internal transfer is the process of transferring liquidity (money) from one liquidity journal/register to another, within a Country Program. There are two types of internal transfers:

A- Internal Transfer Definition

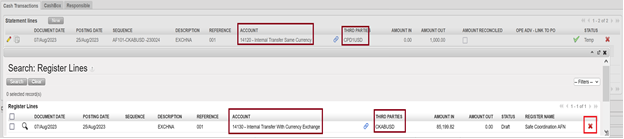

- Account code 21600 – Internal Transfer Same Currency. Sending and receiving journal/register currency is the same.

- Account code 21610 – Internal Transfer Currency Exchange. Sending and receiving journal/register currencies are different.

Transfers could occur within one UniField instance (e.g. safe to cash box), or between two UniField instances (e.g. coordination bank to project bank).

Exclusion: Cash/bank transfers from/to HQ or from/to intermission/intersection are not considered as internal transfer. They have not been changed.

B- Old behaviour for internal transfer between UniField instances

Internal Transfers (same currency or with currency exchange) are register entries booked manually. One transfer consists of two entries: one in the origin (sending) register and another in the destination (receiving) register. Reference to user manual: LUFI-30401 Internal Transfers

- Entries: two entries are booked manually.

- Description and reference should be the same. It is manually filled and maintained outside of UF

- Third Party: At the sending side the “Third Party” is the journal receiving cash. At the recipient side the “Third Party” is the journal sending cash.

- Amount: On the sending side, the amount is OUT. In the receiving side, the amount in IN.

- Reconciliation is manual.

Above described behaviour is still applicable for internal transfers between two UniField instances: e.g. Coordination sending cash to project, or between two project instances.

Regarding internal transfers within one instance (proprietary instance of the journals/registers involved is the same), see below.

C- New behaviour for internal transfers within one UniField instance

This change meant to ease the booking of internal transfers, one of most frequent register entries, via automatic booking of second transfer entry and auto reconcile. There are still two register entries per transfer.

1- Automatic counterpart booking

When internal transfers occur within one instance (proprietary instance of the journals/registers involved is the same), e.g. Bank withdrawal to safe or transfer from Safe to Petty Cash, the following change is applicable.

Note that transfer between a project office and a sub-location of the project office which is using the same UniField instance is also considered as “within one UniField instance”.

After UF30 release, when an internal transfer entry is “temp” or directly “hard” posted in the register, UniField creates automatically the counterpart booking in the Third-Party register.

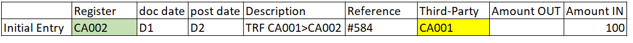

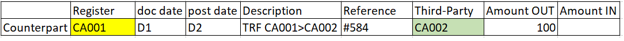

E.g. The cashier books the transfer IN #584 received from the Safe CA001 in the CA002 – Petty cash register.

When this entry is temp posted (or directly hard posted), UF creates automatically in CA001 the following counterpart entry in draft:

UF takes from initial booking all information to populate the fields of the counterpart booking:

- Document and posting dates from initial entry.

- Description and reference from the initial entry.

- Third- party is the sending register of the initial entry.

- Amount is in opposite field. If the initial entry is OUT, the counterpart is IN. It is possible that the transfer IN is booked as initial entry and temp posted. UniField will create the counterpart OUT.

- The entry is in draft status. It could be edited (all fields), it could be deleted.

2- Automatic reconciliation

Internal transfer entries having a counterpart are marked with a link next to third-party field. Click on the link

to see the counterpart booking. This link

is visible on register screen and journal item screen and also synched to Coordination.

When both entries are hard posted, UF reconcile automatically them (at the time of hard-posting the last one). This reconciliation could be undone. It is not possible to manually reconcile (at project or Coor) a transfer entry with a link (= having a counterpart booking).

In case one of the two entries is deleted, the link is broken and the remaining entry could be manually reconciled.

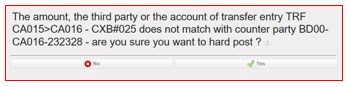

3- When automatic reconciliation does not work

When the booking amounts do not match in internal transfer same currency, the hard-posting process of the second entry will display error message mentioning the “description- Reference” of the entry. UniField proposes two options

- “NO”= The entry will not be not hard-posted. The user could then edit the amount and later hard post. This check is a final review of amount before posting. Use this when the change of amount from initial entry (e.g. due to typo) was not reflected in counterpart.

- “YES”= The entry will be hard posted. There is no auto reconciliation (no partial). The link is broken. Both entries could be manually reconciled with other entries without counterpart. Use this if a transfer OUT is received in 2 or more smaller IN (e.g. The local transfer provider did not have enough cash).

This check applies only on internal transfer same currency. For currency exchange, the reconciliation always goes.

D- Consequences of the changes

4- Before booking an internal transfer

Always refresh the register before booking new internal transfer manually. Good coordination within the team helps also to know who is usually/always booking the initial entry. The following scenarios are for inspiration. Each Country Program /Office could define what is more suitable. E.g.:

- Cashier/FinAssist is in charge of booking the transfer received in Petty Cash from Safe. FinCo/Admin will have draft counterparts ready to post.

- Cheque entries are booked first, as the cheque needs to be issued for cash withdrawal using cheque. Counterpart in safe will be in draft.

5- Modification after temp posting initial entry

Both initial and counterpart entries could be edited and deleted. UniField does not send update to the other entry. Any modification applied both sides after temp posting the initial entry should be communicated to the other register owner and applied on the other entry.

Major modifications: If the modification is on Third-Party or account code, it is better to delete both initial and counterpart and start from new. To do so, click on the link to access the counterpart entry and delete it with the red x

before deleting the initial entry. Then book the correct entry.

Modification on Third-Party or account code meant that the counterpart register is not correct. As consequence, the counterpart entry created could not be used as it is not possible to move it to other register.

Tips: Review those fields before “temp” posting an initial transfer entry – especially the third party (frequent mistake).

Minor Modifications: If the modifications are on dates, description, reference, amount, both entries could just be edited. Those modifications need to be communicated to the owner of the counterpart register and applied on the counterpart entry. It is possible to click on the link and access the counterpart entry in order to check if the modifications have been applied.

If one of the entries is deleted, the link is broken, and the remaining entry could be reconciled with other entries without counterpart.

6- Manual reconciliation

After hard posting of all register entries, all transfers with counterpart will be automatically reconciled. The list of transfers non-reconciled should be reviewed among other manually reconcilable entries as per procedures. Those transfers are:

- To/from other instances

- Within the same instance but the counterpart has been deleted.

7- How to book an entry without counterpart

If a correction transfer without counterpart is needed (e.g. To replace a counterpart which has been deleted), book a transfer entry in the appropriate register. Then using the link , delete the counterpart immediately after temp post. The link

is broken. The entry is reconcilable with other entries without counterpart.

Some examples:

Internal transfer the same currency

When booking transaction as internal transfer with the same currency the counterpart transaction will create automatically based on 3rd party “Journal” that used in the transaction based on below specifications:

Booked transaction must be temp posted to create counterpart transaction.

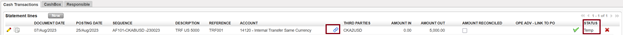

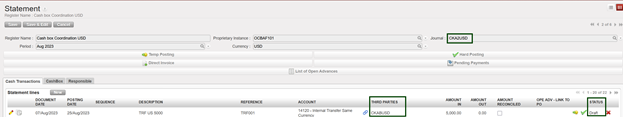

Once the internal transfer temp posted it will create link named as “Linked to a counterpart line” between columns “Account” and “THIRD PARTIES” as below:

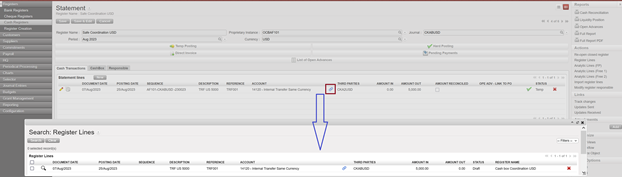

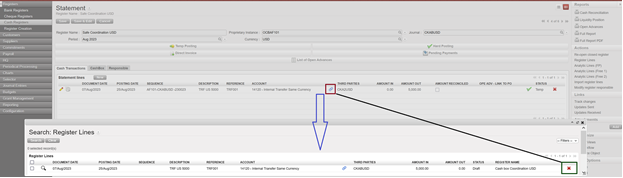

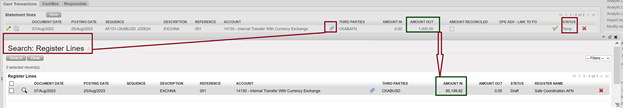

- By click on the link it will open popup “Search: Register Lines” show the draft counterpart entry with popup:

- In our example the counterpart with CKA2USD, so check in CKA2USD, the draft entry is available as draft:

We need to consider the following:

- If original entry created with wrong “Document date” the correction should be done manually at both sides.

- In case 3rd party of journal that used is wrong so is possible to click on the link of the original entry and delete through X, click on Save, when checking the counterpart entry is deleted.

Internal Transfer with Currency Exchange

- When booking transaction as internal transfer with currency exchange the counterpart transaction will create automatically based on 3rd party “Journal” that used in the transaction based on below specifications:

- Booked transaction must be temp posted to create counterpart transaction.

- Once the internal transfer temp posted it will create link named as “Linked to a counterpart line” between columns “Account” and “THIRD PARTIES”

- By click on the link it will open popup “Search: Register Lines” show the draft counterpart entry with popup showing amount booked in the equivalent amount:

The same like transfer with the same currency consider the following:

- If original entry created with wrong “Document date” the correction should be done manually at both sides.

- In case 3rd party of journal that used is wrong so is possible to click on the link of the original entry and delete through X, click on Save, when checking the counterpart entry is deleted.

For both “Internal transfer with the same currency” and “Internal transfer with exchange” if the account changed is going automatically to change 3rd party of journal, so for the counterpart entry it should be deleted through X: