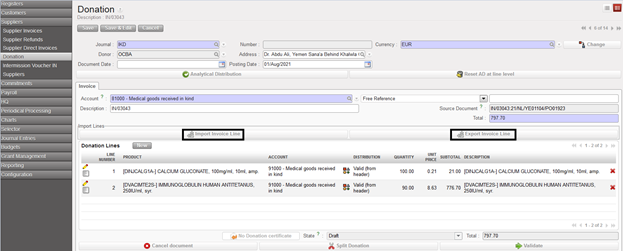

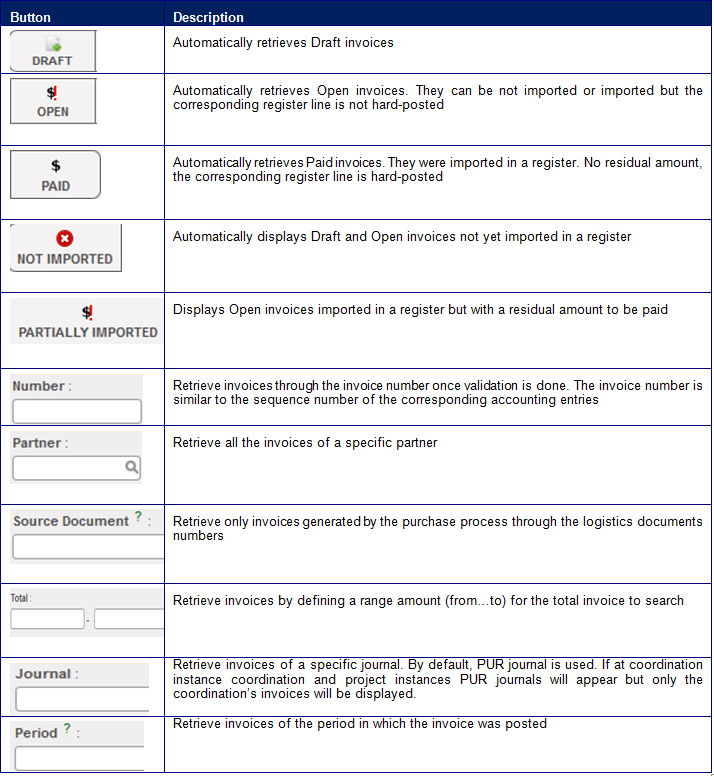

Finance User Manual ENG -> 3. Payments -> 3.2 Purchase to Payment Process: Supply&Finance Links -> LUFI-30207 Supplier Invoice Payment: Step Five in the Purchase Process

LUFI-30207 Supplier Invoice Payment: Step Five in the Purchase Process

LU Introduction

A supplier invoice can be paid from the cash, bank or cheque registers via the {Pending Payments} function. In order to make the payment, the supplier invoice must be imported into the appropriate register. Importing the payment into the register automatically creates a temp posted register entry. In the liquidity journal, the payable account is debited to cancel the debt and the liquidity account (cash, cheque or bank depending on type of payment) is credited to recognize the money out.

Note that a supplier invoice can be paid before the invoice posting date provided the payment is done in the same (monthly) period or in a later period.

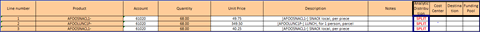

How to Import a Supplier Invoice into a Register

In the below example the payment is done in a cash register.

Go to: Accounting / Registers

- Open the relevant register to import the invoice

- Click on the Button {Pending Payments}

Pending Payments invoice on a register form

Pending Payments invoice on a register form

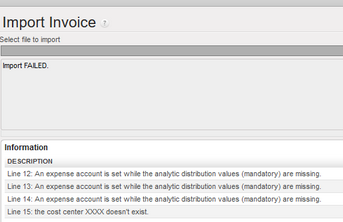

An {Import invoice} window display

3. Click on {Add} and select the relevant invoice.

Add button to select an invoice

Add button to select an invoice

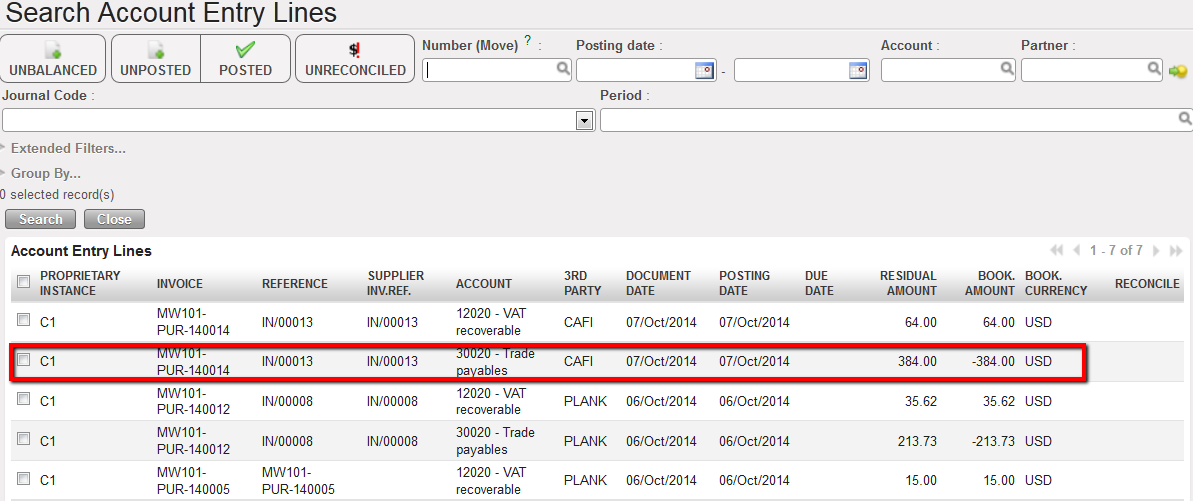

Search Account Entry Lines window opens to select the invoice to import in the register

Search Account Entry Lines window opens to select the invoice to import in the register

4. Remember the PO/Supplier invoice process we saw before. Here, we will import only the supplier invoice booked on the Trade Payables account. The VAT will be paid later on.

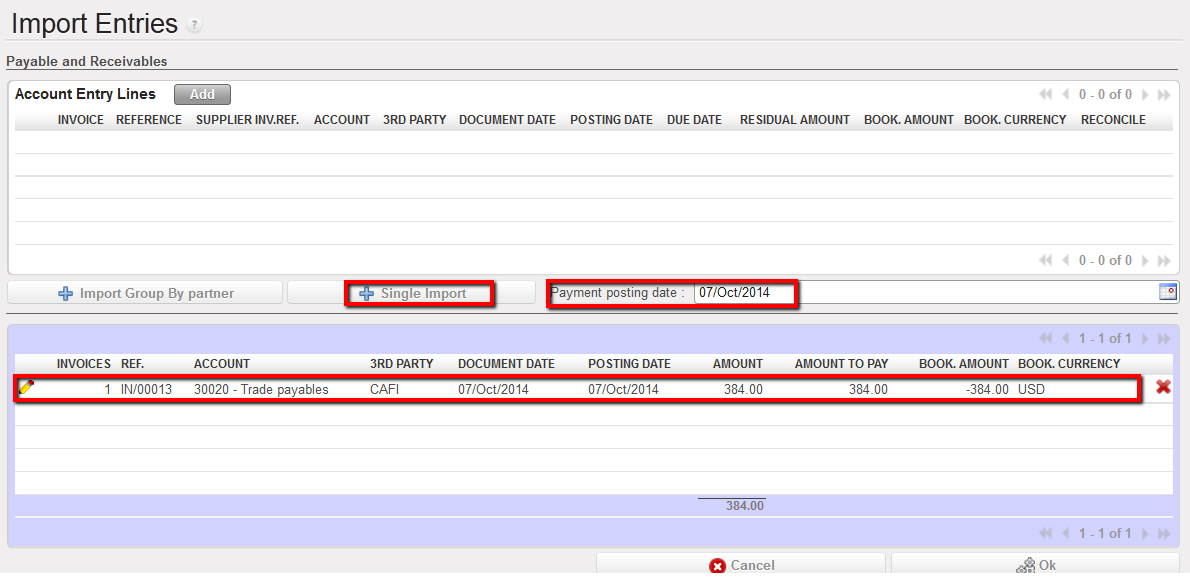

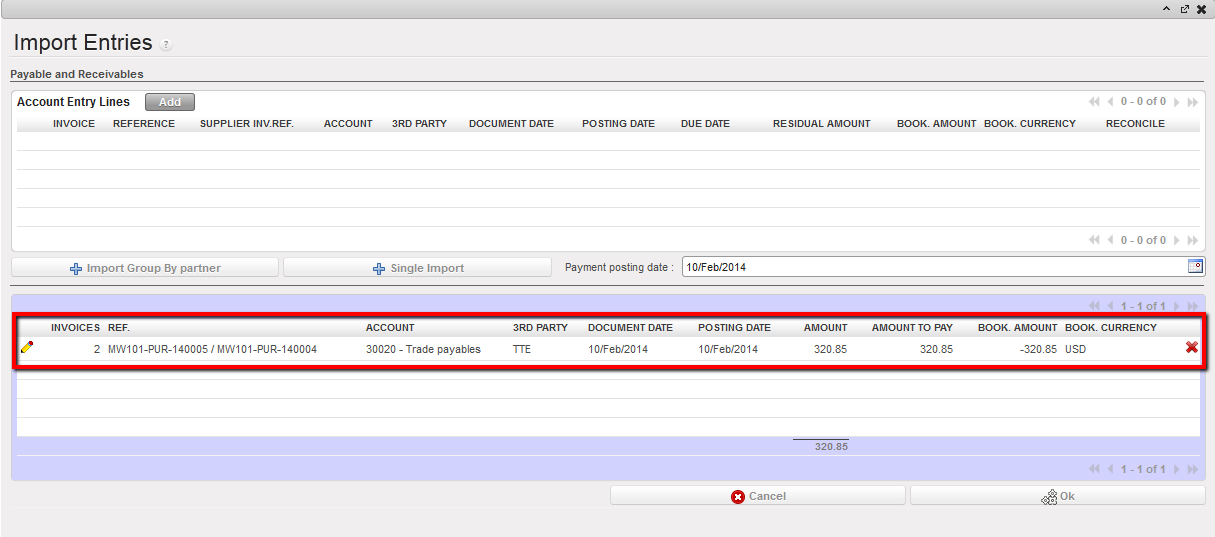

5. Add a Payment posting date and click on {Single import} because in this illustration we only have to import one invoice from one supplier.

Invoice imported in the Import Entries window

Invoice imported in the Import Entries window

6. The invoice moved down to the bottom half of the {Import Invoice} window. Changes can be made here as well. However, the document date must be changed on the top screen. If making a payment through the cheque register, the cheque number will need to be entered. Once verified, click {Ok}. The window closes.

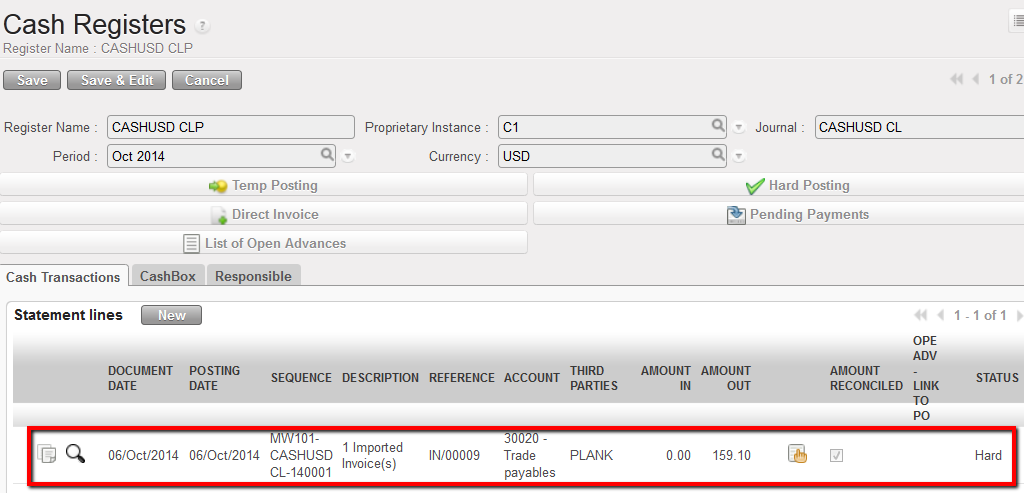

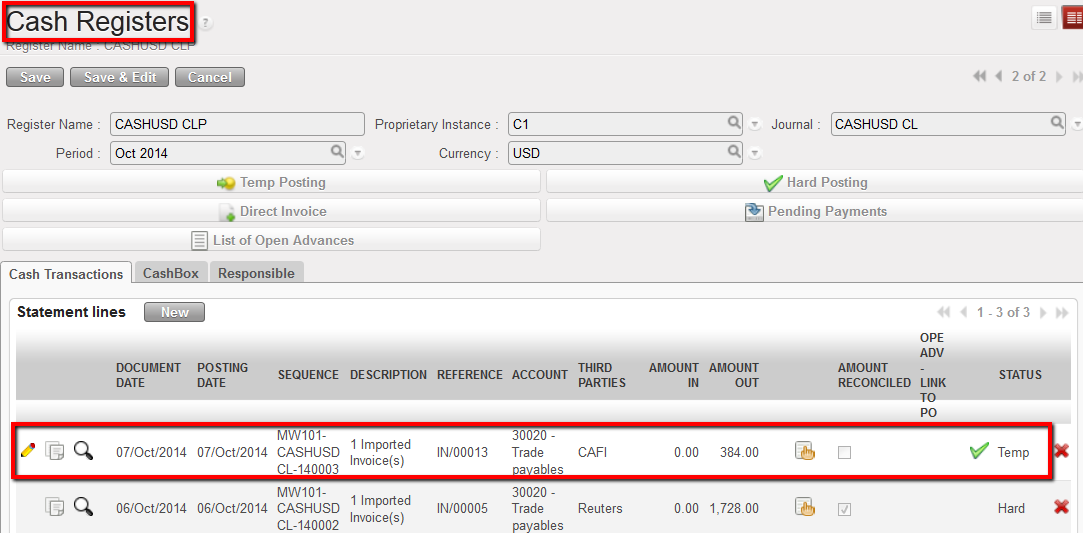

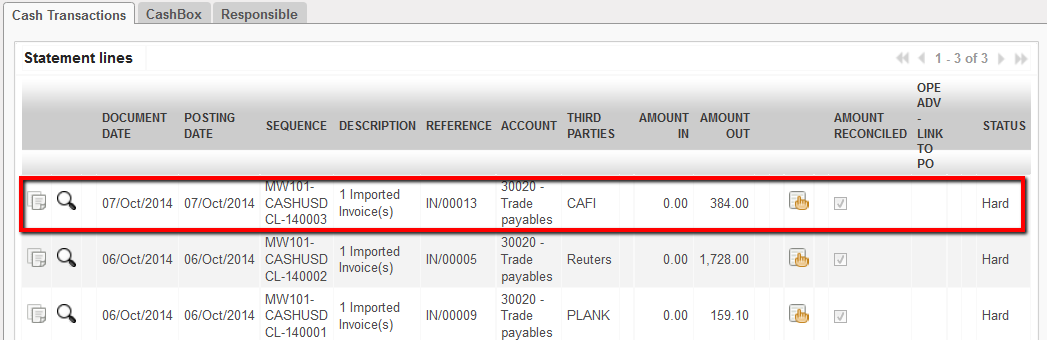

An entry is created in the register and booked to {30020 – Trade Payables} to pay the amount owed to the Supplier. The description defaults to {Imported Invoice}. The reference is automatically retrieved from the reference of the supplier invoice. There is no automatic reconciliation on the A/P account until the register line is hard posted.

Payment entry displayed in the register in Temp state

Payment entry displayed in the register in Temp state

7. The link will take you to the supplier invoice; if user clicks on this line, the Supplier Invoice list view will display.

Invoice Lines displays when the link is clicked in Register. Click on line to open Supplier Invoice.

Invoice Lines displays when the link is clicked in Register. Click on line to open Supplier Invoice.

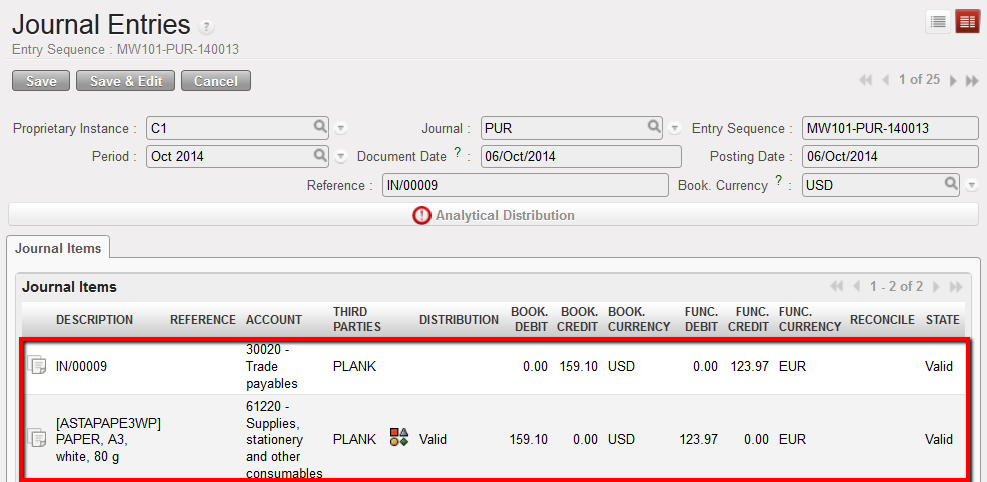

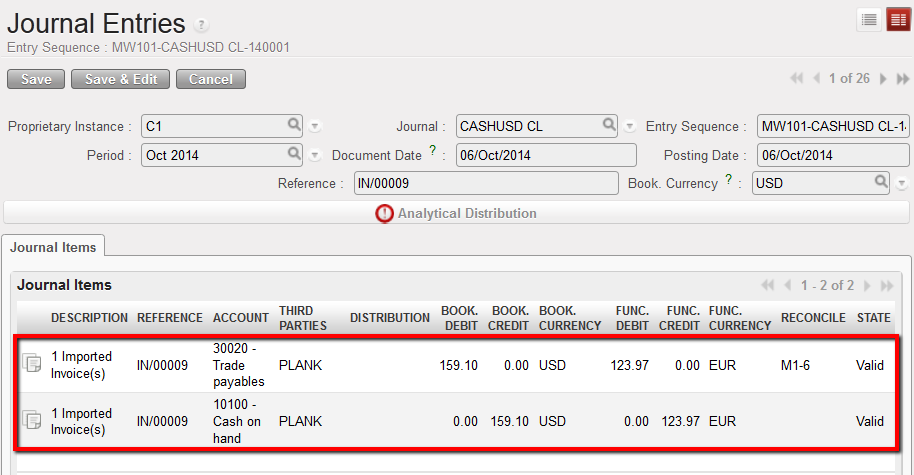

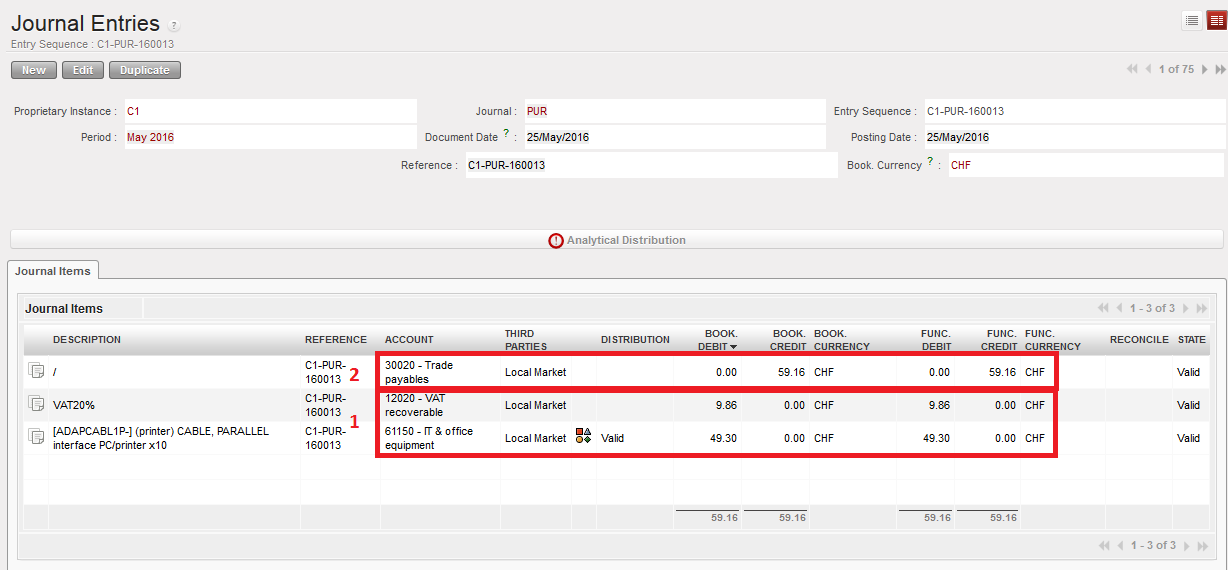

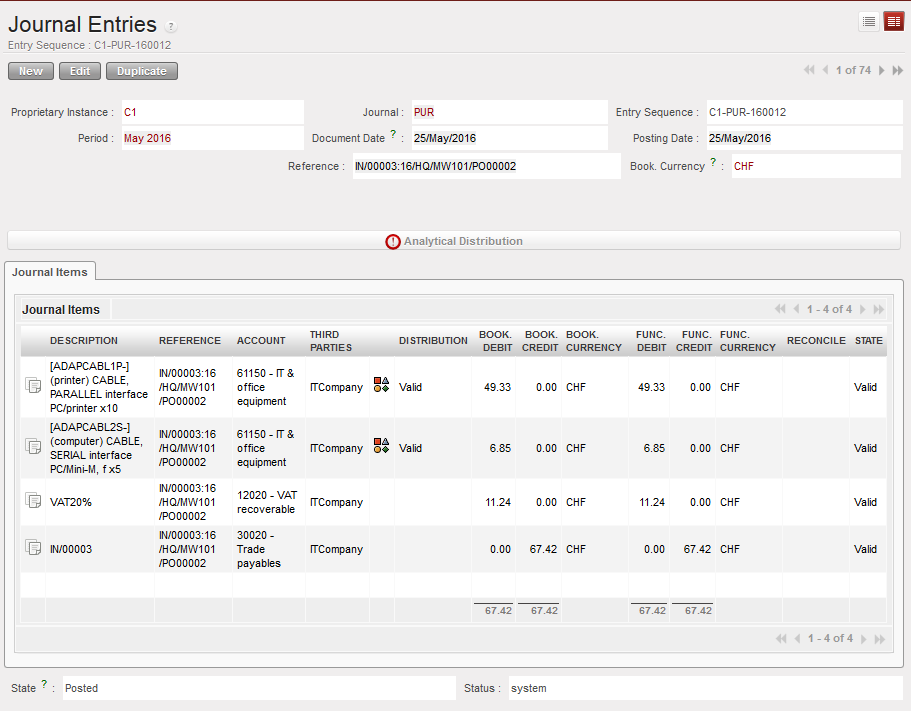

As soon as the supplier invoice is imported, the register line is Temp posted and the entries created in the liquidity journal items are:

- Credit to 10100 Cash on Hand (the invoice was imported into a cash register) to reduce the cash balance by the amount of the invoice.

- Debit to 30020 Trade Payables to reconcile the outstanding A/P entry created when the supplier invoice was validated

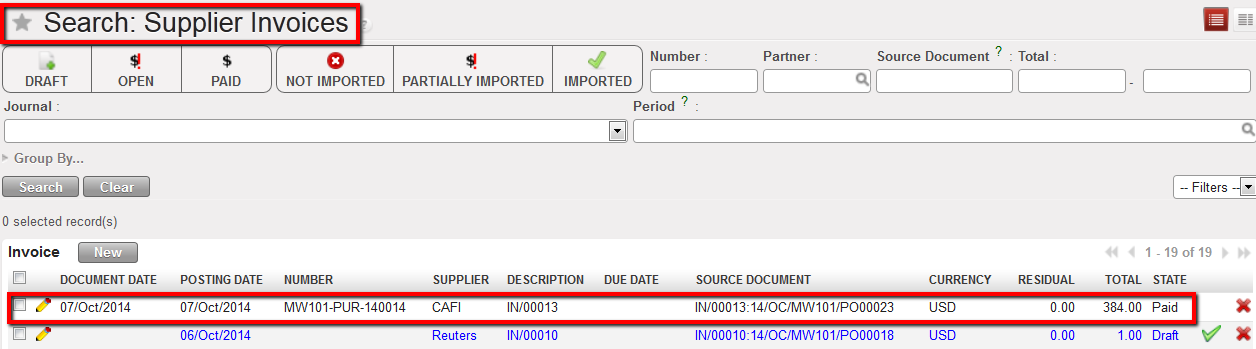

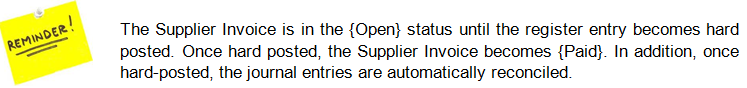

Once the register entry is hard posted, the payable entries are reconciled (M1-8). The supplier invoice status changes to {Paid}.

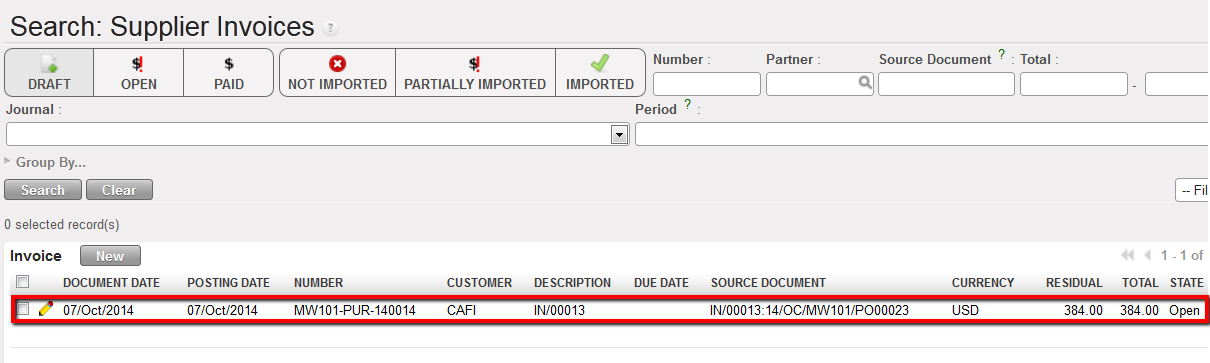

The entry corresponding to the imported invoice was hard posted.The entry state is Hard.

The entry corresponding to the imported invoice was hard posted.The entry state is Hard.

Created Journal Items of the paid supplier invoice when the register line became hard posted.

Created Journal Items of the paid supplier invoice when the register line became hard posted.

Supplier Invoice becomes paid when its corresponding register entry is hard-posted

Supplier Invoice becomes paid when its corresponding register entry is hard-posted

In case you want to import several invoices from the same supplier in one entry, you can use the {Import Group by partner} function.

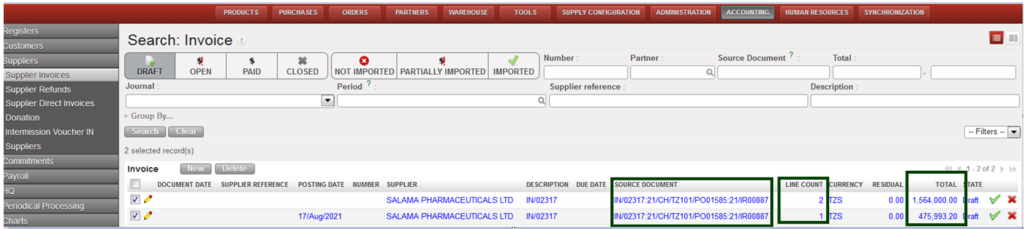

Selection of 2 invoices to pay to a same supplier before importing in a register

Invoices references are displayed in the Ref. field

Invoices references are displayed in the Ref. field

Register line reflecting the import of 2 supplier invoices.

Register line reflecting the import of 2 supplier invoices.

In case there are more than 3 invoices embedded in the payment, all references may not be fully displayed in the payment reference field as the system will cut off the text string to bypass display issues. But the payment will be processed for all selected invoices.

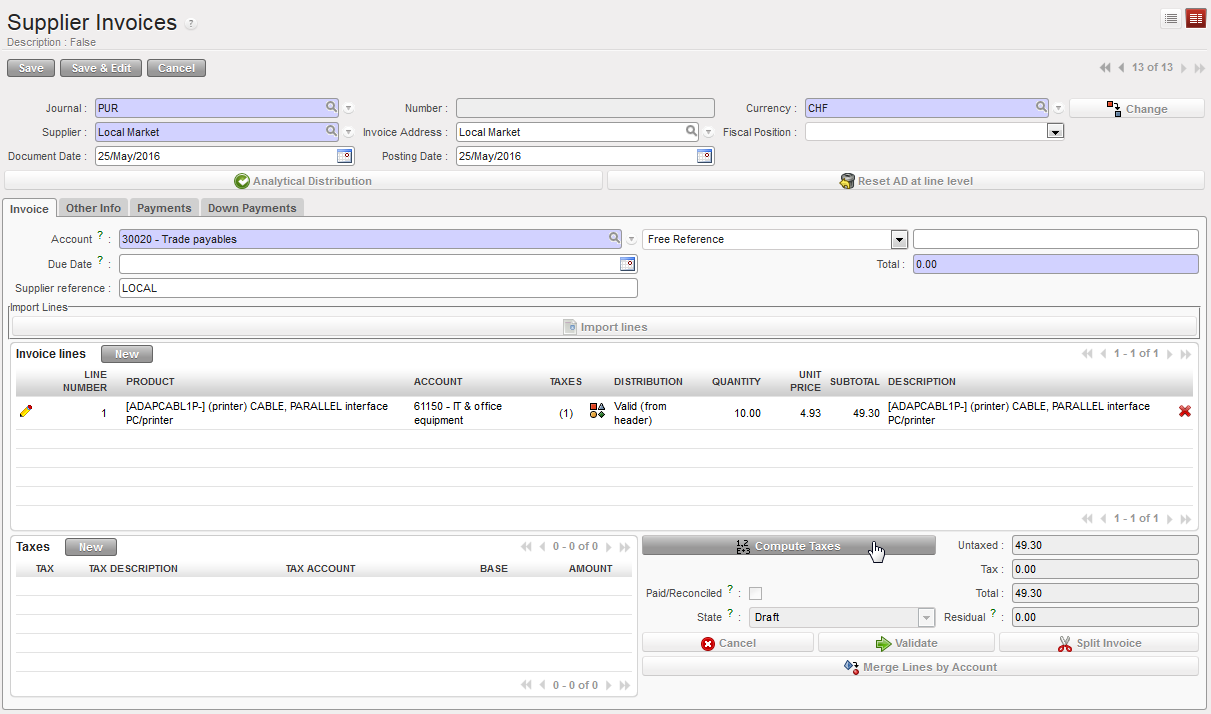

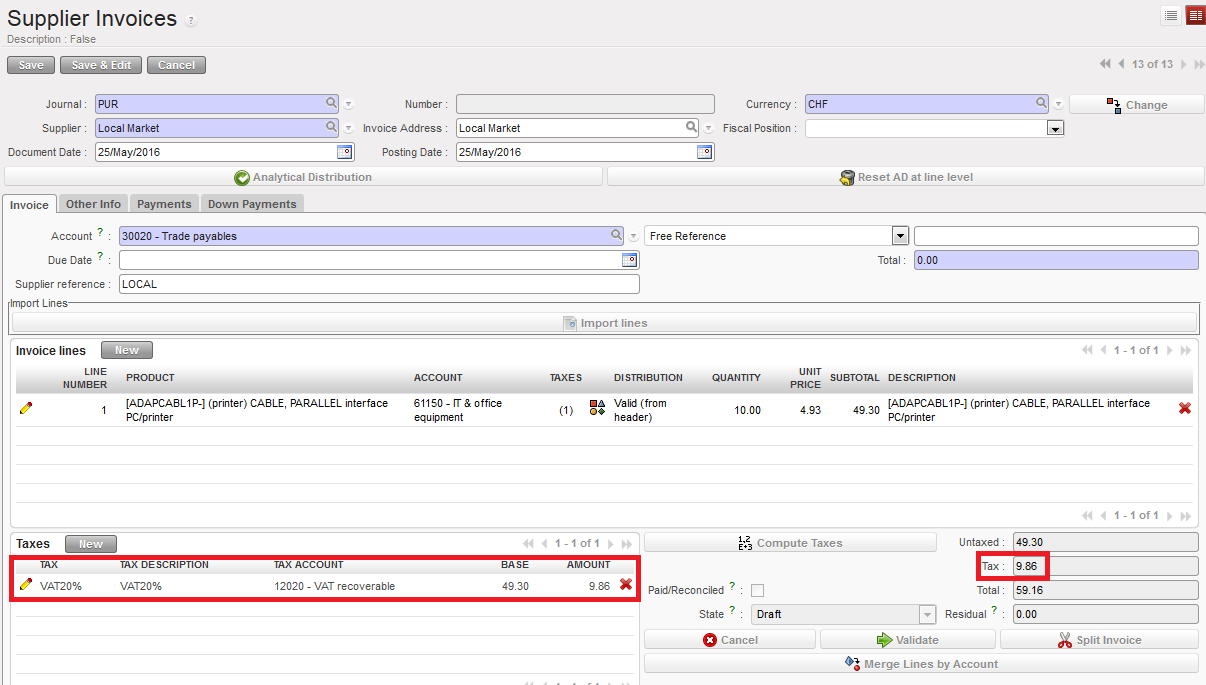

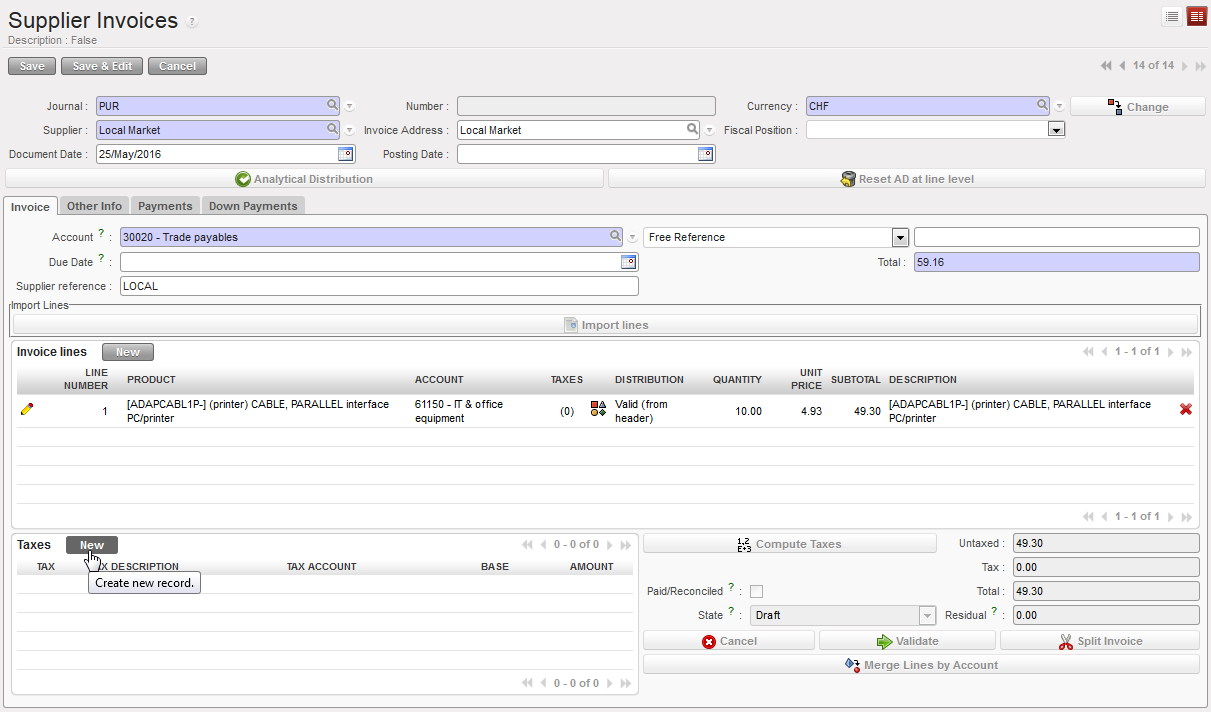

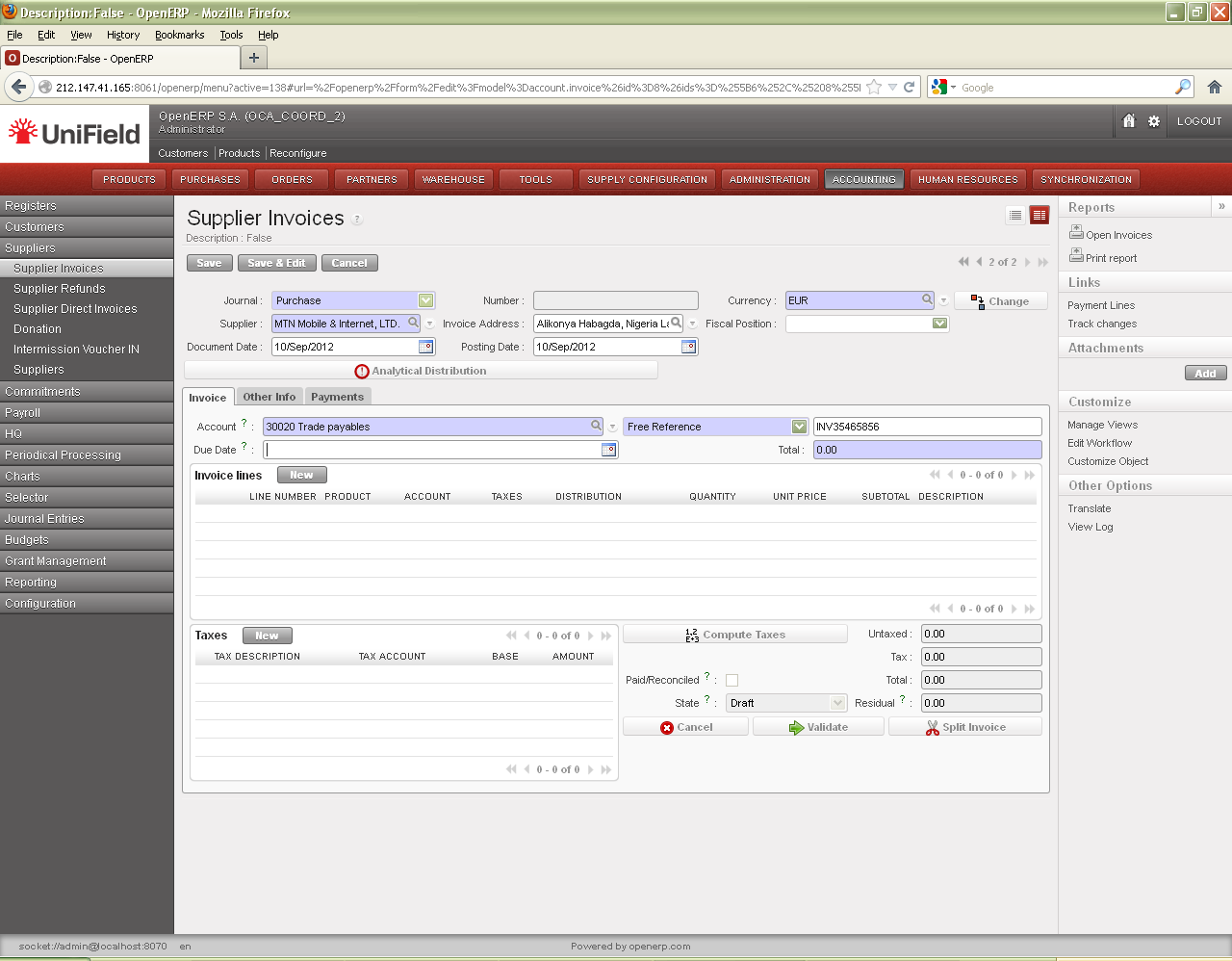

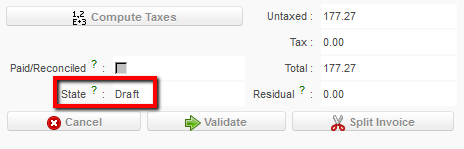

Compute Taxes button for automatic calculation of the VAT applied to this invoice

Compute Taxes button for automatic calculation of the VAT applied to this invoice The tax is calculated automatically. Amount excluding and including VAT are split.

The tax is calculated automatically. Amount excluding and including VAT are split.

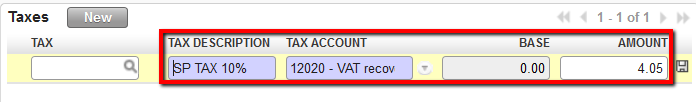

TAX code selection and automatic input of TAX DESCRIPTION, ACCOUNT and AMOUNT field

TAX code selection and automatic input of TAX DESCRIPTION, ACCOUNT and AMOUNT field Manual input and calculation of the VAT

Manual input and calculation of the VAT

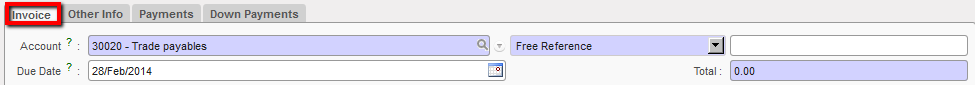

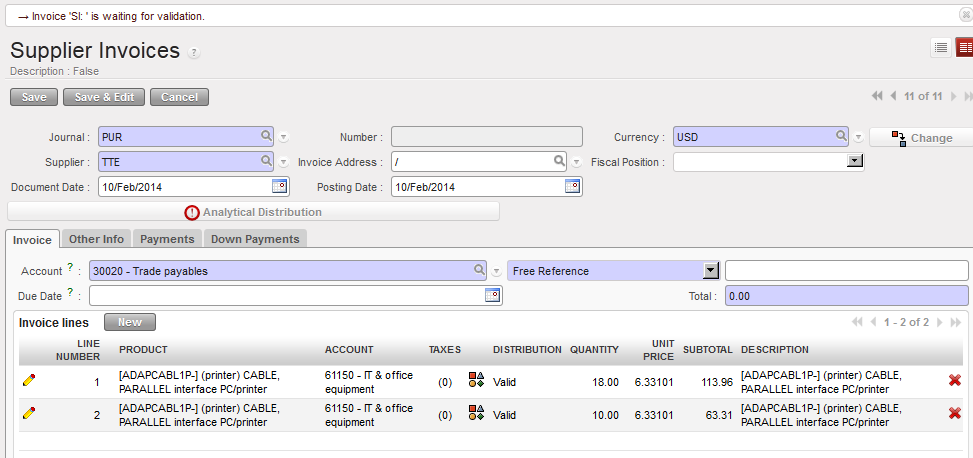

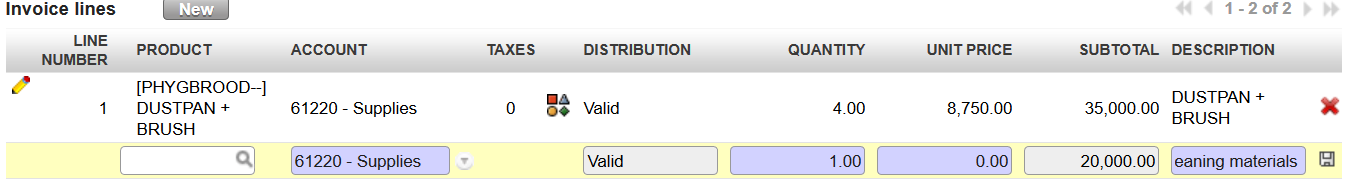

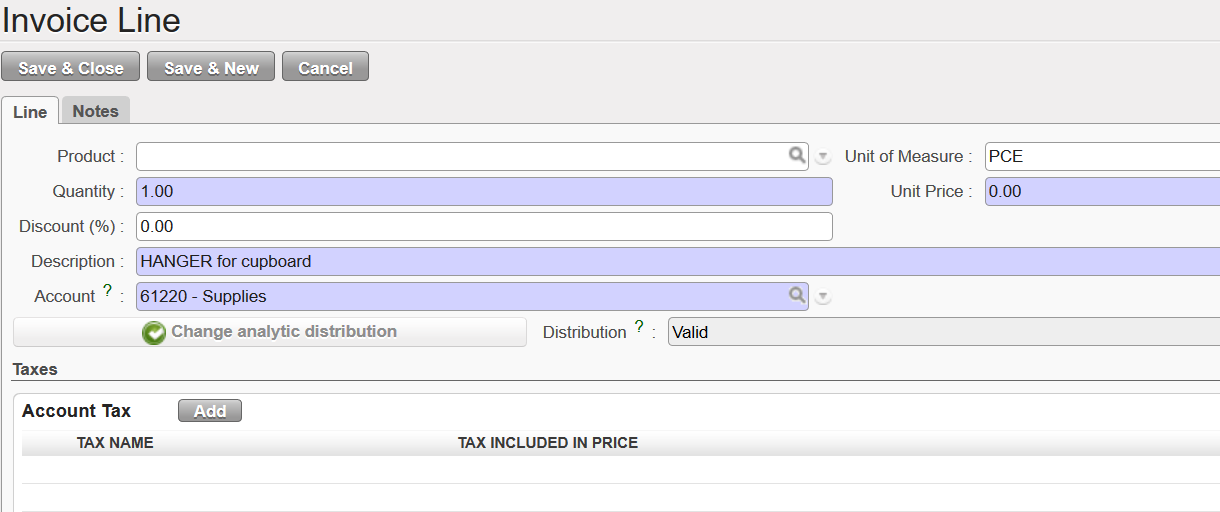

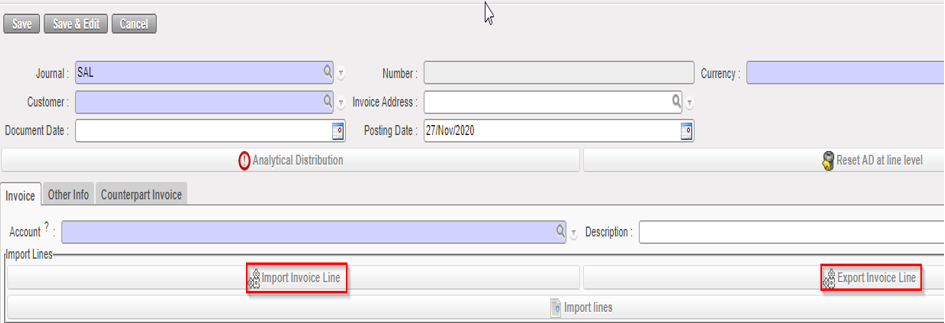

{New} button to input invoice lines

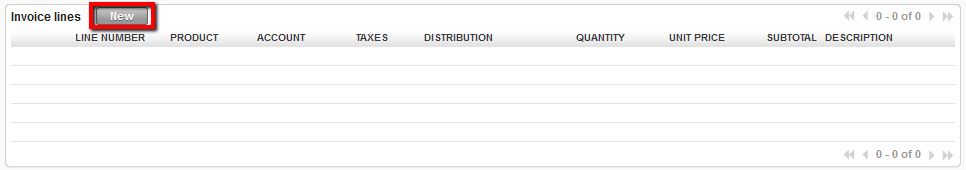

{New} button to input invoice lines {Invoice Line} window to add line items on a manually created Supplier Invoice

{Invoice Line} window to add line items on a manually created Supplier Invoice

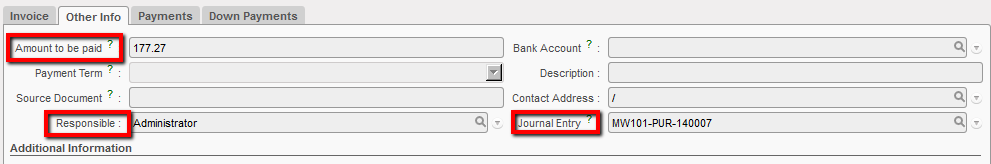

{Other Info} tab

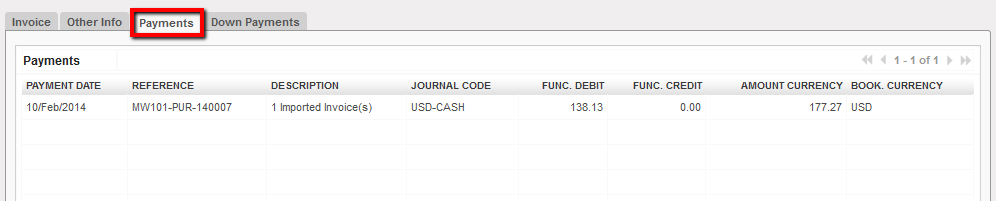

{Other Info} tab {Payments} tab of a Paid supplier invoice

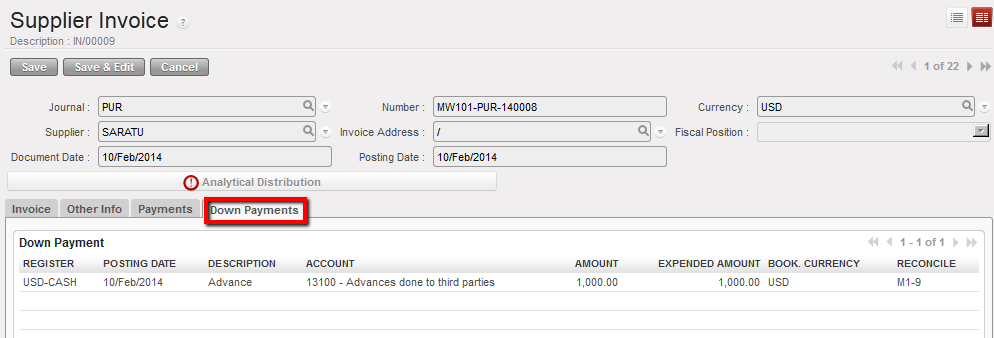

{Payments} tab of a Paid supplier invoice Down Payments tab of a supplier invoice

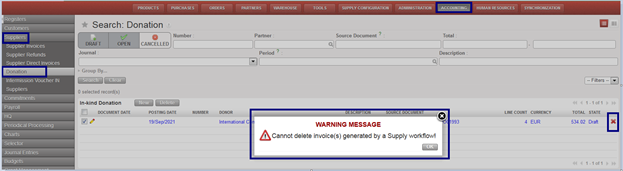

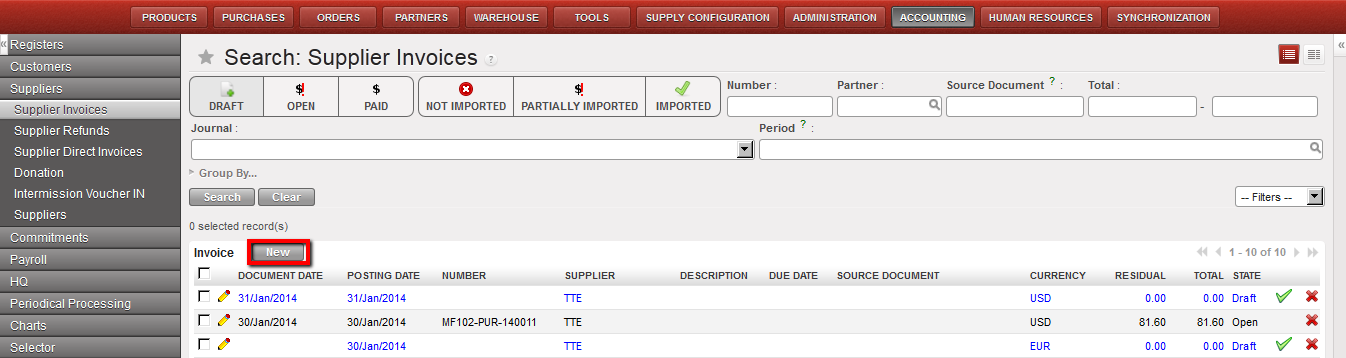

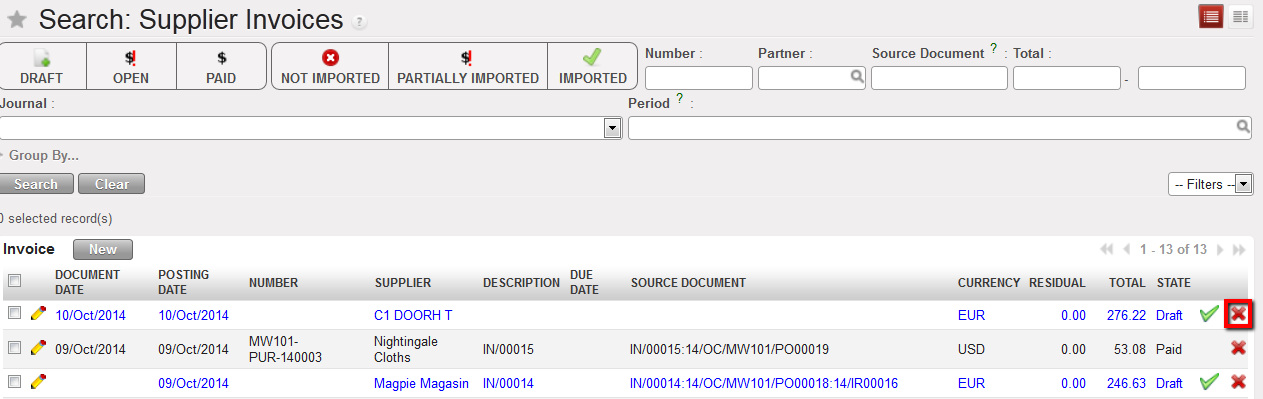

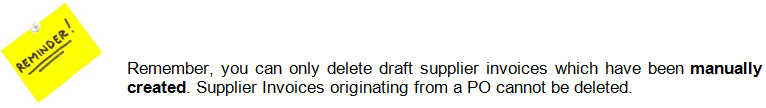

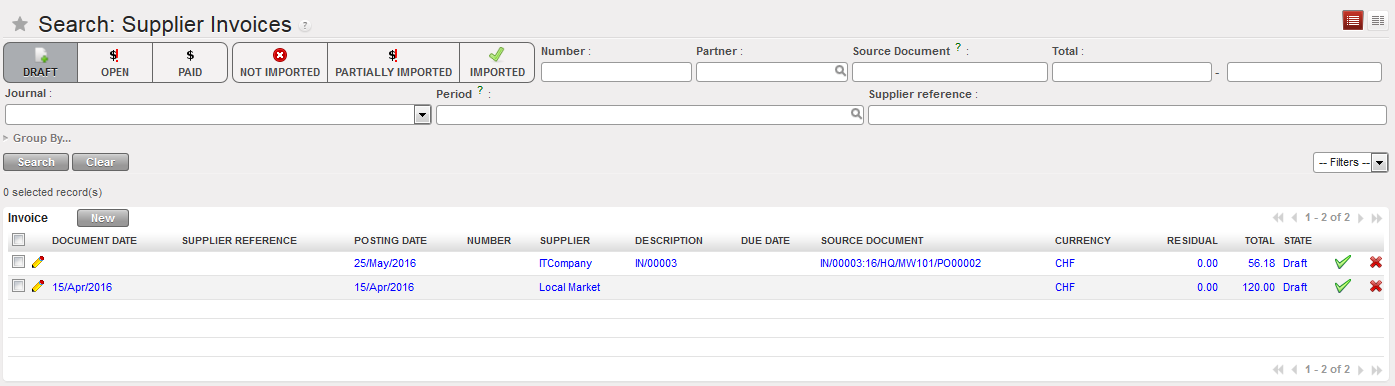

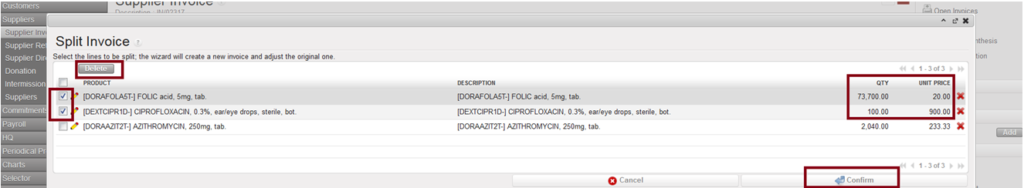

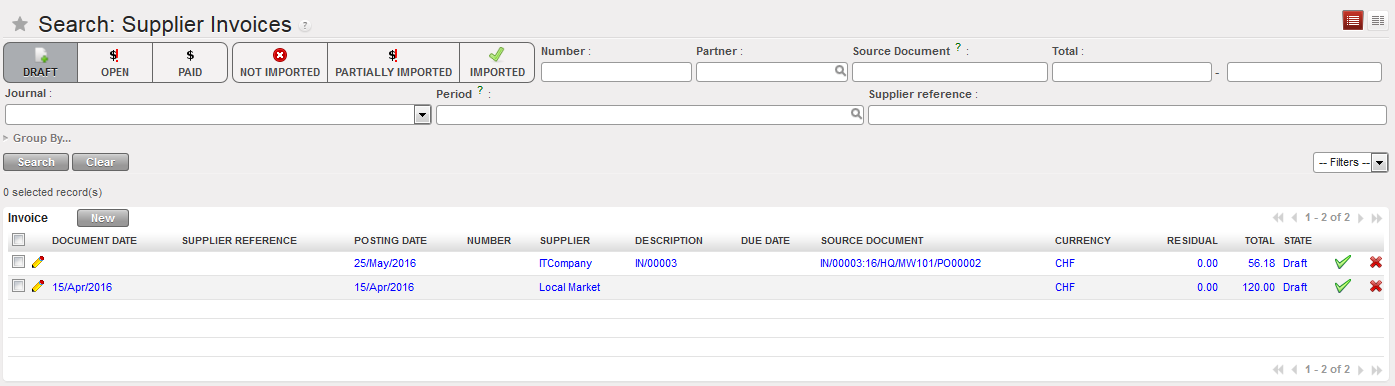

Down Payments tab of a supplier invoice Delete button to erase a draft supplier invoice in the Search Supplier Invoices view

Delete button to erase a draft supplier invoice in the Search Supplier Invoices view

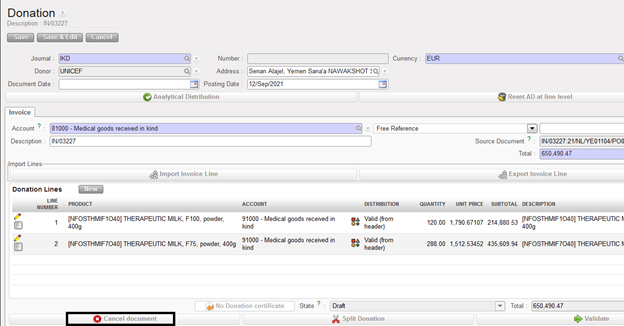

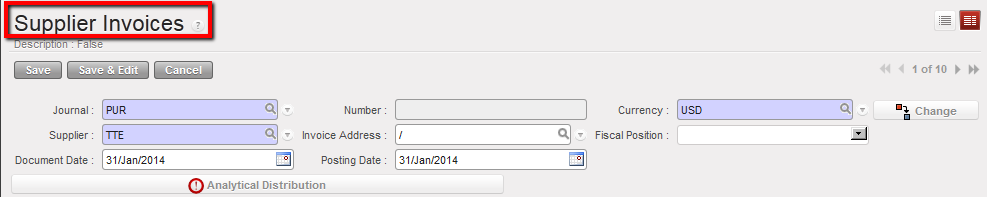

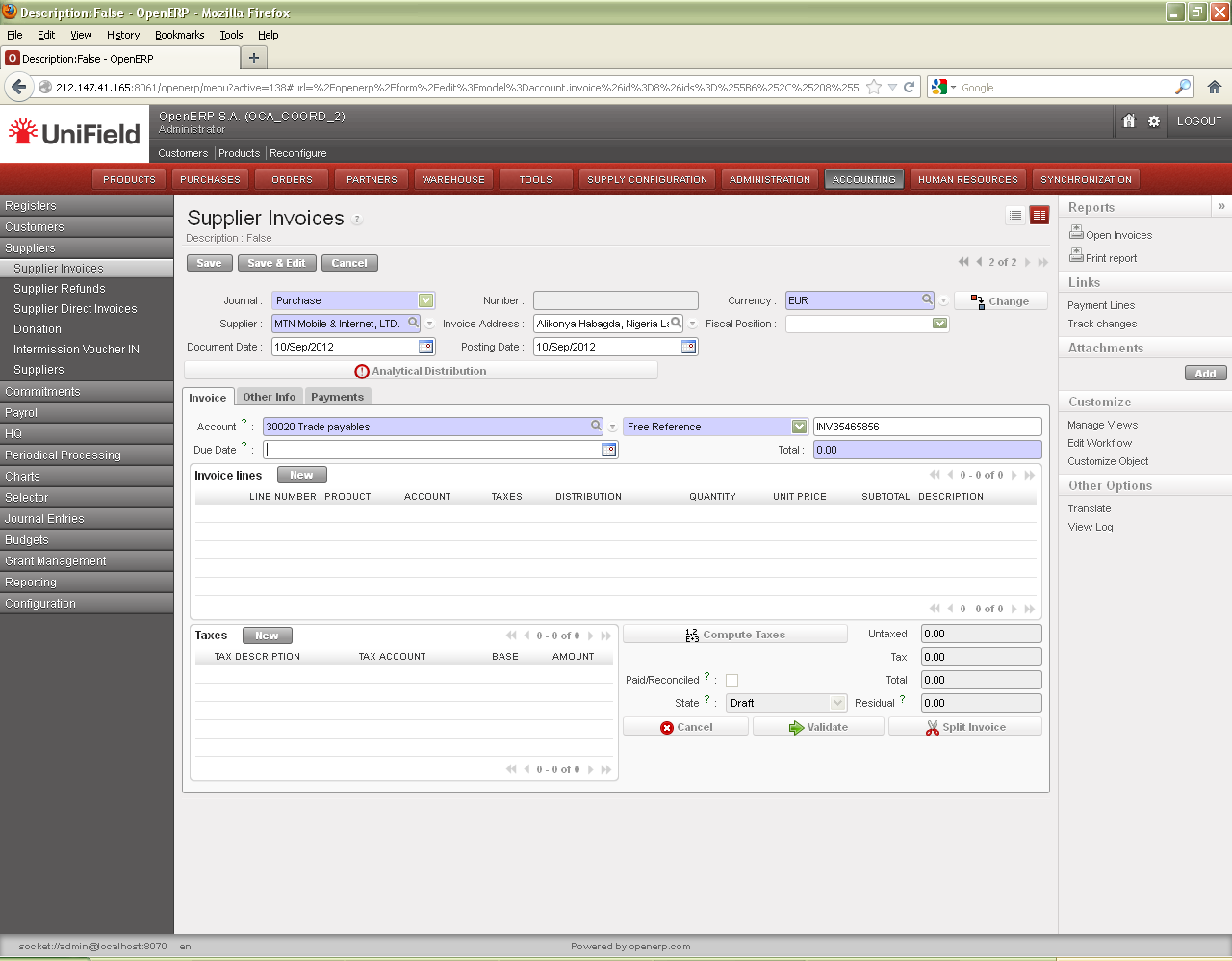

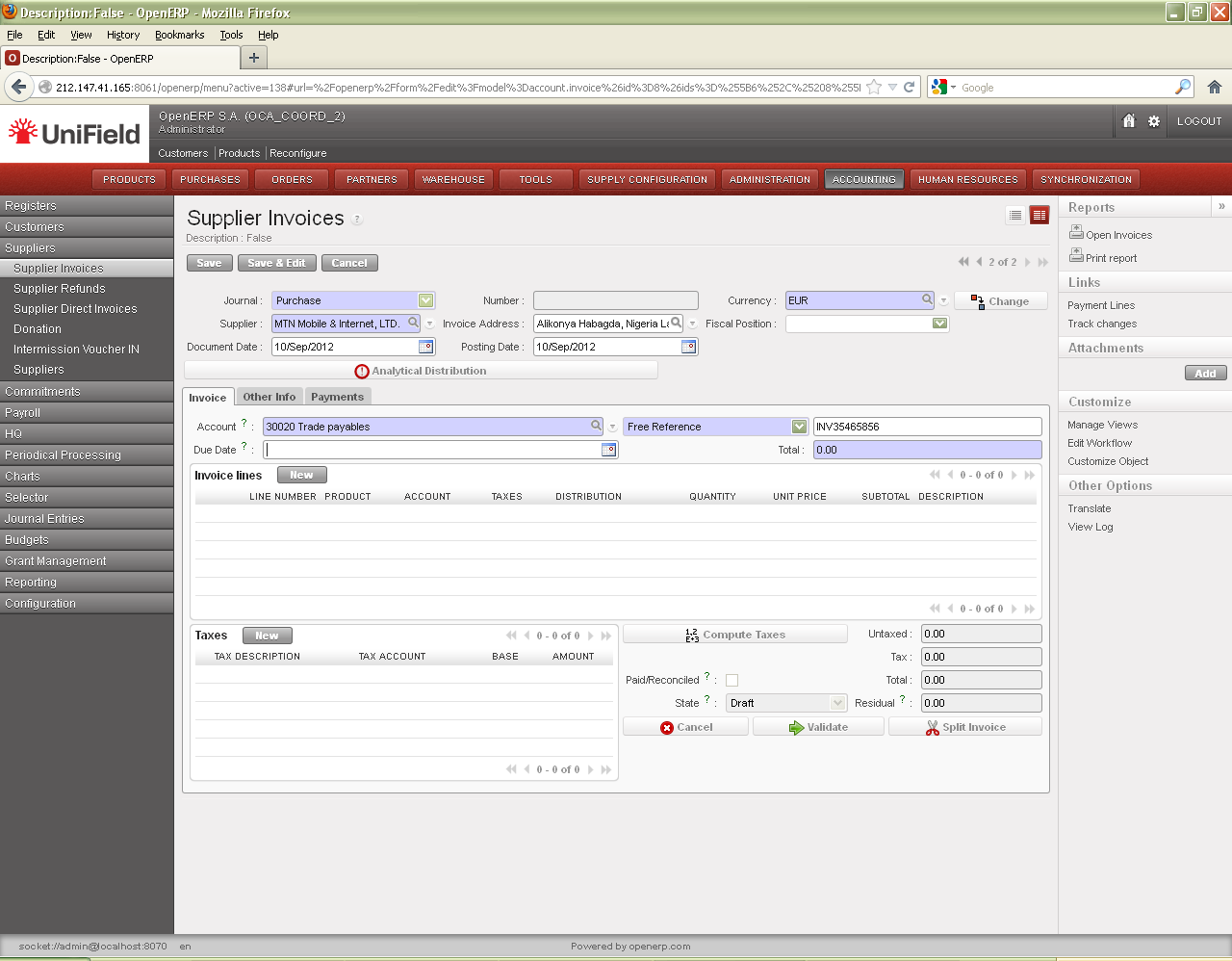

Draft supplier invoice

Draft supplier invoice

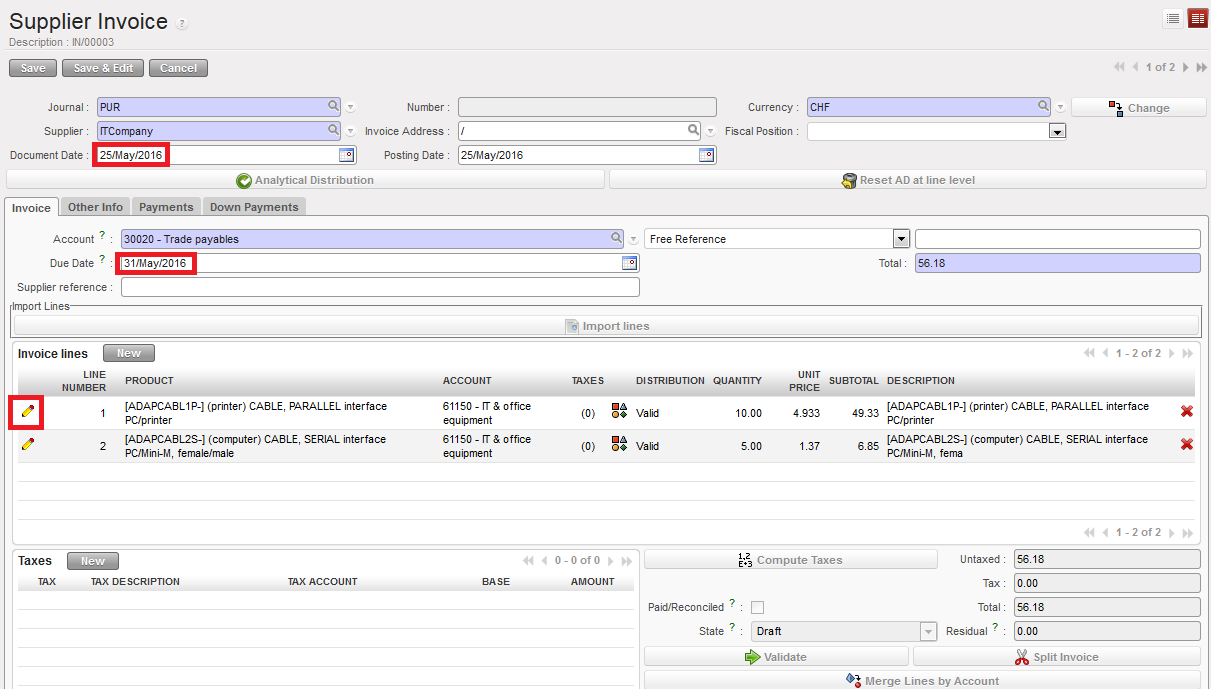

Edit button located on each invoice line, document date and due date fields

Edit button located on each invoice line, document date and due date fields

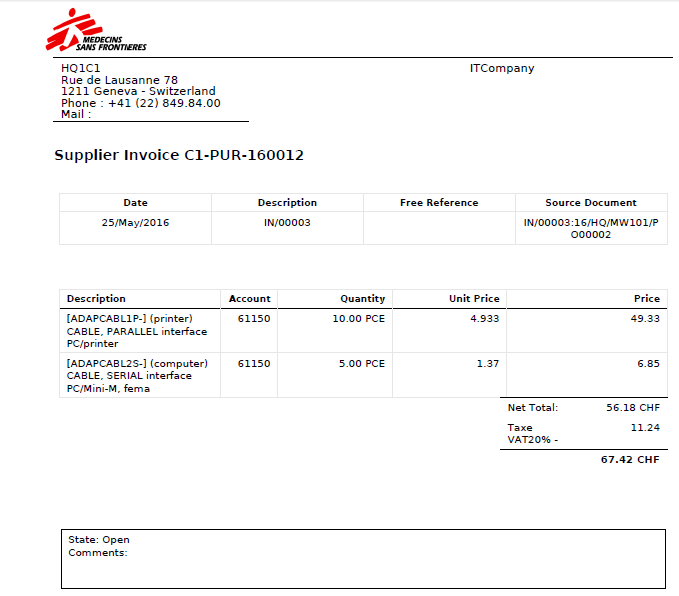

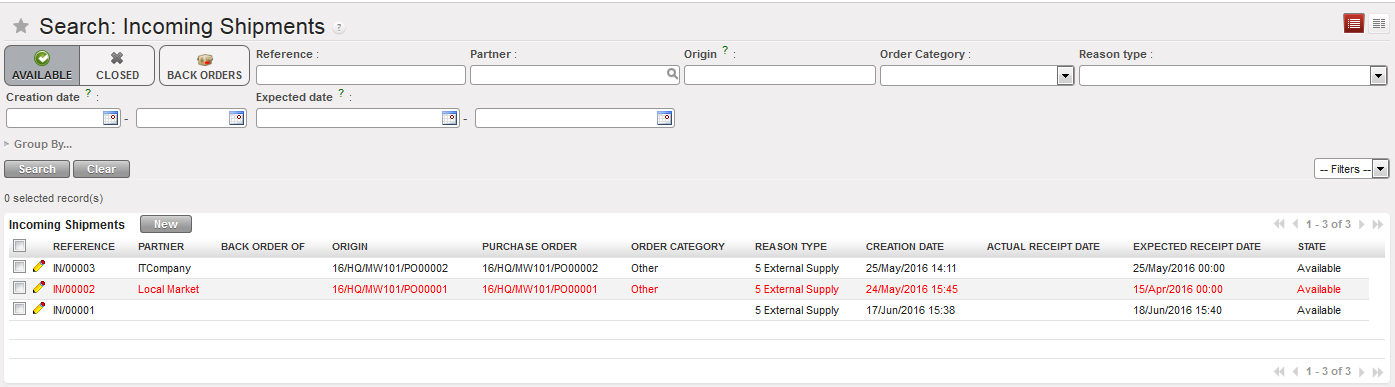

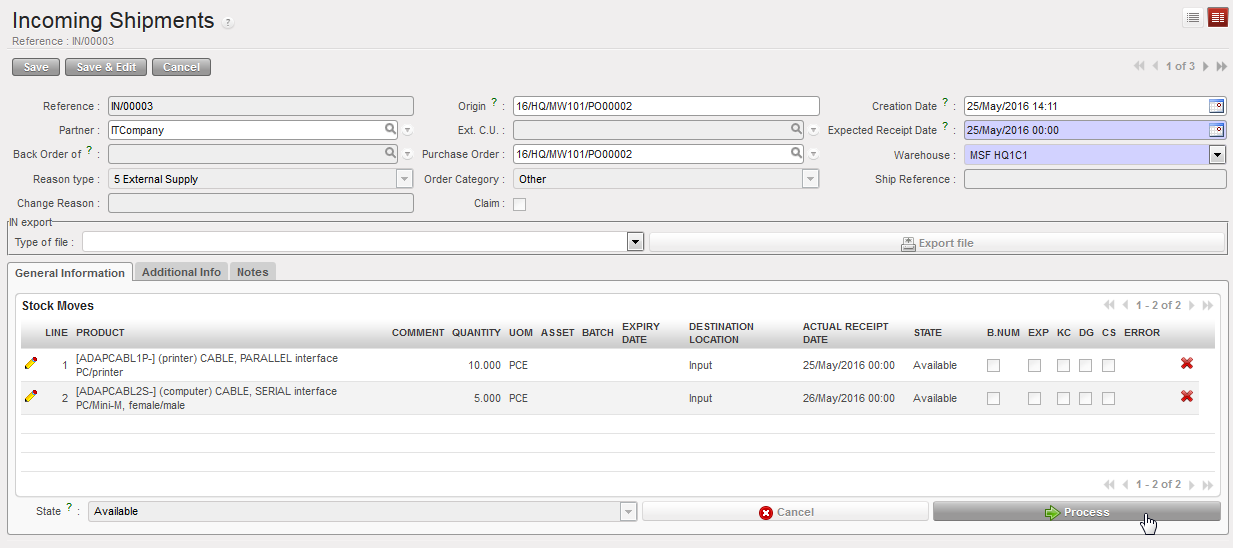

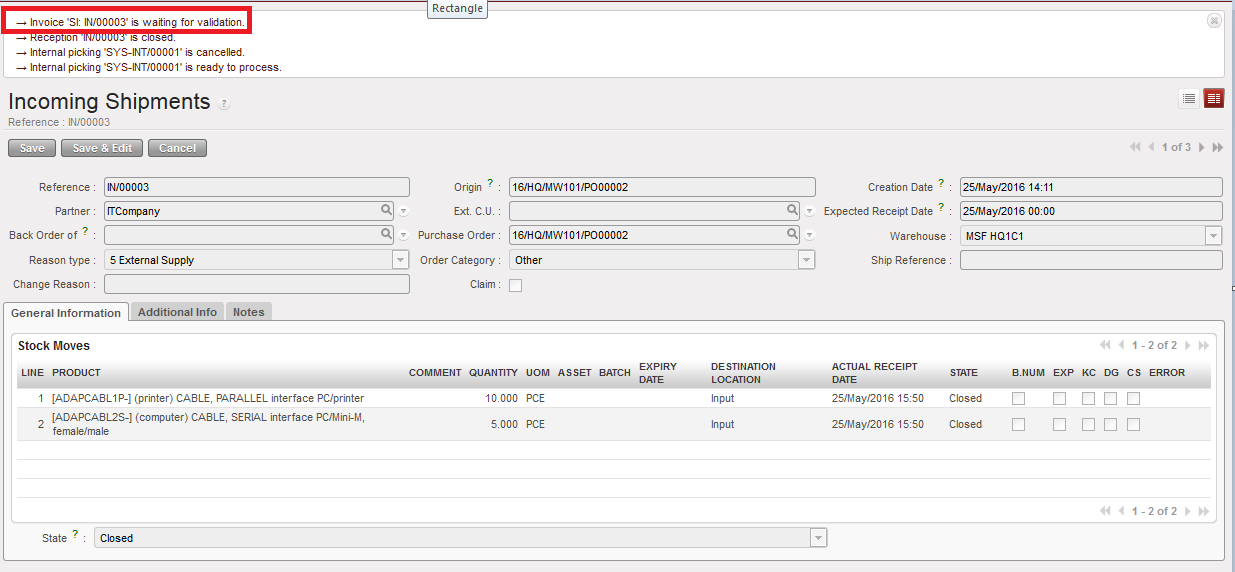

Supply processes Incoming Shipment

Supply processes Incoming Shipment Logistics validates Incoming Shipment. Reception is Closed and a Supplier invoice is generated

Logistics validates Incoming Shipment. Reception is Closed and a Supplier invoice is generated

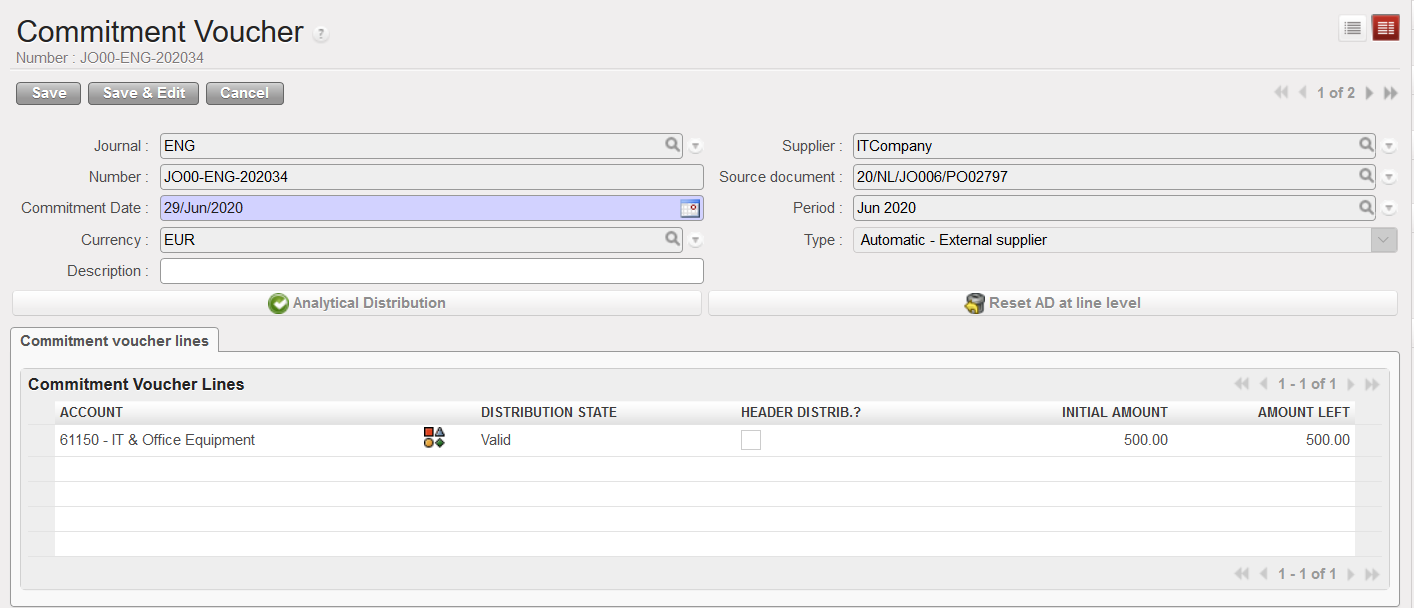

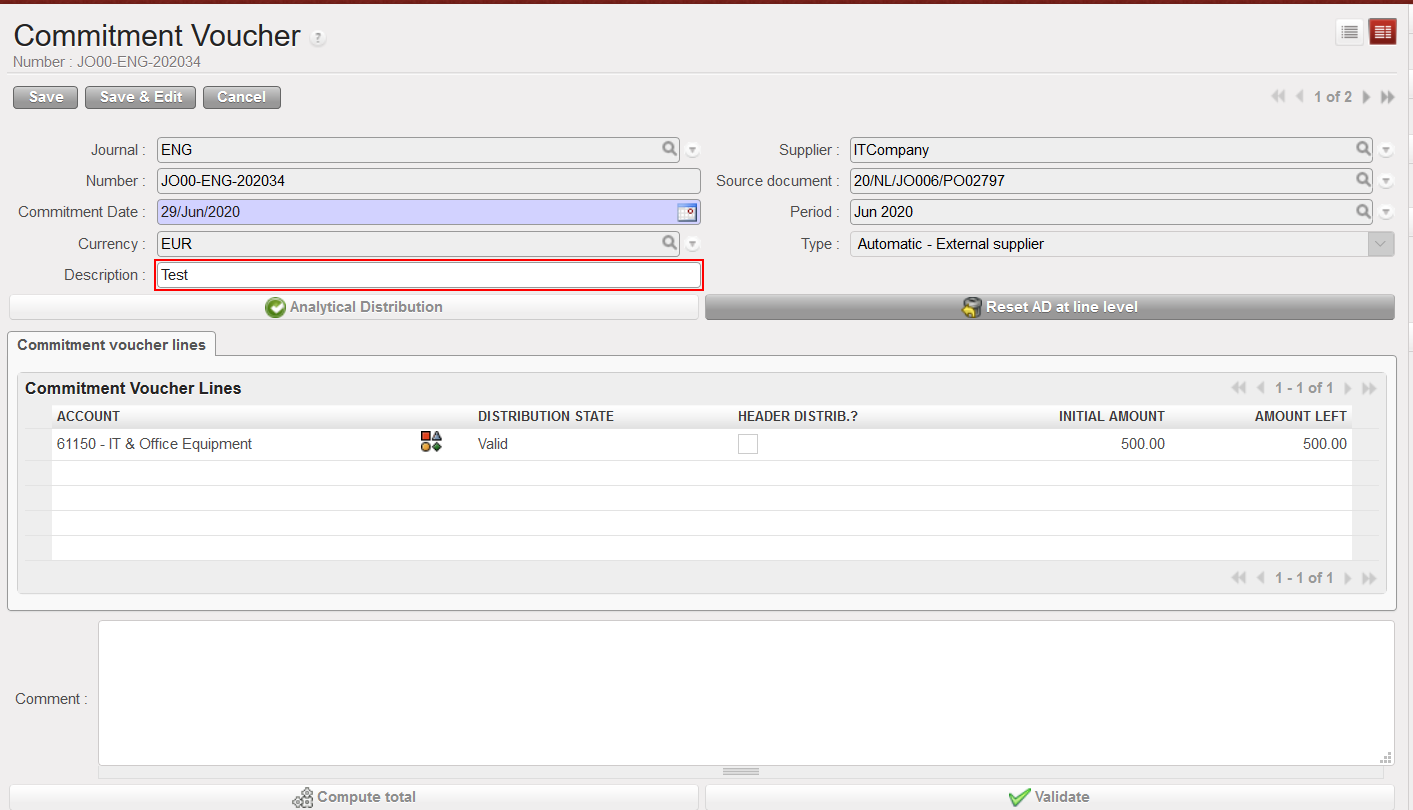

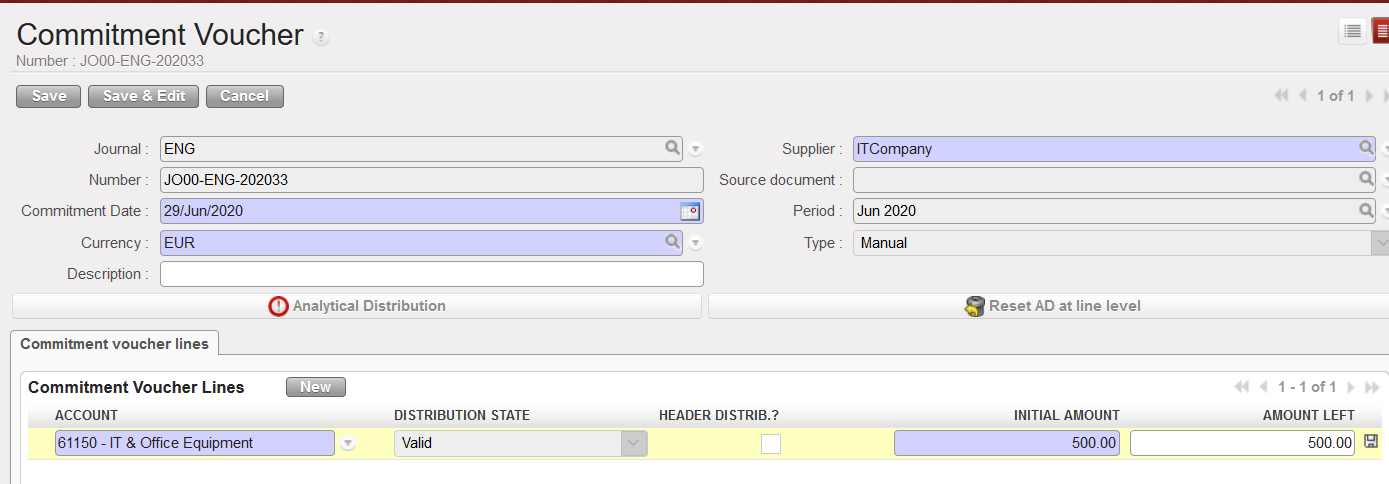

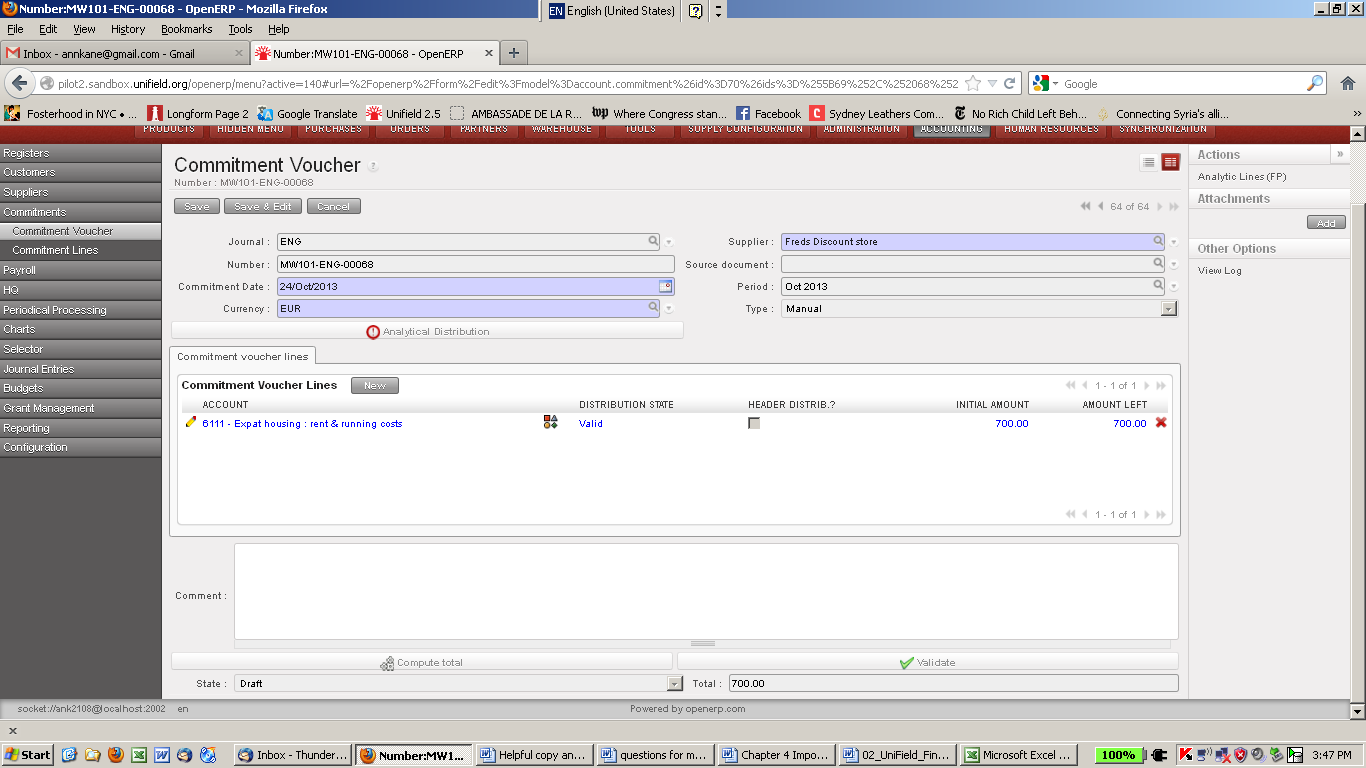

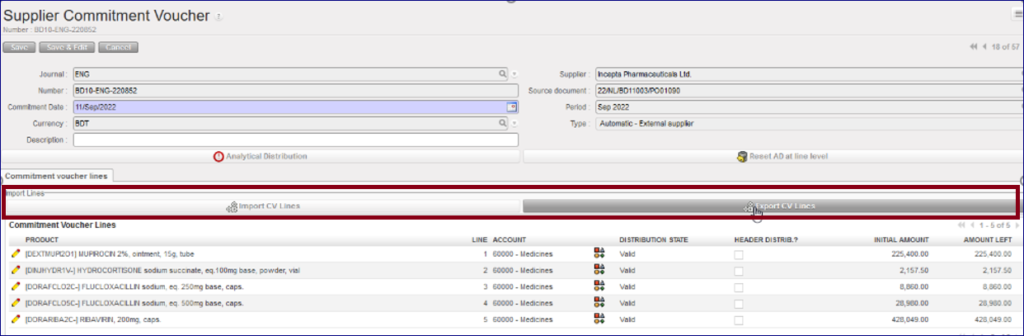

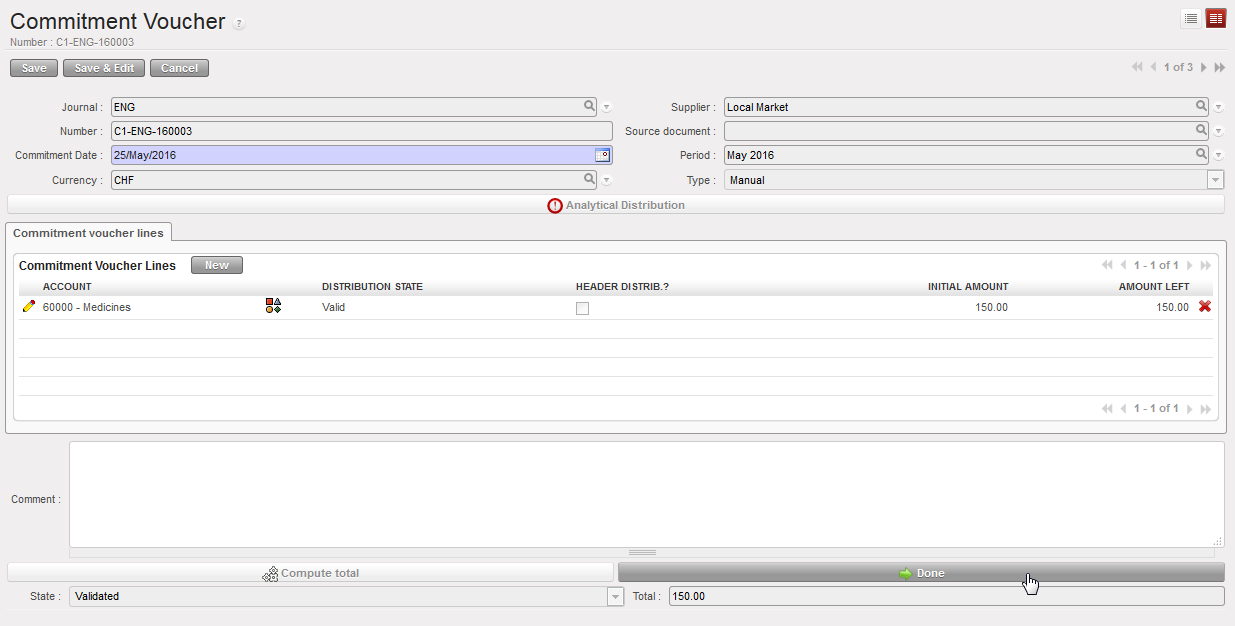

Commitment voucher in Form view where the analytical distribution can be changed

Commitment voucher in Form view where the analytical distribution can be changed

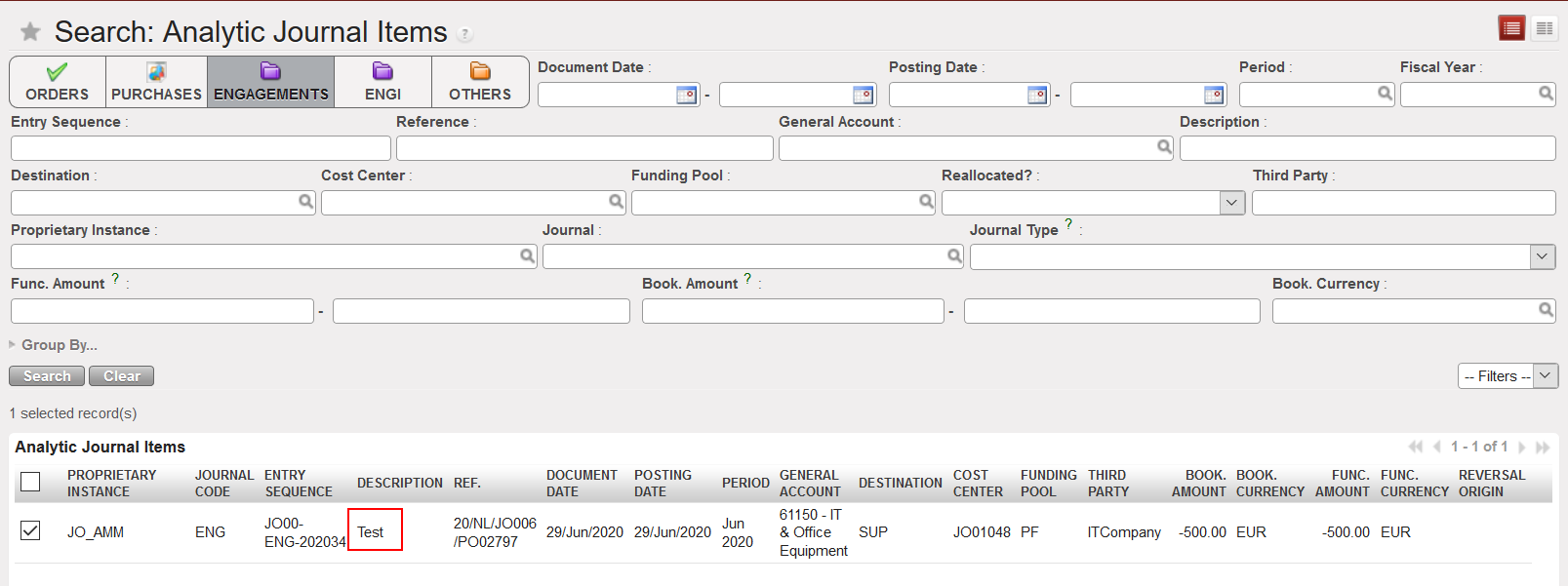

Analytic journal items reflected on the Engagement journal. These lines are not editable

Analytic journal items reflected on the Engagement journal. These lines are not editable

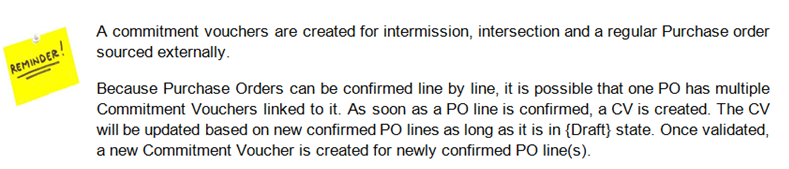

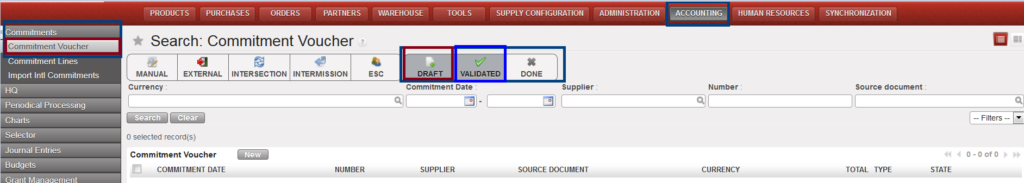

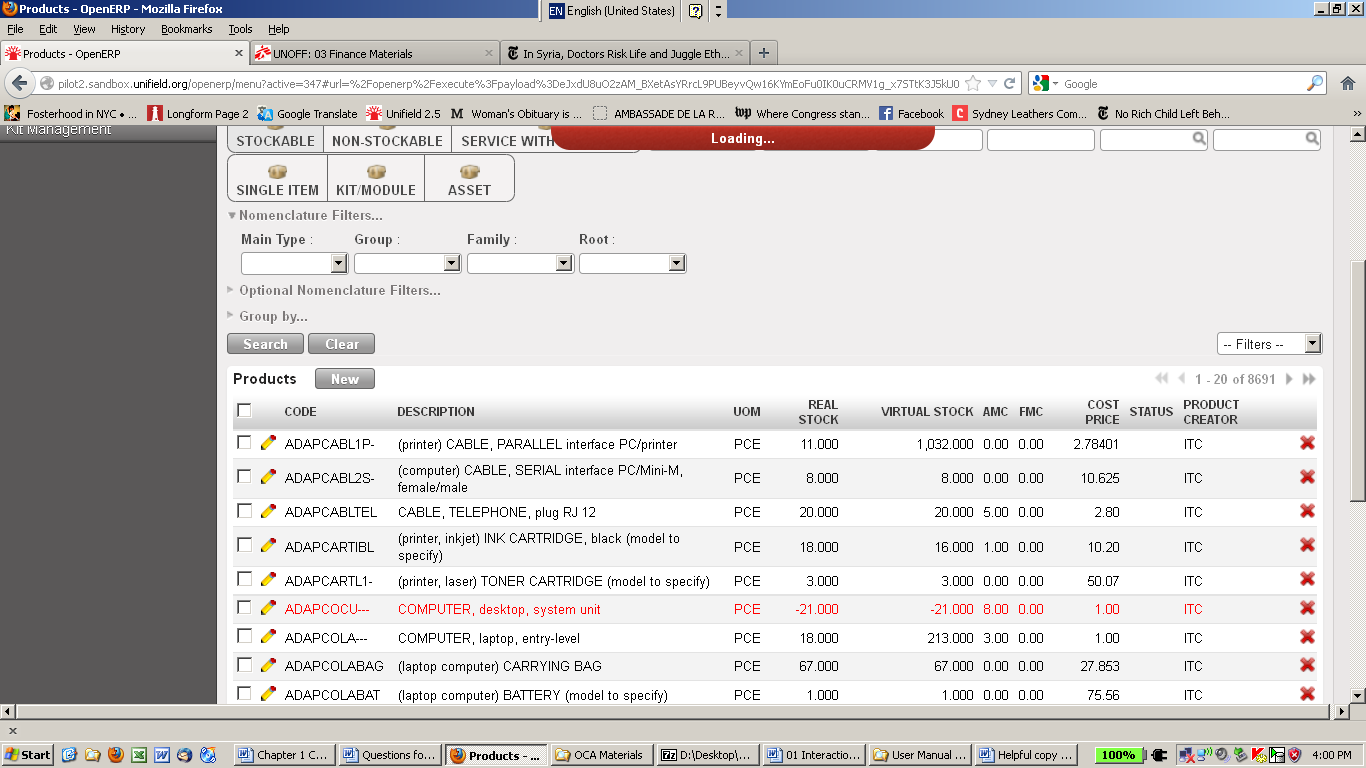

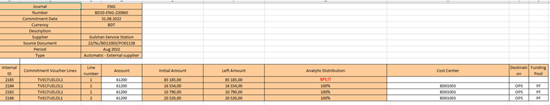

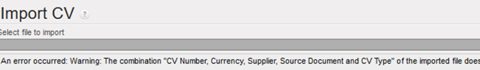

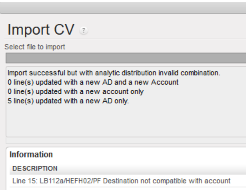

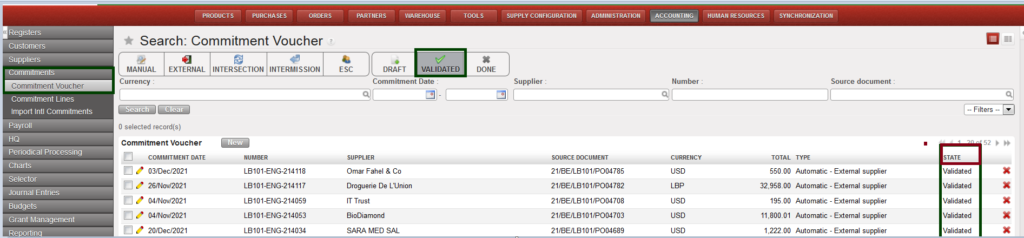

Commitment Voucher Screen

Commitment Voucher Screen

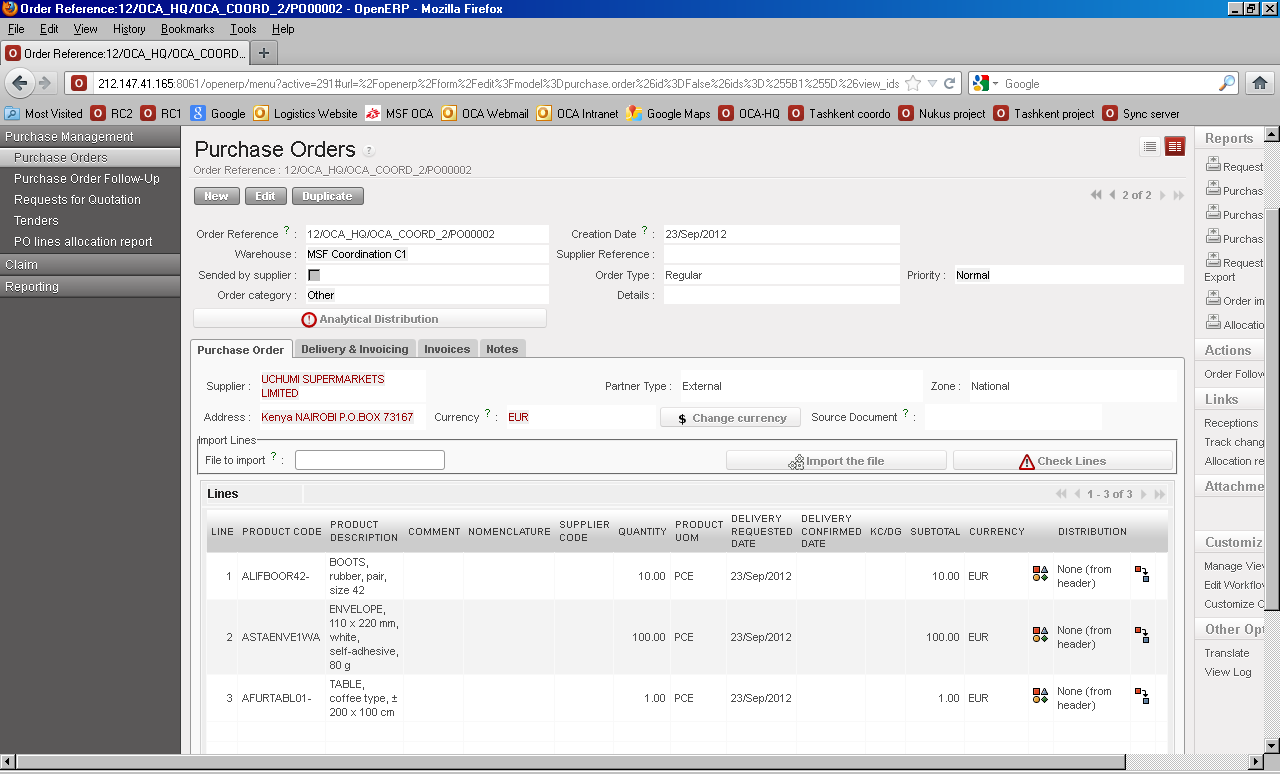

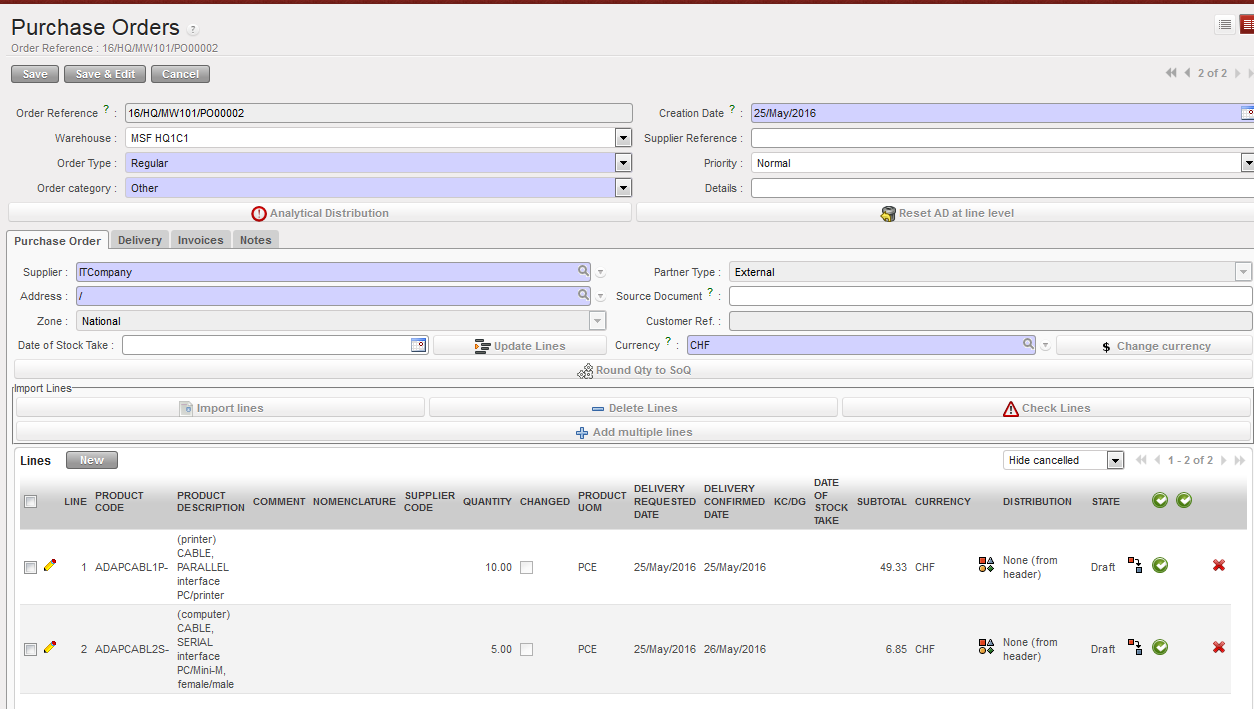

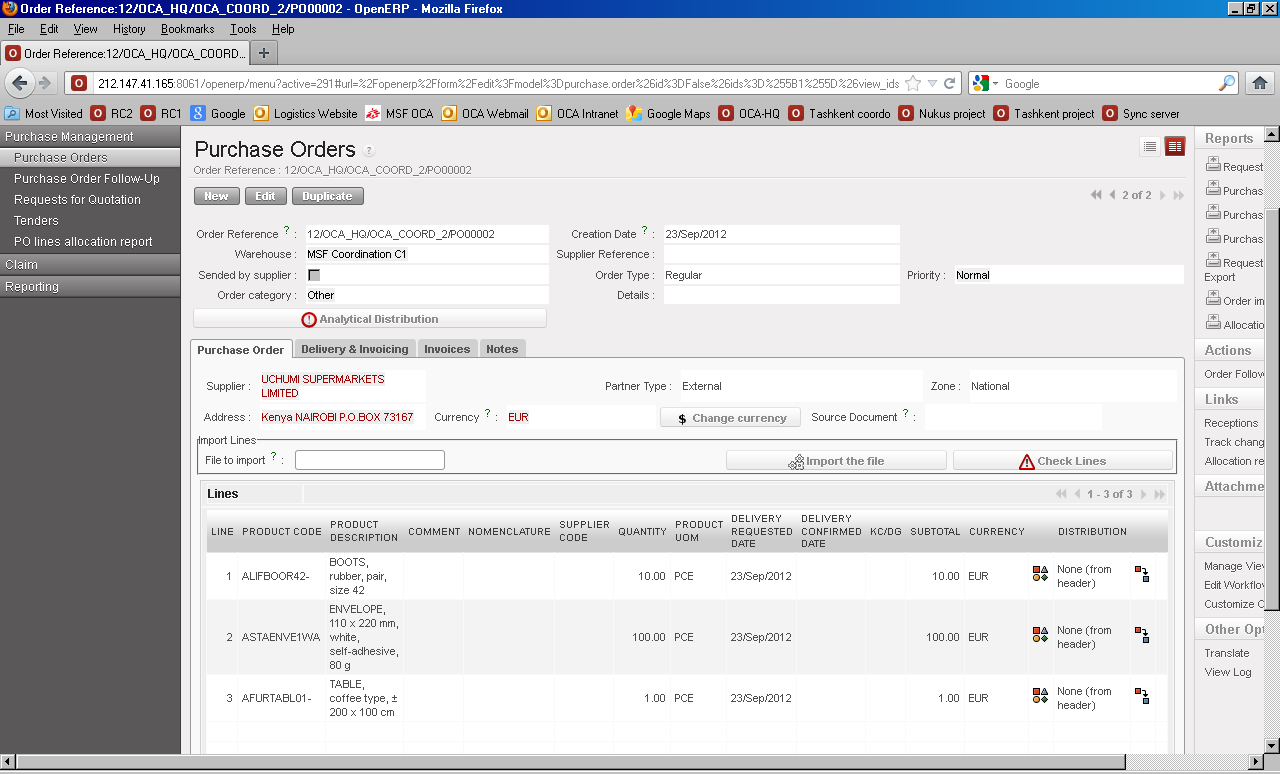

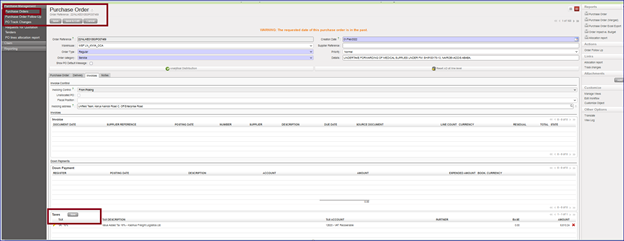

Purchase Order type regular with external partner

Purchase Order type regular with external partner

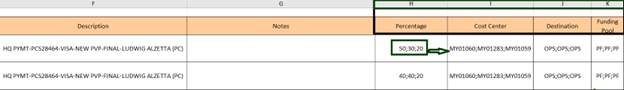

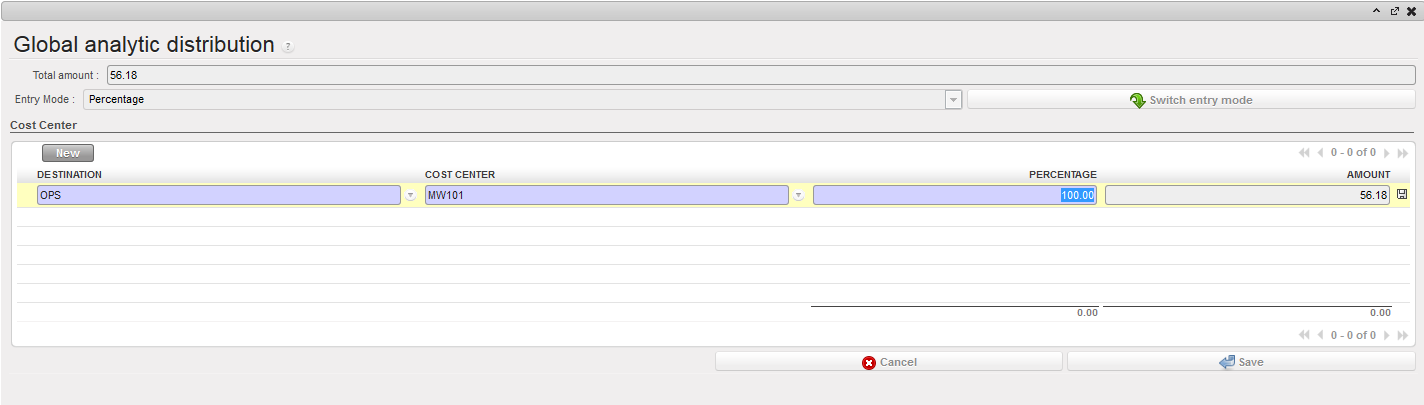

Analytic distribution wizard

Analytic distribution wizard

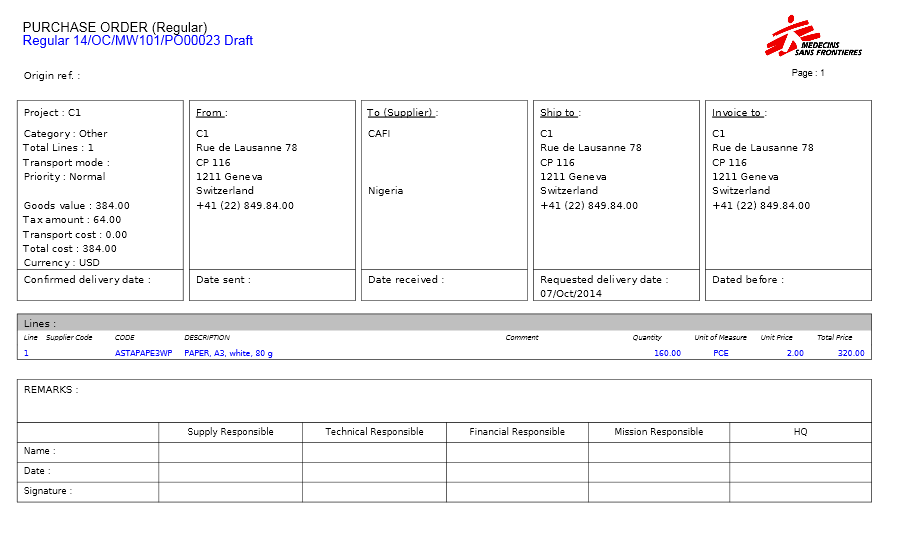

PO printed out for approval of a purchase of paper

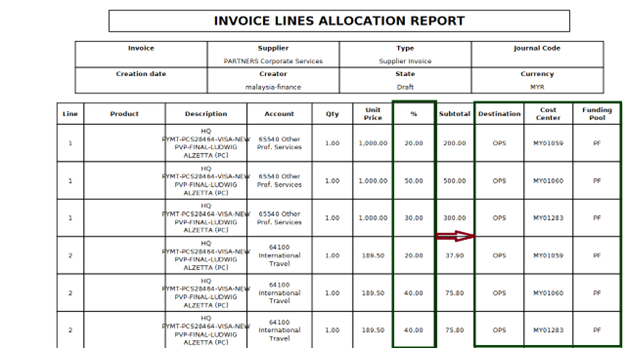

PO printed out for approval of a purchase of paper {Allocation report} functionality

{Allocation report} functionality PO lines allocation report for a purchase order

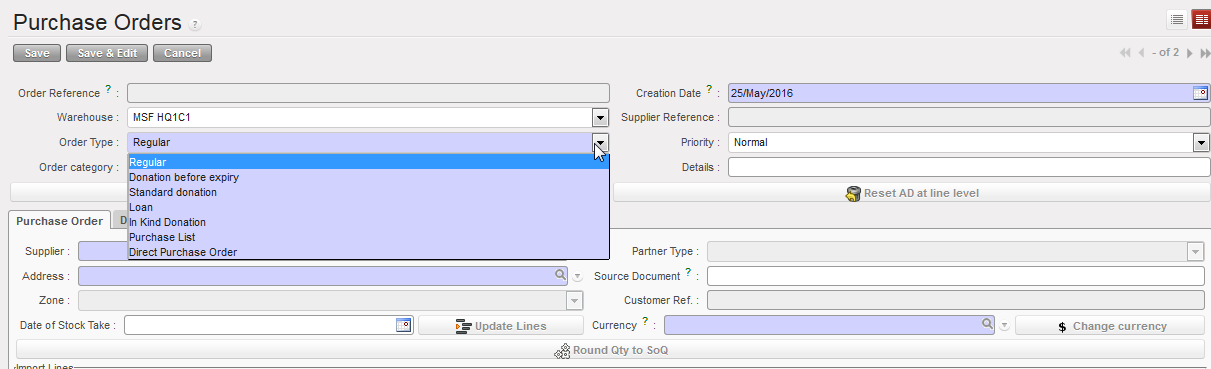

PO lines allocation report for a purchase order Types of Purchase Orders:

Types of Purchase Orders: